Today I was listening to one of my favorite macro podcasts talk about the Fed's meeting from yesterday. One of the best interviewers in the space, and one of his top interviewees.

And I couldn't finish it. So boring.

They were literally noting the tiniest details. The Fed's prepared statement didn't mention a rate cut in September. And then Fed chairman Powell's prepared press talk also didn't mention it. However, when asked about a September rate cut, he flipped to a page where he had a prepared statement indicating that yeah they're kind of leaning toward a September rate cut, and read it.

So they were like, "Huh! I wonder what the significance of that is. He had a prepared written statement about September, but only when asked!"

People literally judge the Fed chair's body language, facial movements, details like whether he has a prepared statement for a given question, etc. Omg.

For my work I need to note the basics of what the Fed said and all that, like the 3-minute summary of all that stuff. But the sheer excitement that these people had when discussing details like that for an hour was so banal. It seemed like satire.

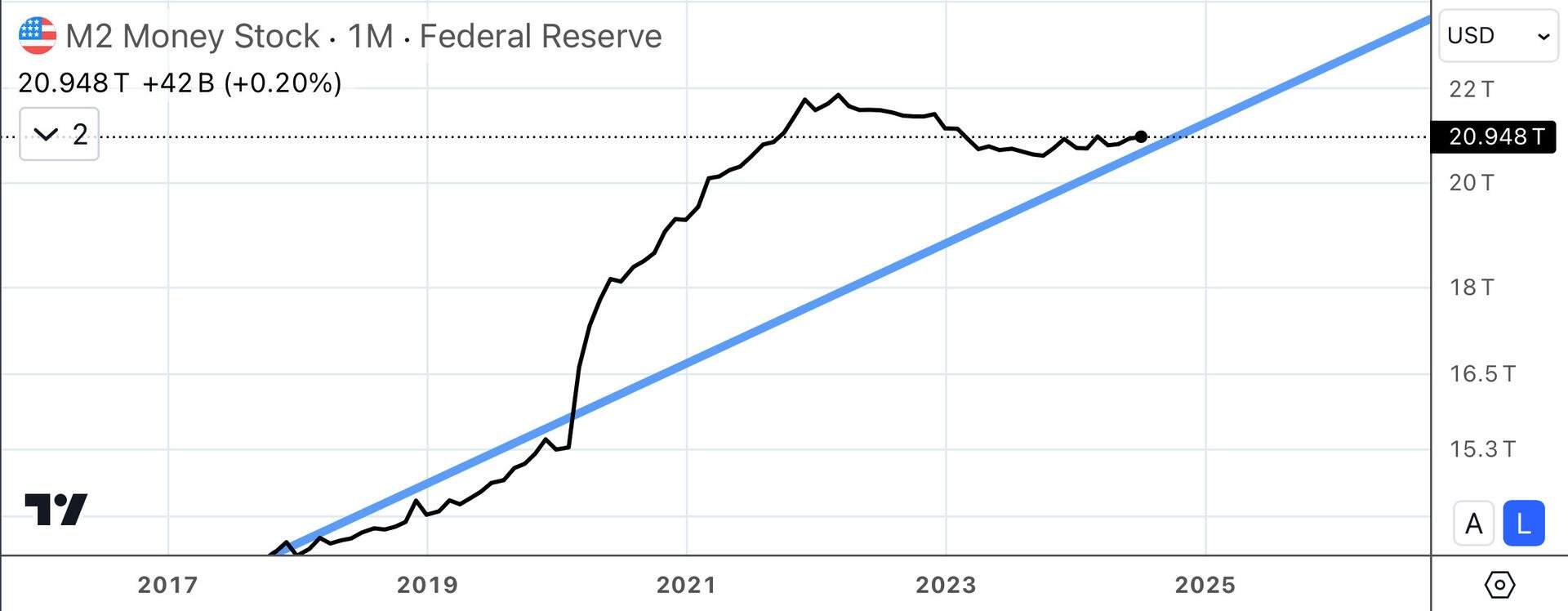

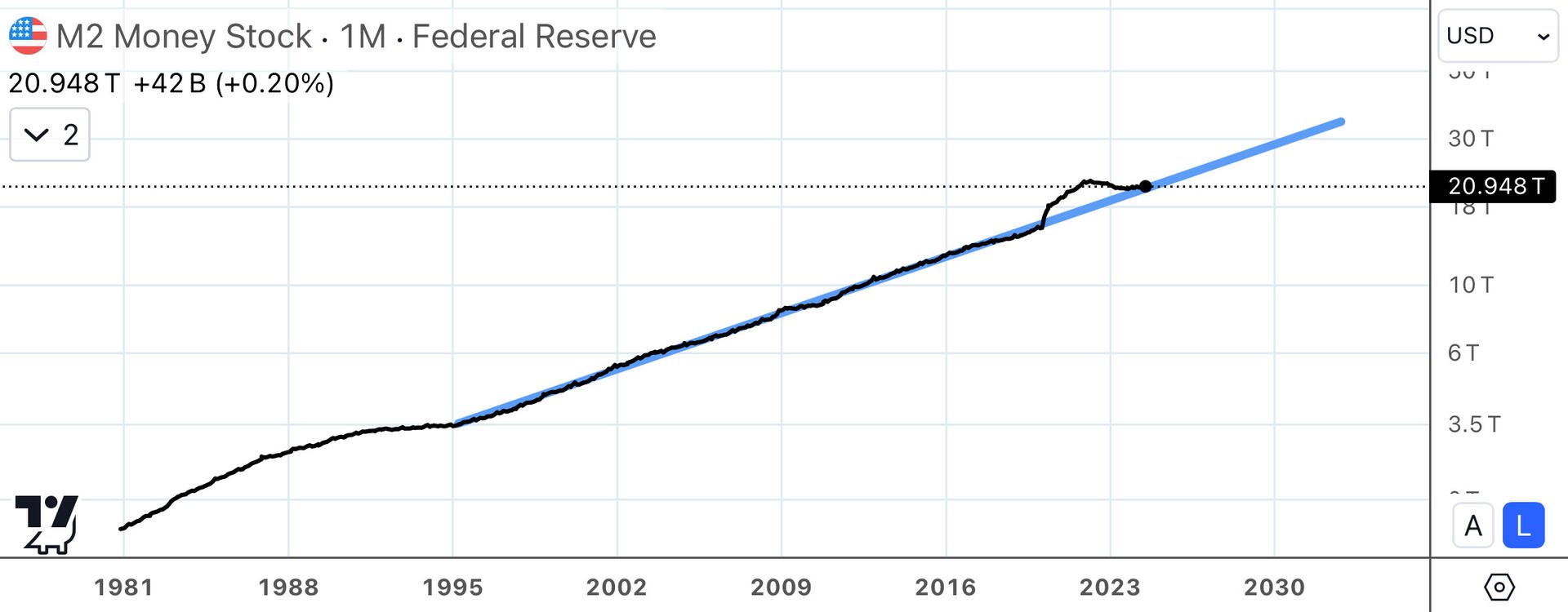

Zoom out.