**Big-Tech & Bitcoin Jump, Bonds & Bank Stocks Dump As US Default Risk Soars**

Big-Tech & Bitcoin Jump, Bonds & Bank Stocks Dump As US Default Risk Soars

Another day, another **ugly macro print**(durable goods orders - ex Boeing - far weaker than hoped for, and shipments slumped); more **banking system anxiety** (not helped by FRC threats); and even **more debt-ceiling anxiety** as Dems make it clear no matter what Reps offer, they won't pass it.

FRC issued a blackmail threat to the other banks to 'rescue them or face the wrath of the markets when we explode' (our translation), but the market did not like and dumped the stock even more (down 35% today after yesterday's 50% collapse). The FDIC didn't help things by suggesting FRC's Fed borrowings capacity could be cut (clearly in a play for force a public bailout and make the big banks - that face billions of losses from uninsured deposits given to FRC - to pay up for FRC's loans)...

?itok=rbPXP7yX (

?itok=rbPXP7yX ( ?itok=rbPXP7yX)

?itok=rbPXP7yX)

_Source: Bloomberg_

The KBW Bank Index tumbled back near post-SVB lows...

?itok=OFnlcRyM (

?itok=OFnlcRyM ( ?itok=OFnlcRyM)

?itok=OFnlcRyM)

_Source: Bloomberg_

**One stumbling block to a solution has been the conflicting needs of US officials and the banks that might help.**

- The regulators favor a private rescue that doesn’t involve the US seizing the bank and taking a multibillion-dollar hit to the FDIC’s insurance fund.

- Banks want to avoid anything that damages their own finances and have been waiting for the government to offer aid, such as the FDIC taking control of the firm’s least desirable assets - something that can happen under the law only if First Republic fails and is put into receivership.

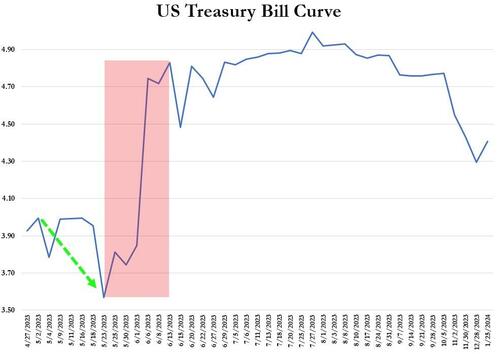

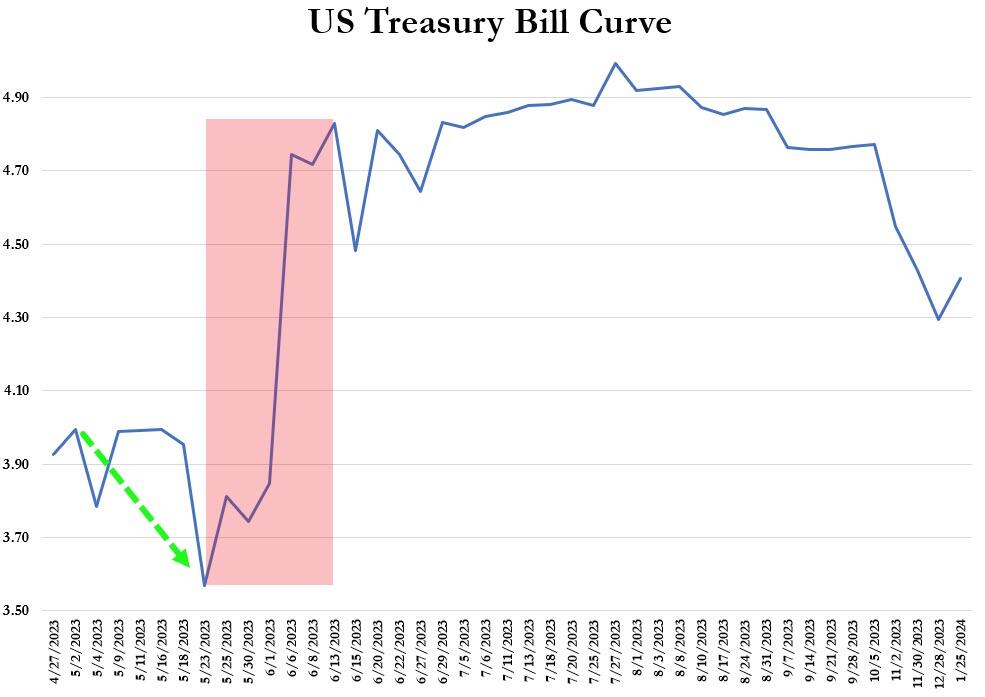

Not pretty but the T-Bill curve is breaking bad for a worst-case scenario X-Date...

?itok=s19Iectv (

?itok=s19Iectv ( ?itok=s19Iectv)

?itok=s19Iectv)

_Source: Bloomberg_

And USA Sovereign risk has never been this high...

