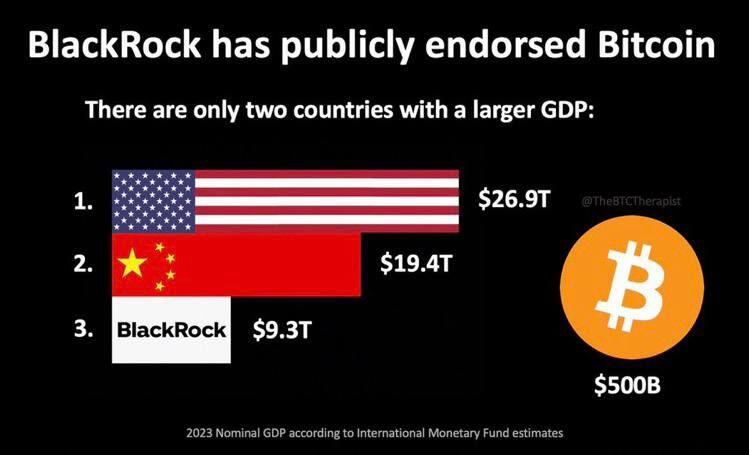

🥇 BlackRock, with its $9.3 trillion in assets under management, has publicly endorsed Bitcoin and is actively pursuing an ETF.

This figure means BlackRock's size is equivalent to 34.57% of the US GDP and 47.93% of China's total GDP.

When comparing BlackRock's assets to the economic outputs of the US and China, the scale of its management is astounding.