Financial question:

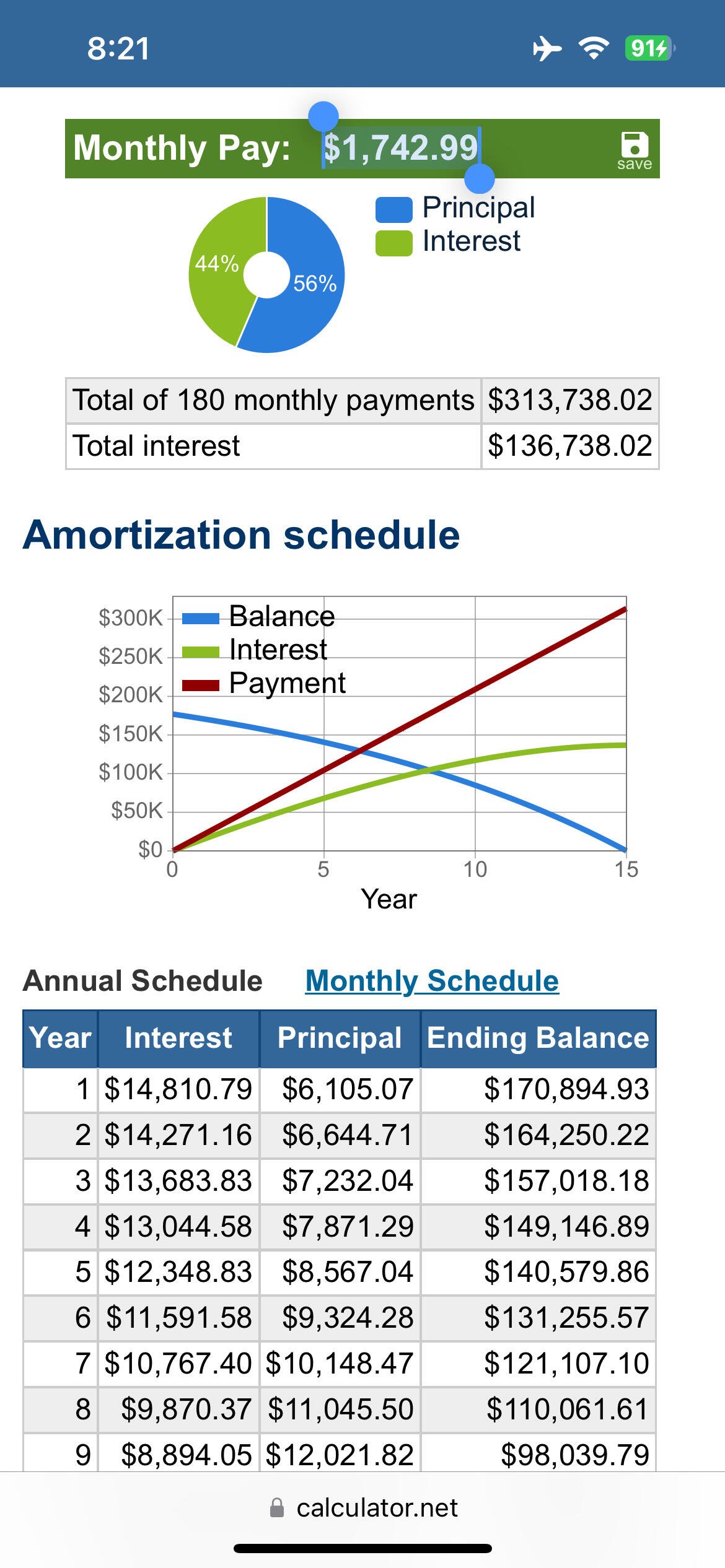

My home is estimated to be worth 630k, I owe 327k, 2.99% fixed 26 years left. If I borrow 177k of the equity at 8.5% over 15 years (leaving 20% equity in the home), and buy btc today, it seems like projections say I could sell the btc at some point in the future (1-5 years) and payoff both the primary and equity loan.

I know the mantra, stay humble and stack sats. And the inherent mantra, never sell btc. And I know I could get rekt if btc drops and doesn't recover in the next 5 years. But, I have the extra income to cover the equity payments now, and I've got the stomach toaggressive? (traded options for amseveral years).

Am I being too aggressive?