My answer would be that it made more sense when most people were poor, and people were more exploited in general. But a loan isn’t inherently exploitative; if you have regulations that limit the rates a lender can charge, limit the recourse they have if you can’t pay it back, etc, then it’s not inherently unethical or exploitative.

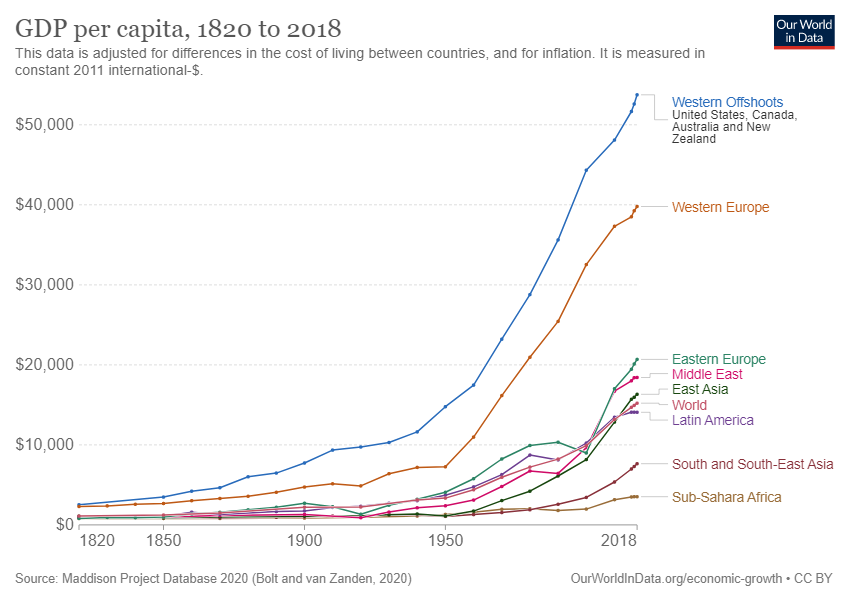

Also, it fuels innovation, and that time period you mentioned happens to be around the time things really started popping off (grabbed a GDP per capita chart for reference).