**Bonds & Bullion Burst Higher, Banks Battered As JOLTs Plunge Ahead Of Jay Powell**

Bonds & Bullion Burst Higher, Banks Battered As JOLTs Plunge Ahead Of Jay Powell

A surprise RBA rate-hike, hotter than expected headline EU inflation, weak JOLTS, poor US factory orders, a sudden realization of the urgency and seriousness of the debt ceiling debacle, Europe back from vacation, and/or just pre-FOMC jitters?

...or was it this?

> As a reminder, the Fed NOW has next week's dire SLOOS report in hand

>

> — zerohedge (@zerohedge) May 2, 2023 (https://twitter.com/zerohedge/status/1653400481199161345?ref_src=twsrc%5Etfw)

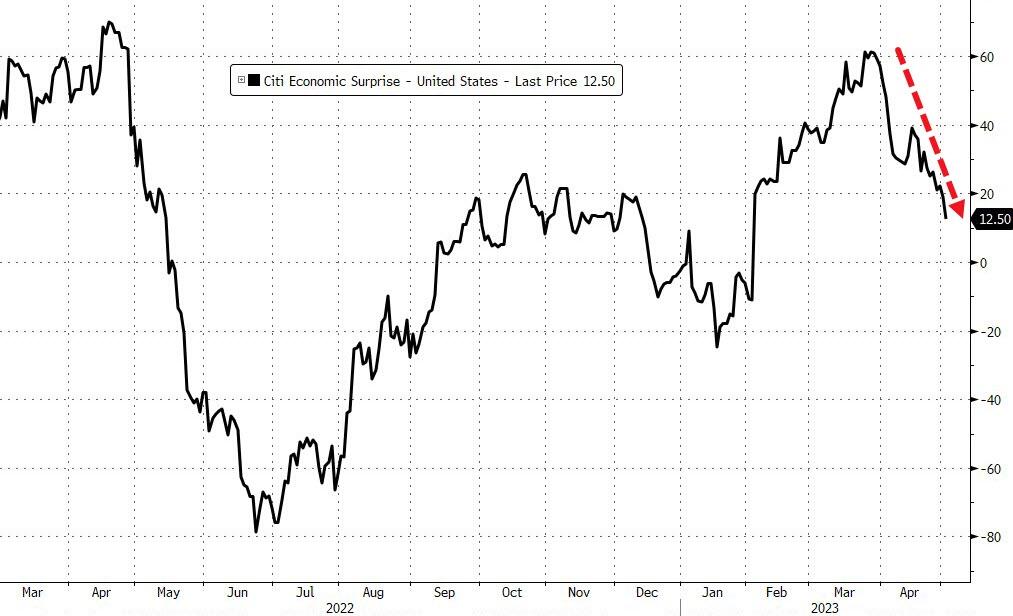

US Macro data is serially disappointing...

?itok=BdK4H5gc (

?itok=BdK4H5gc ( ?itok=BdK4H5gc)

?itok=BdK4H5gc)

_Source: Bloomberg_

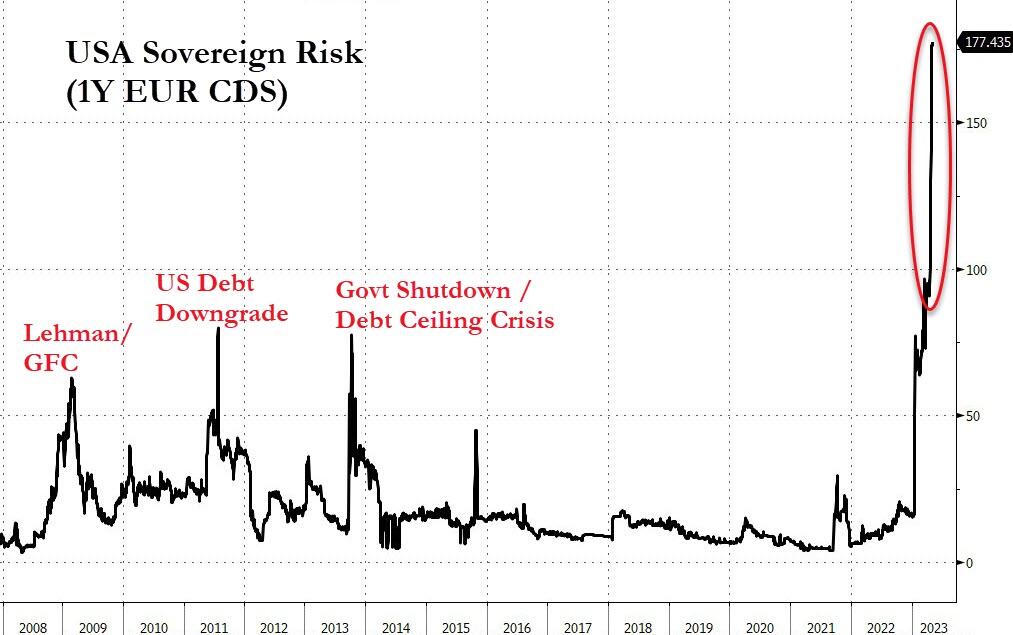

US debt ceiling anxiety is serially increasing...