?itok=3UlbcFvi (

?itok=3UlbcFvi ( ?itok=3UlbcFvi)

?itok=3UlbcFvi)

_Source: Bloomberg_

Nasdaq was the big winner today (thanks to MSFT and GOOGL) while Small Caps and The Dow led to the downside

?itok=PkETzLTA (

?itok=PkETzLTA ( ?itok=PkETzLTA)

?itok=PkETzLTA)

VIX (normal, 1D, and 9D) all gapped down at the open - from yesterday's spike - but that vol-selling faded around 1200ET (as puts were bid, sending vol higher)...

?itok=Nj2Yi5CF (

?itok=Nj2Yi5CF ( ?itok=Nj2Yi5CF)

?itok=Nj2Yi5CF)

... **as 0DTE traders piled aggressively into puts** (while call plays were entirely muted (once again confirming Nomura's Charlie McElligott's recent note that there has been a **regime-change in 0DTE from intraday-hedging/fading trends to an "accelerant risk"**...

?itok=hHnsMsxd (

?itok=hHnsMsxd ( ?itok=hHnsMsxd)

?itok=hHnsMsxd)

_Source: SpotGamma_ (https://spotgamma.com/hiro-indicator/)

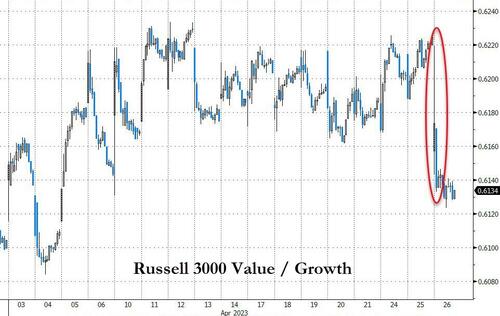

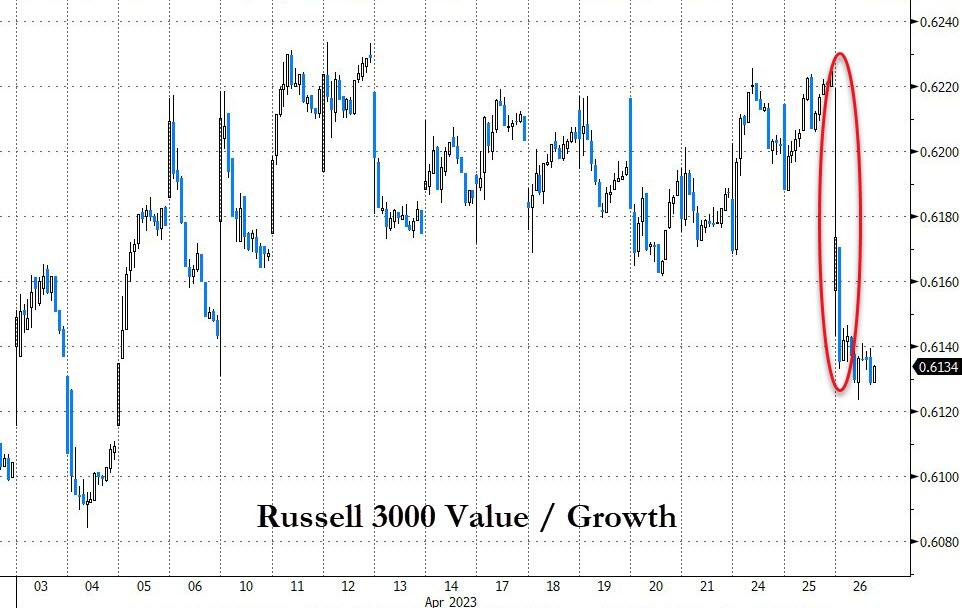

**Value stocks crashed relative to growth** today after chopping sideways relative to each other for the last three weeks...

?itok=5WNWnT42 (

?itok=5WNWnT42 ( ?itok=5WNWnT42)

?itok=5WNWnT42)

_Source: Bloomberg_

**This was the biggest growth/value daily shift since Nov '22.**

And ATVI was clubbed like a baby seal after UK regulators denied MSFT's bid (MSFT rallied on the day BUT it was not moved by the ATVI decision)...

?itok=aj62ZZzi (

?itok=aj62ZZzi ( ?itok=aj62ZZzi)

?itok=aj62ZZzi)

**Treasuries were mixed today with the short-end lower in yield and the long-end underperforming**(2Y -3bps, 30Y +4bps). Yields remain significantly lower though on the week with the short-end outperforming (curve steepening)...

?itok=ScJl6q1r (https://cms.…

?itok=ScJl6q1r (https://cms.…

https://www.zerohedge.com/markets/big-tech-bitcoin-jump-bonds-bank-stocks-dump-us-default-risk-soars