Record Foreign Demand For Stellar 2Y Auction

Record Foreign Demand For Stellar 2Y Auction

Amid rising fears that the Fed's next move may be a rate hike instead of a cut, it appears that bond buyers - and especially foreign bond buyers - did not get the memo, and instead today's just concluded sale of $69 billion in 2Y paper was one of the strongest on record.

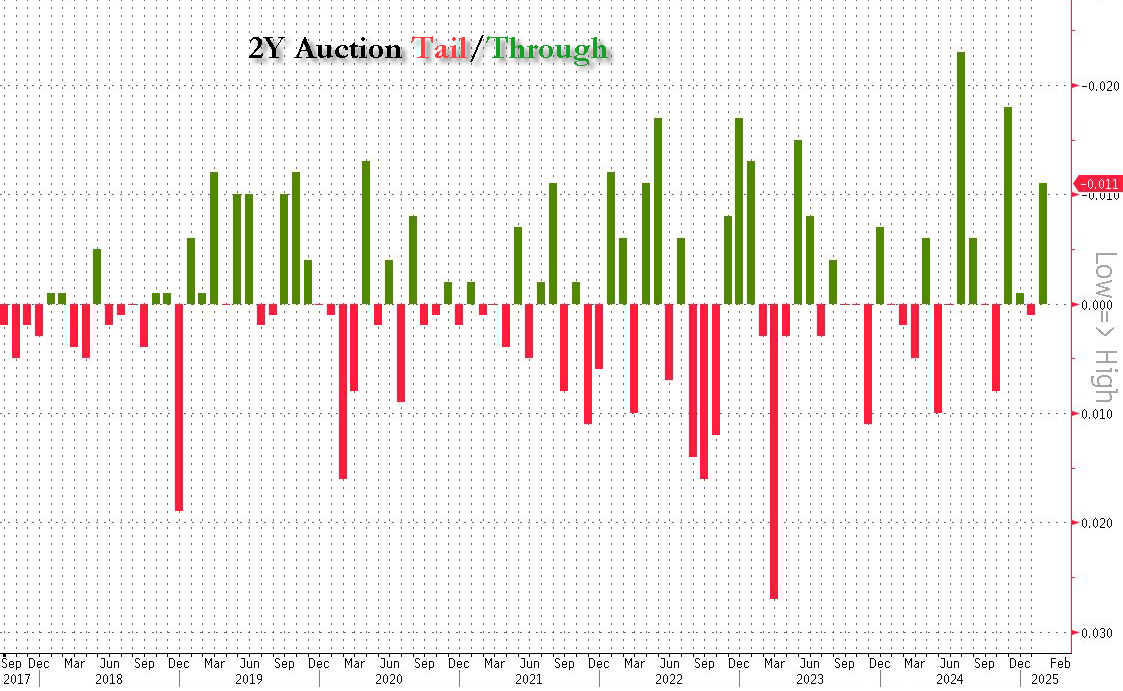

Starting at the top, the auction stopped at 4.169% at its 1pm close out time; this was down from 4.211% last month and also stopped 1.1bps through the 4.18% When Issued, following last month's modest tail. This was the third biggest stop through in the past two years as shown in the chart below.

?itok=R0isO1fS

?itok=R0isO1fS

The Bid to Cover was less exciting: at 2.56% it was down 10bps from last month's 2.66% and was the lowest since October, which is why it was well below the six-auction average of 2.66%.

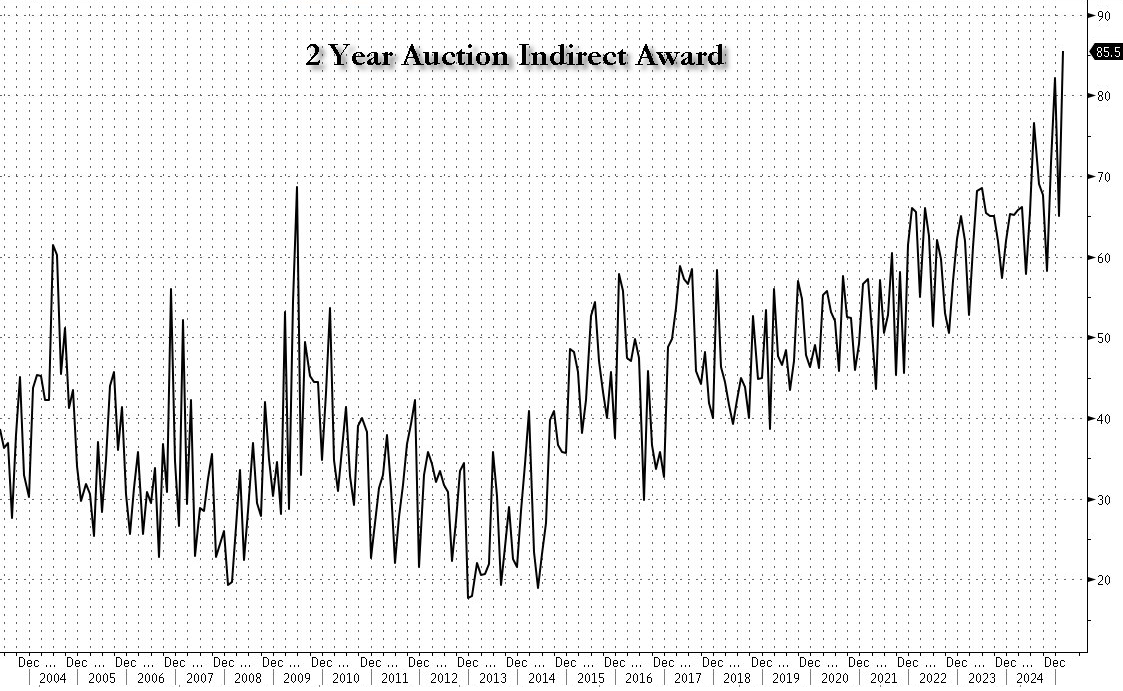

But what the auction lacked in BTC, it more than made up for thanks to foreign demand, because with 85.5% of the auction awarded to Indirects, i.e., foreign buyers, this was the highest Indirect award on record.

?itok=MGT1OjOk

?itok=MGT1OjOk

And with Directs awarded 7.6%, Dealers were left holding just 6.9% of the auction, the lowest on record!

Overall, this was a stellar auction, and on news of the break the 10Y yield, already near session lows, dropped to a fresh low for the day, just below 4.40% and likely set to drop even more.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/24/2025 - 13:31

https://www.zerohedge.com/markets/record-foreign-demand-stellar-2y-auction