?itok=ej7BUS7P (

?itok=ej7BUS7P ( ?itok=ej7BUS7P)

?itok=ej7BUS7P)

_Source: Bloomberg_

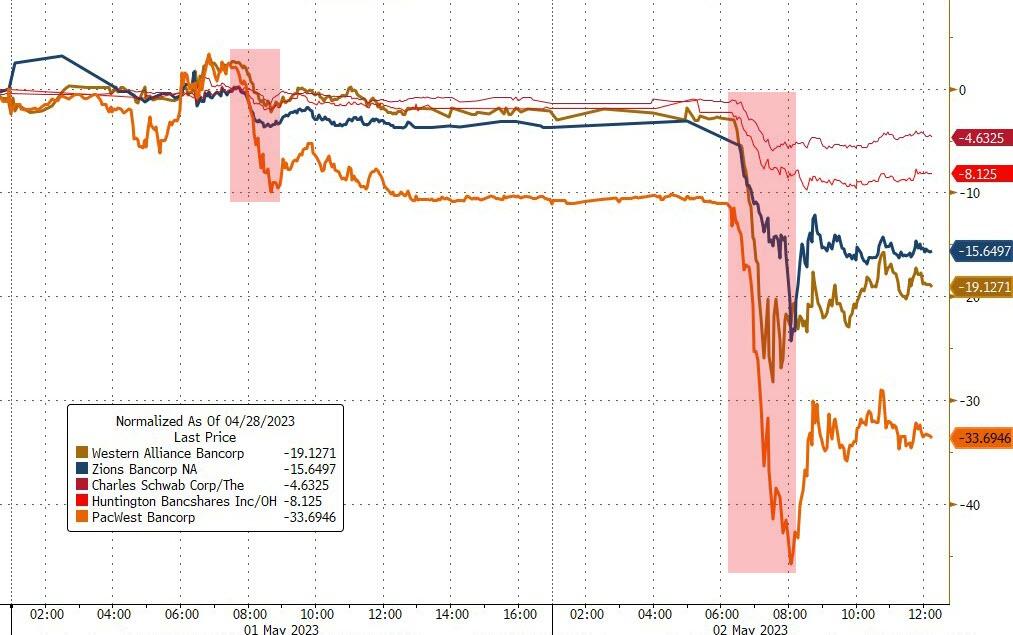

Bank stocks were a bloodbath as the world and his pet rabbit realized JPM hadn't saved the universe. Regionals were smashed lower as whack-a-mole resumes...

?itok=UUGq-iGi (

?itok=UUGq-iGi ( ?itok=UUGq-iGi)

?itok=UUGq-iGi)

_Source: Bloomberg_

And even the big boys suffered...

?itok=ZdBo1R1l (

?itok=ZdBo1R1l ( ?itok=ZdBo1R1l)

?itok=ZdBo1R1l)

