The Great Taking would destroy Saylor, right? Almost worth it for them to blow up everything else to seize those ~500k coins in a roundabout 6102.

Discussion

I just listened to the book. The same thing occured to me too. But on second thought, do not commodities thrive in deflationary and recessoinary environments? Bitcoin is a commodoty. So maybe as securities assets undergo a liquidation cascade, maybe bitcoin will endure and strategy will not have to liquidate its btc. What do you think about that?

His debt would become extremely expensive. Same thing for a house with a mortgage.

Yes it would but strategy isnt in that much debt. Strf doesnt get repaid. And i think strk is only redeemable for stock. So that leaves only strd to be repaid (i think) and he can sell common stock all the way down to pay much of the claims. But my question was more about if you think bitcoin would perhaps do well as a commodity and as a safe haven asset in cintrast to the equities which would be rugged as described in the book. Thx

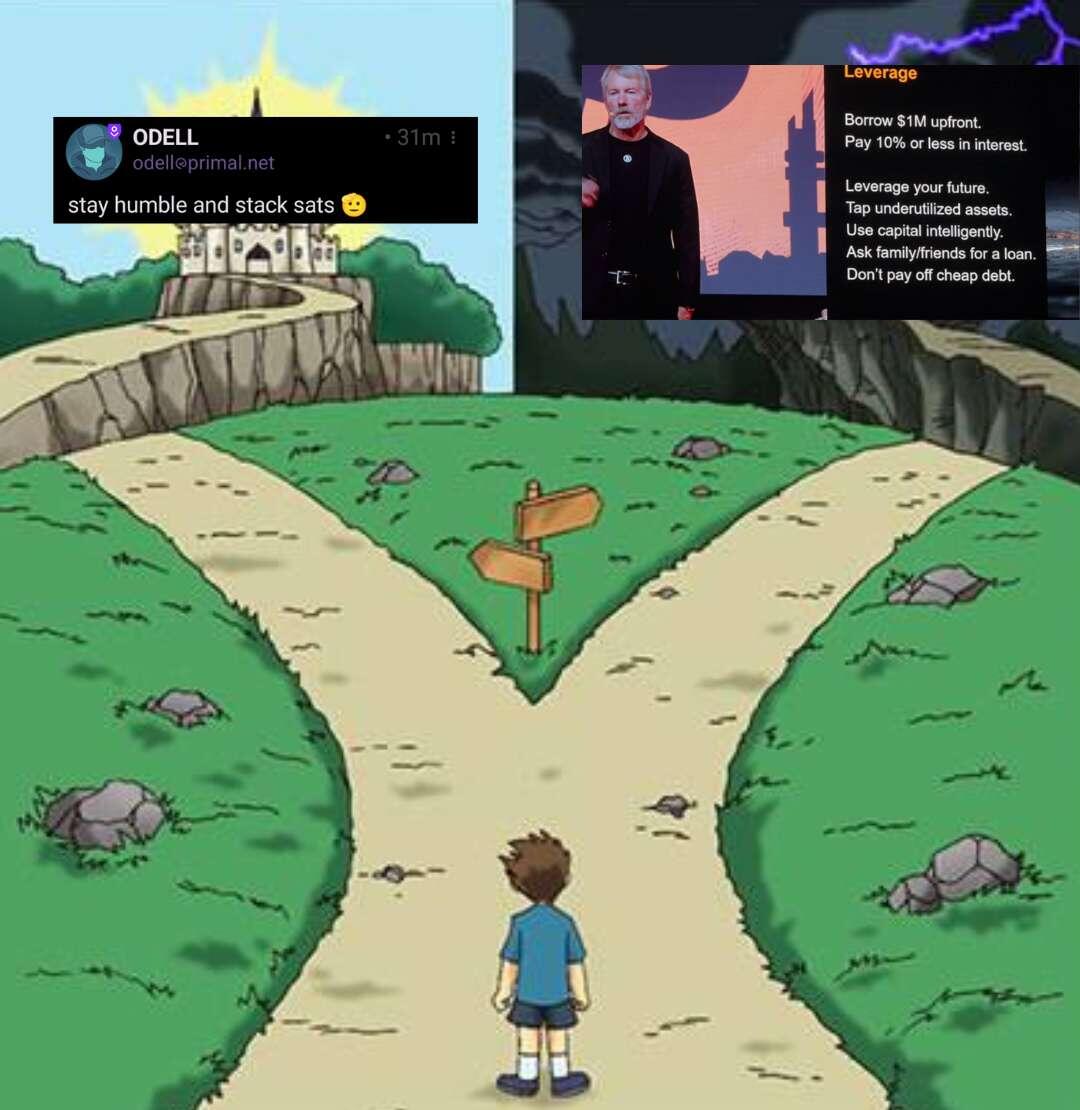

Definitely better than equities since there isn’t inherent counterparty risk. Bitcoin is on its own vector…to victory. Despite how common it is to call Bitcoin a commodity, as a way to distinguish it from shitcoins (aka securities) Bitcoin isn’t a commodity because it isn’t used/consumed as an input to create something else. Just because something isn’t a security, doesn’t automatically make it a commodity. I have many posts about this on X. nostr:note14gm5pnr0lsycdcg58nquualqtmp236945swax7sm2f2e4d4jx44sv7h353

The incentives to actively want a blow up is low, considering how many big corpos and vested interests have exposure to Bitcoin now.

But it's possible for market-driven blowups to happen.

Are you familiar with The Great Taking?

Not more than reading summaries of it

nostr:note1zyel9nyvagretxvmugfcdmtz7gar7l9sdxpj4lwhmpjy8c6wlpvq4ghn3l