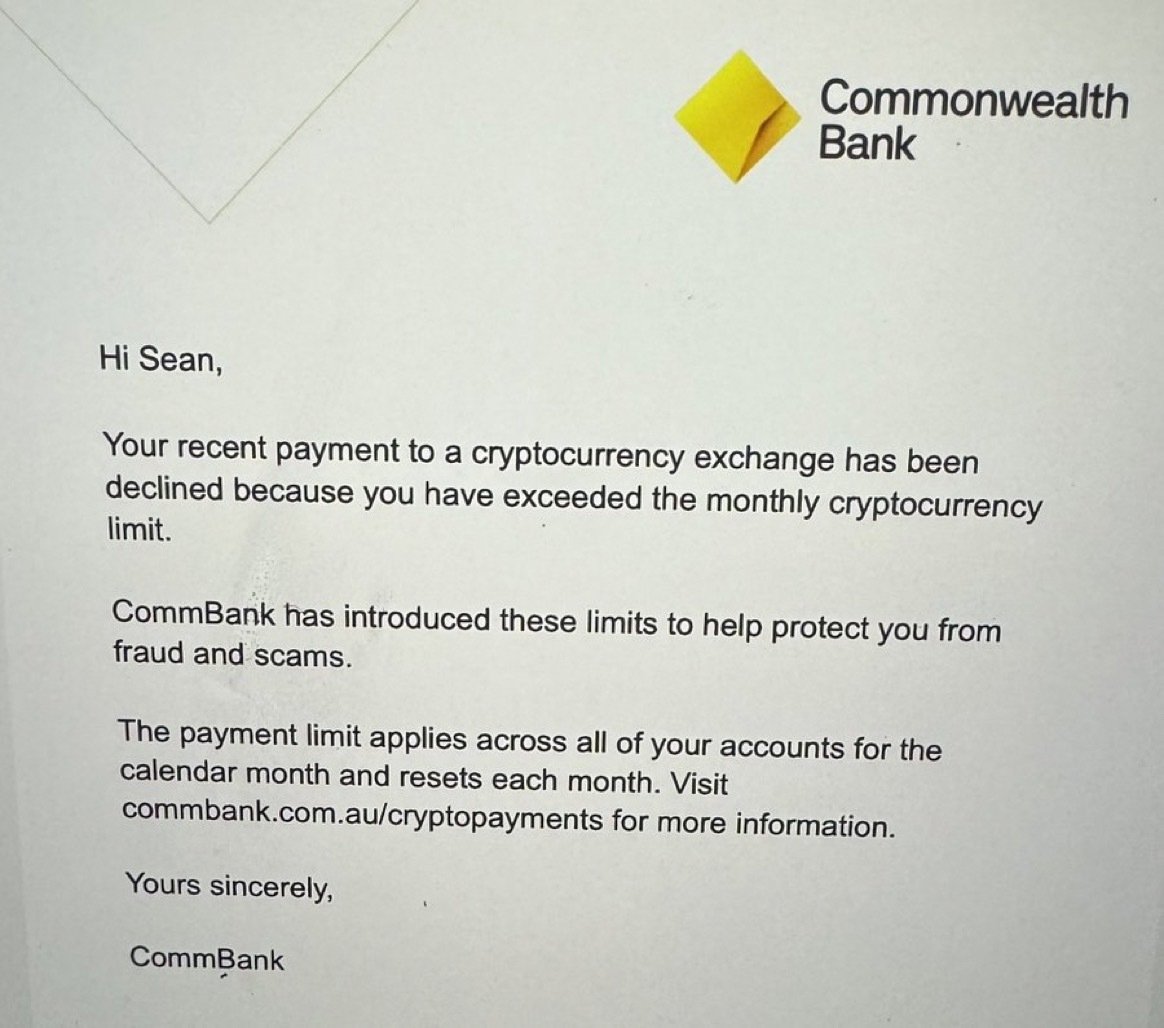

Sorry Sean, you’re going too far off the reservation. We need to protect your from fraud and scams by controlling the money we print out of thin air - CommBank  nostr:note15wvy0htws9chq0jnzv9gvz3y0tv6msq7k49tdtntkh5yr4nap8gq2asc0v

nostr:note15wvy0htws9chq0jnzv9gvz3y0tv6msq7k49tdtntkh5yr4nap8gq2asc0v

Discussion

Same thing as that guy's mom happened to me with two banks in Spain. They even block card payments. Worse, now even Wise blocks transfers to exchanges (cards still allowed).

Wise seems to be heavily permissioned, I guess given the reduction in friction they could enable they had the screws tightened on them.

It 8s very confusing for me to think about the fact that many (most?) people still leave large amounts of their FRNs in the legacy banking system. Why? Has it not already proven itself illegitimate in innumerable ways since 2008??

I had a thread about this a few weeks ago - nostr:note1ecdg2jsm3333uugw0wwwqtw7vzkpc6jn0ad24aa2e504vq7n4ezqewrfg0

It’s not as straightforward as you think. Imagine you sold your car or house and wanted to put the proceeds into Bitcoin rather than hold cash. Or you just got orangepilled and want to convert stock holdings.

Not everyone is already all out of fiat.

Yeah, fair enough but i think that if a person is coming into a large aount of cash (and they are aware the system is shit) , they should probably have a scattershot plan of hoovering up all sorts of hard assets(gold, silver, btc even land or a decent piece of art) from a a variety of locales...individuals on FB marketplace/craigslist, coin shops, proper dealers, etc. Everyrhing, all at once, a pain in the ass no doubt, and, doubly challenging within an Ozzie context given the new restrictions on pulling hard cash out of banks. Aus certainly has changed a lot since i was there 16 yrs ago

Capital controls, how cute.

You could take out some cash too and buy bitcoin with that, but I guess there is a limit too.

You could buy from someone via wire (bisq etc), but yep this someone could be already flagged and your "suspicious behaviour" could trigger an investigation by the banks.

Yep, the doors are closing.

Bisq simply doesn’t have the available volume today to replace exchanges.

But with these on-ramps closing up in Aus & UK and other places, P2P is going to take off again in the coming few years.

Forget about borrowing against your Bitcoin to live, smart Bitcoiners will work out how to trade P2P in volume and live off the Premium.

Bisq never had anywhere close to useful liquidity. It's just a small hole in the wall you can take advantage of. Probably best used to slowly DCA.

The problem with becomming a very active whale P2P trader is you'll end up in jail soon for illegal money laundering. At least where I live (🤬EU).

The unplugged (unpluggable) hole I see rn is when you pay someone for work, services or goods.

Also you could buy miners (and solar panels maybe).