_Source: Bloomberg_

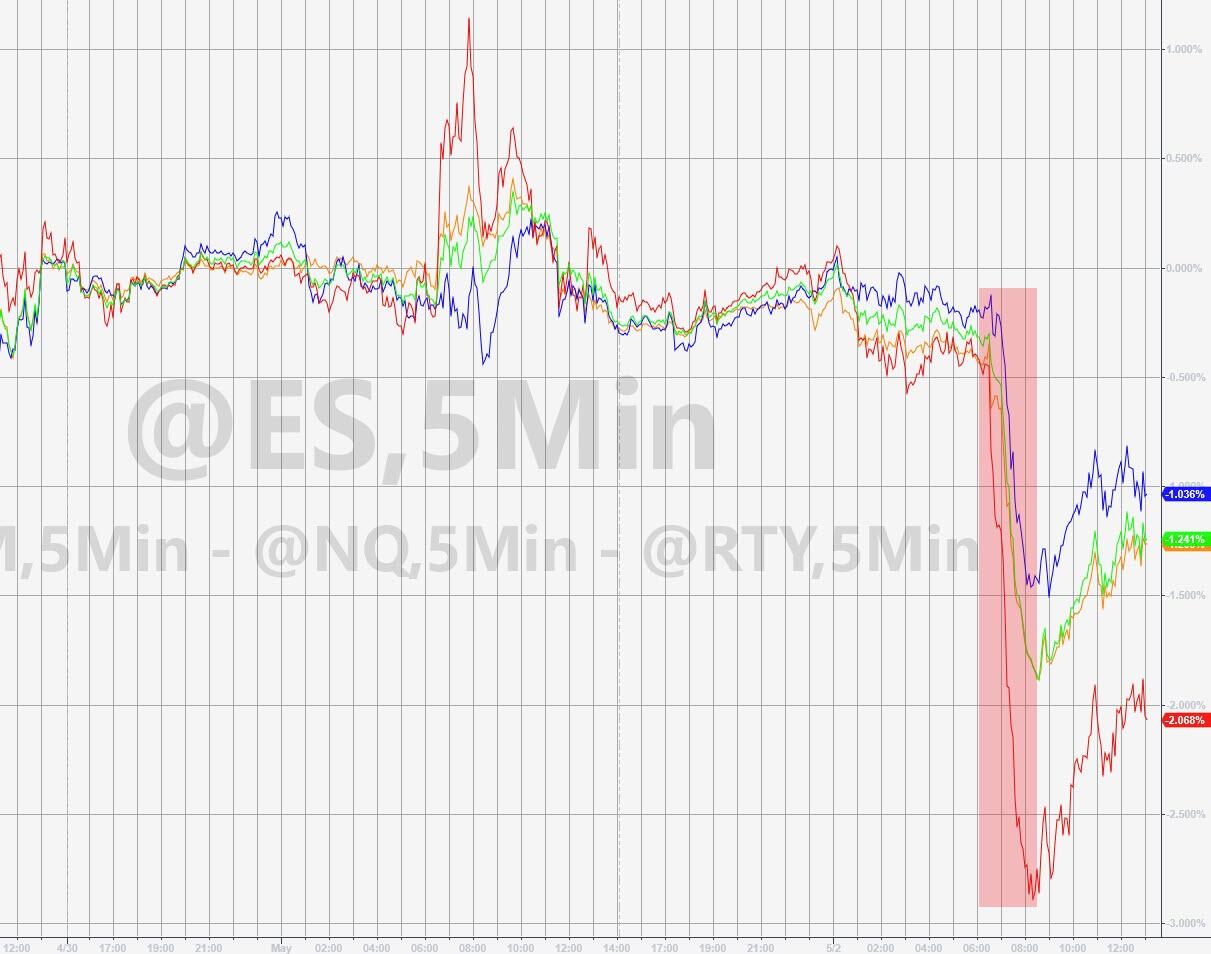

Overall, all the majors were lower today with Small Caps hardest hit...

?itok=KeWWlFXh (

?itok=KeWWlFXh ( ?itok=KeWWlFXh)

?itok=KeWWlFXh)

'Most Shorted' Stocks puked hard...

?itok=YH7lKKdr (

?itok=YH7lKKdr ( ?itok=YH7lKKdr)

?itok=YH7lKKdr)

_Source: Bloomberg_

0-DTE fought hard against the initial down-thrust in stocks from the cash-open. Stocks stalled around 4100 then rebounded and then around 1400ET, 0-DTE call-buyers took profits...

?itok=zWCms02y (

?itok=zWCms02y ( ?itok=zWCms02y)

?itok=zWCms02y)

_Source: SpotGamma_ (https://spotgamma.com/hiro-indicator/)

