Understood! I own a ton of $RIOT and $MARA stock and have been floating the idea of getting some exposure to $MSTR. Thank you for this framework! Time to dive into the numbers.

Discussion

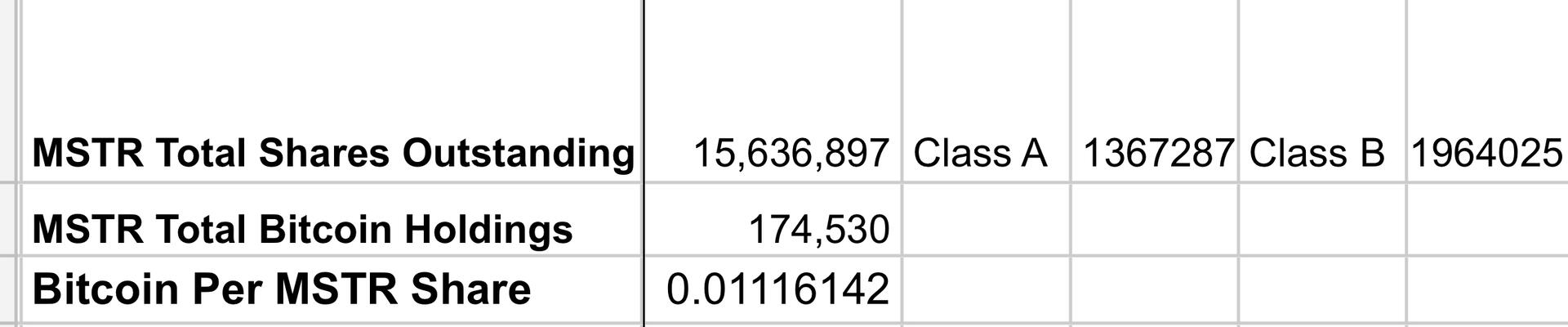

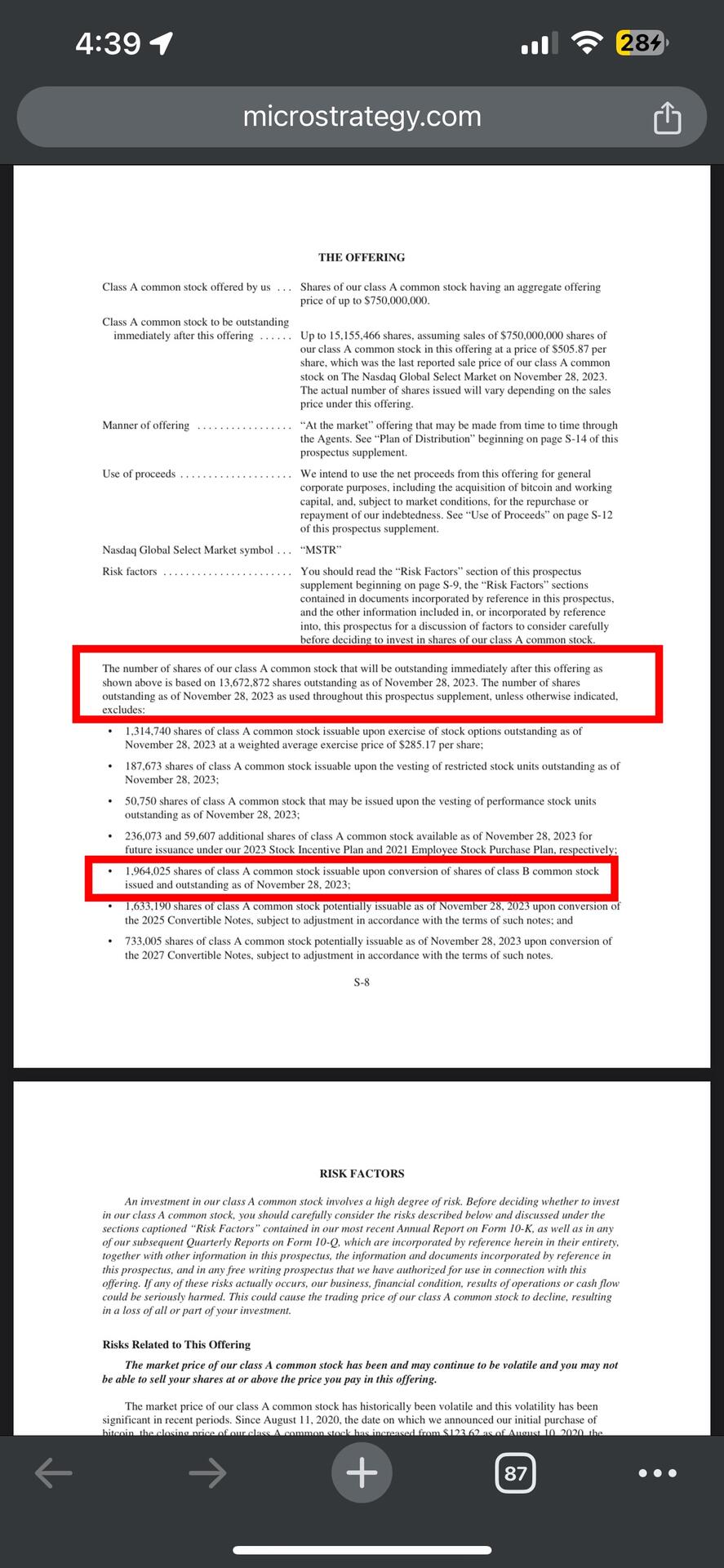

I think my numbers were off slightly. These numbers are taken from page S-8 of the supplemental prospectus and accurate as of November 28th. (I had to verify and kit just trust my work! Haha) https://www.microstrategy.com/content/dam/website-assets/collateral/financial-documents/financial-document-archive/prospectus-supplement_11-30-2023.pdf

Excellent, thank you! 🤙