I’ve been experiencing the Baader-Meinhof phenomenon with power laws 😅

Gone from a curiosity to suddenly everywhere!

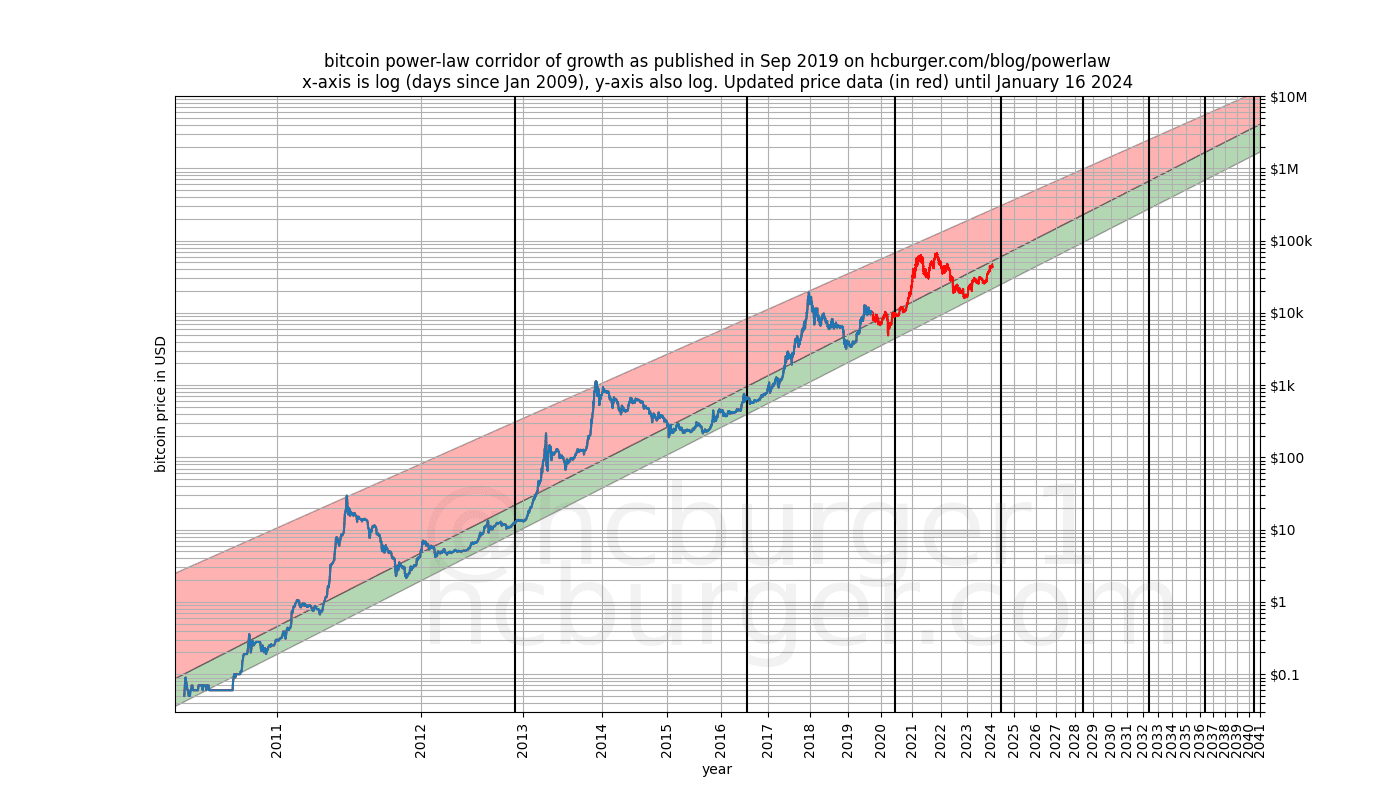

The models seem to fit but our understanding behind them is weak. Geoffrey West explains that oftentimes for these exponential patterns to continue what is actually happening is the underlying hits an inflection point before entering a new exponential and smoothed out this tracks the power law. Understood in this way it would be easy to see how the access to capital via ETFs could be that next step change with corporate balance sheets and nation state adoptions possibly representing future step changes to extend the power law. Once liquidity in Bitcoin approaches gold for example, it opens up new usecases and new adoption that isn’t possible today at sub $1 Trillion, all these things have to follow in a certain natural order predicated on previous cycles but it seems obvious that it will continue on this path over a 10-20 year period.

Regardless, if the power law IS true it provides some interesting anchor points for Bitcoiners to consider:

- $100k floor from the 2028 halving onwards

- $500k floor by 2035 (ie on par with Gold’s 2024 mkt cap)

- $1M is NOT happening this cycle

- $1M is likely 10 years away (circa 2033-34)

- $1M floor from 2038 onwards, by this point you can expect 1 BTC will always be minimum 7 figures of filthy fiat  nostr:note1c5xmrqkq8j03kz0zmfe5hl8cn5rdgakcy79ad5gyytndt3ve3ggsa6p04n

nostr:note1c5xmrqkq8j03kz0zmfe5hl8cn5rdgakcy79ad5gyytndt3ve3ggsa6p04n