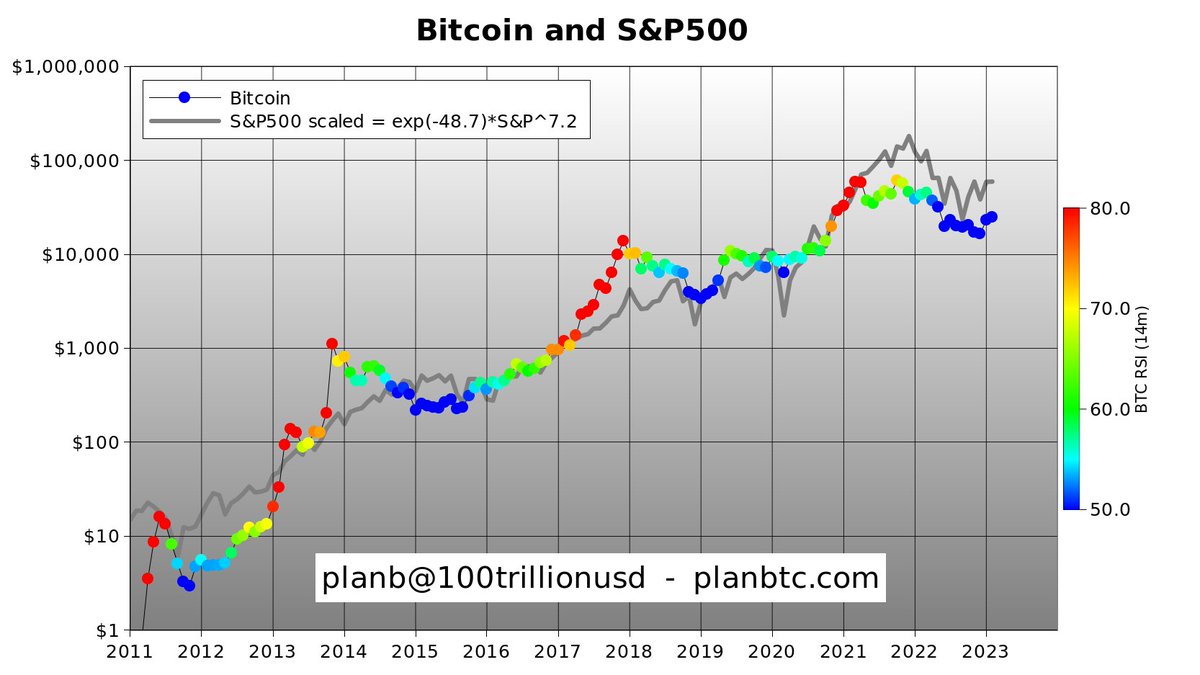

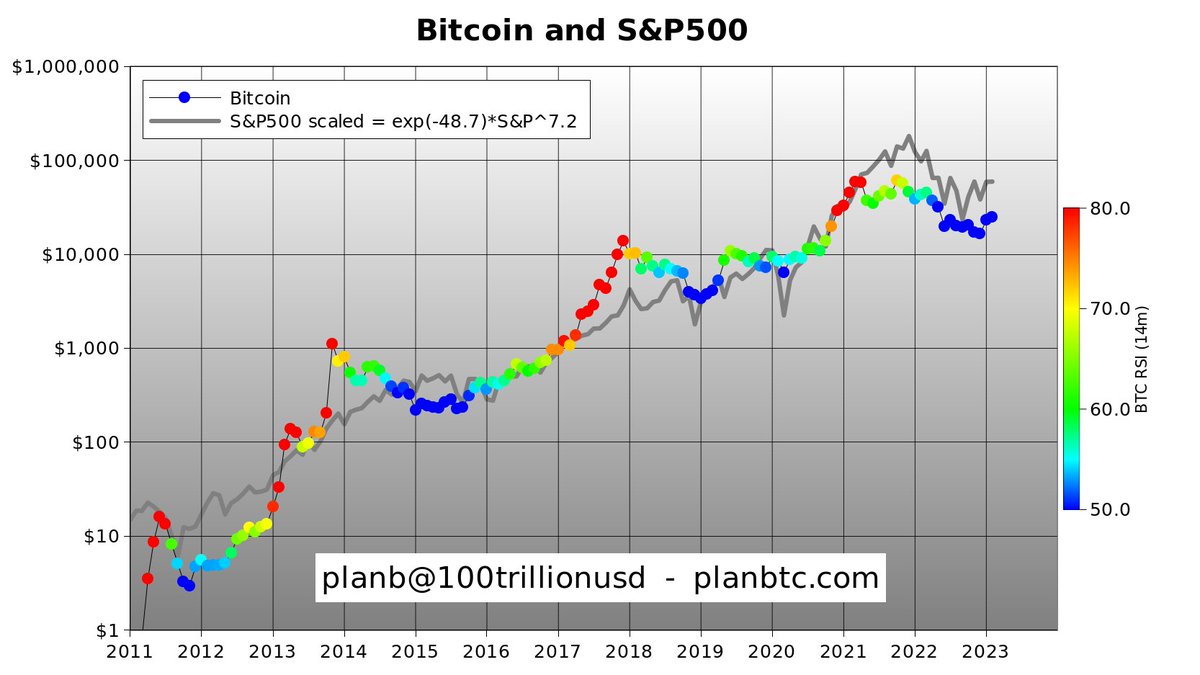

S&P500 is my macro proxy because stock markets price in / anticipate all macro events (inflation, recession, central bank action, war etc)

S&P500 is my macro proxy because stock markets price in / anticipate all macro events (inflation, recession, central bank action, war etc)

I'm also monitoring #NASDAQ in additional to #SP500 to understand the market situation that seems to closely affect to #Bitcoin $BTC price

I often look at Nasdaq/Btc and Gold/Btc for a view of Bitcoin both as a technology and also a commodity.

The CNY10/DXY is a fascinating precursor for global liquidity

And I'm not going to blah blah about "not investment advice", because we're all responsible adults here😉

2 more halvings and S&P 500 will legit look like an absolute shitcoin vs Bitcoin. Era of high growth has died, era of scarcity is awaiting us.

I was following the correlation with the S&P, now I have added the SSE as well

How do the two curves fit each other? What is the error?