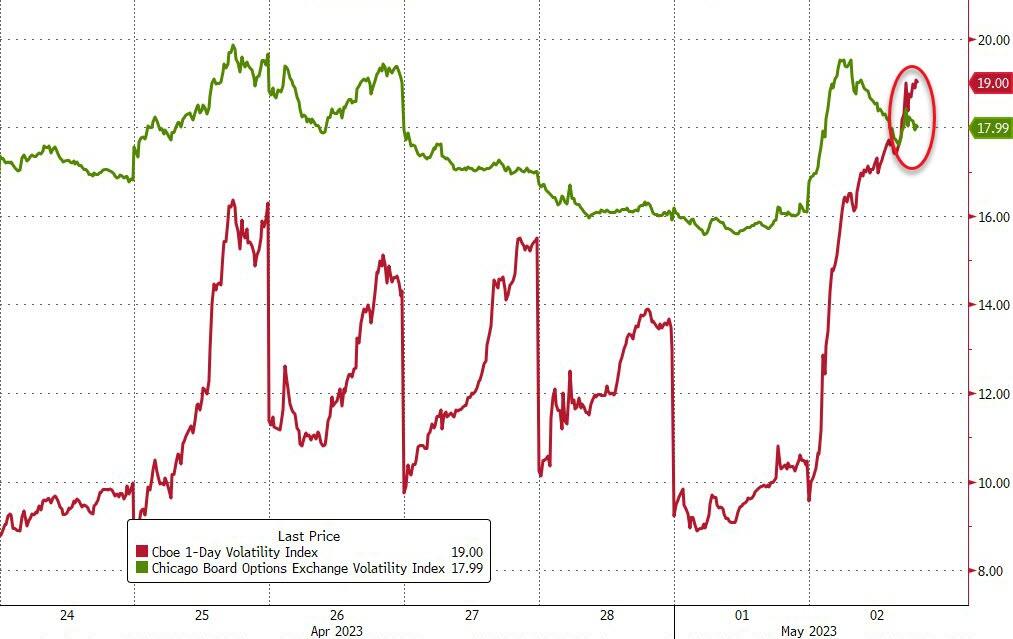

VIX1D soared today, breaking back above VIX for the first time since April 11th (ahead of CPI) and April 6th (ahead of payrolls)...

?itok=XDT9hM63 (

?itok=XDT9hM63 ( ?itok=XDT9hM63)

?itok=XDT9hM63)

_Source: Bloomberg_

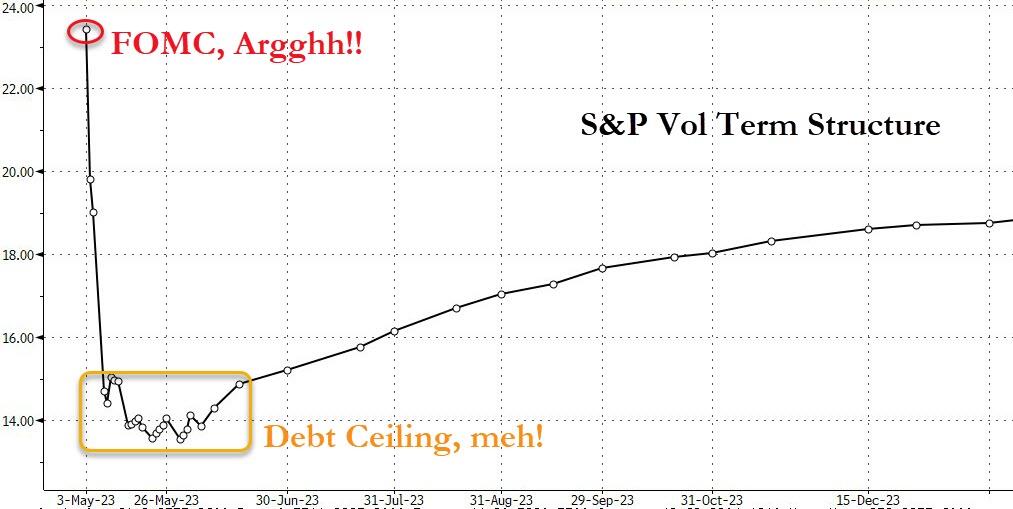

And as we noted earlier, equity markets remain somewhat more sanguine about the debt ceiling threat that other markets

?itok=AgLJqgIG (

?itok=AgLJqgIG ( ?itok=AgLJqgIG)

?itok=AgLJqgIG)

_Source: Bloomberg_

And then there was Chegg, down 50%... AI's first victim...

?itok=Xk0e2B9M (

?itok=Xk0e2B9M ( ?itok=Xk0e2B9M)

?itok=Xk0e2B9M)

_Source: Bloomberg_

Treasuries were aggressively bid as Europe's liquidity returned and the heavy corporate calendar eased up. **The long-end underperformed but the entire curve plunged** (30Y -10bps, 5Y -18bps, 2Y -16bps)...

?itok=7G4n9SzL (

?itok=7G4n9SzL ( ?itok=7G4n9SzL)

?itok=7G4n9SzL)

_Source: Bloomberg_

2Y Yields fell back below 4.00%...

?itok=NnsQN1_X (

?itok=NnsQN1_X ( ?itok=NnsQN1_X)

?itok=NnsQN1_X)

_Source: Bloomberg_

Rate-hike odds plunged today ahead of tomorrow's FOMC statement. The market adjusted down to an 85% chance of a 25bps hike tomorrow...

?itok=00Ehy-Xb (

?itok=00Ehy-Xb ( ?itok=00Ehy-Xb)

?itok=00Ehy-Xb)

_Source: Bloomberg_

...but most notably, June went from a 35% chance of 25bps hike to a 15% chance of a 25bps rate-cut today...

?itok=PHS4LNqG (https://cms…

?itok=PHS4LNqG (https://cms…