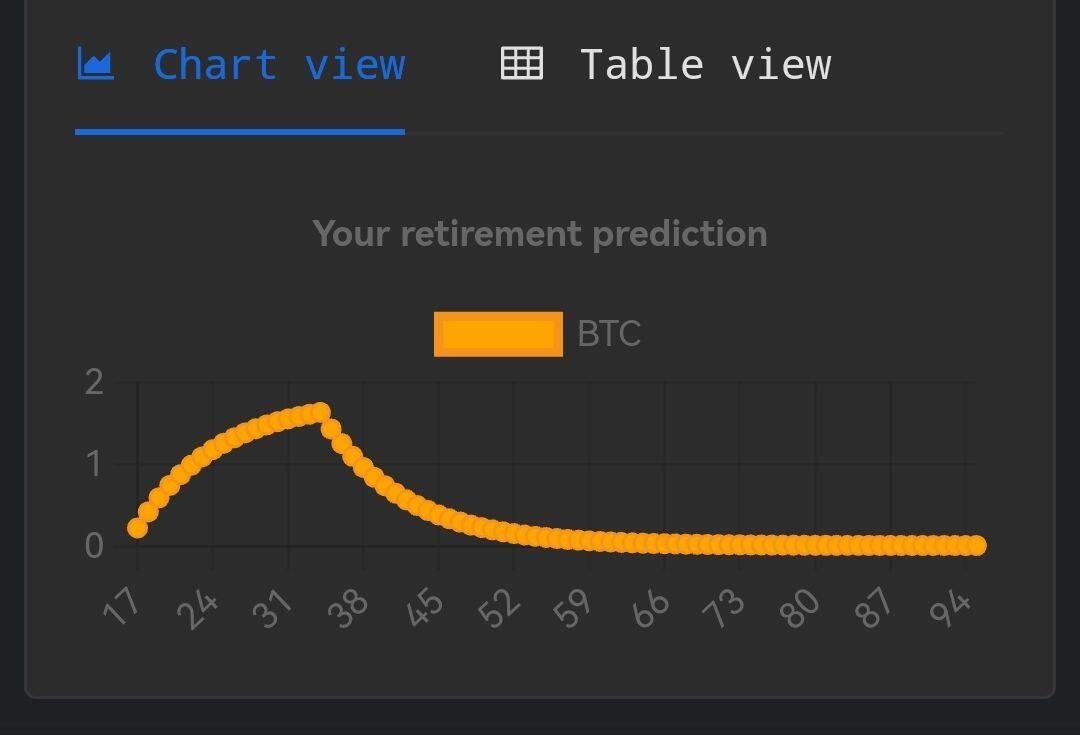

Well, I reviewed it here. I selected the same rate for BTC price growth and fiat inflation. This caused the table to return constant BTC flows to constant FIAT flows over time. It is considering the appreciation of BTC relative to FIAT as a difference between BTC price growth and fiat inflation. This doesn't seem logical to me. The appreciation of BTC over a given fiat currency, in my opinion, in the long term, is a directly proportional function of BTC adoption and the fiat inflation in question, wich I believe can be measured directly by BTC price.

Discussion

Setting both at same rate would mean bitcoin had no advantage compared to FIAT b/c both behave similar.

We know that isn't the case.

The difference of both is what actually matters.

I estimate the difference to be higher than productivity growth as long as adoption (hyperbitcoinization) is completed.

After that the difference would be at the overal productivity growth / rate of technological deflation.

Don't know if FIAT still existed then or would be fixed to BTC... But doesn't matter here.

Seems quite clear to me.