I'd honestly be more concerned when the US govt tries to prevent other nation states from dumping their assets(esp US ones) to aquire BTC. They may prevent/slow their own citizens from it but other nations might seize on the opportunity to aquire that kind of relatively unristricted liquidity...

nostr:npub1n3sjlzmhpu8rl56umtptc4lua6zkretq2p82yhytnmlcuq639vlqd0te5l, you pointed out that the energy FUD is not likely to be a long term issue for Bitcoin regulation (thanks to the hard work of many badass bitcoiners, including yourself), but that the KYC/AML “clean coins” surveillance state is a much more compelling move for regulators to take, with little opposition.

If this does make it harder for KYC and non-KYC coins to function in a shared economy, doesn’t this likely mean that the US “Bitcoin economy” is forced to fall behind? If the country’s citizens can only legally use (or hodl) a small portion of available coins, there’s less available wealth to save. I’m thinking over a 20-50 year period.

It also deters investment from the wealthiest-to-be class (bitcoiners of today, fast forward a few decades).

I guess it’s too early to tell, but you’ve got me thinking. What does bitcoining look like in a state with strict regulation around nodes, mining, and KYC?

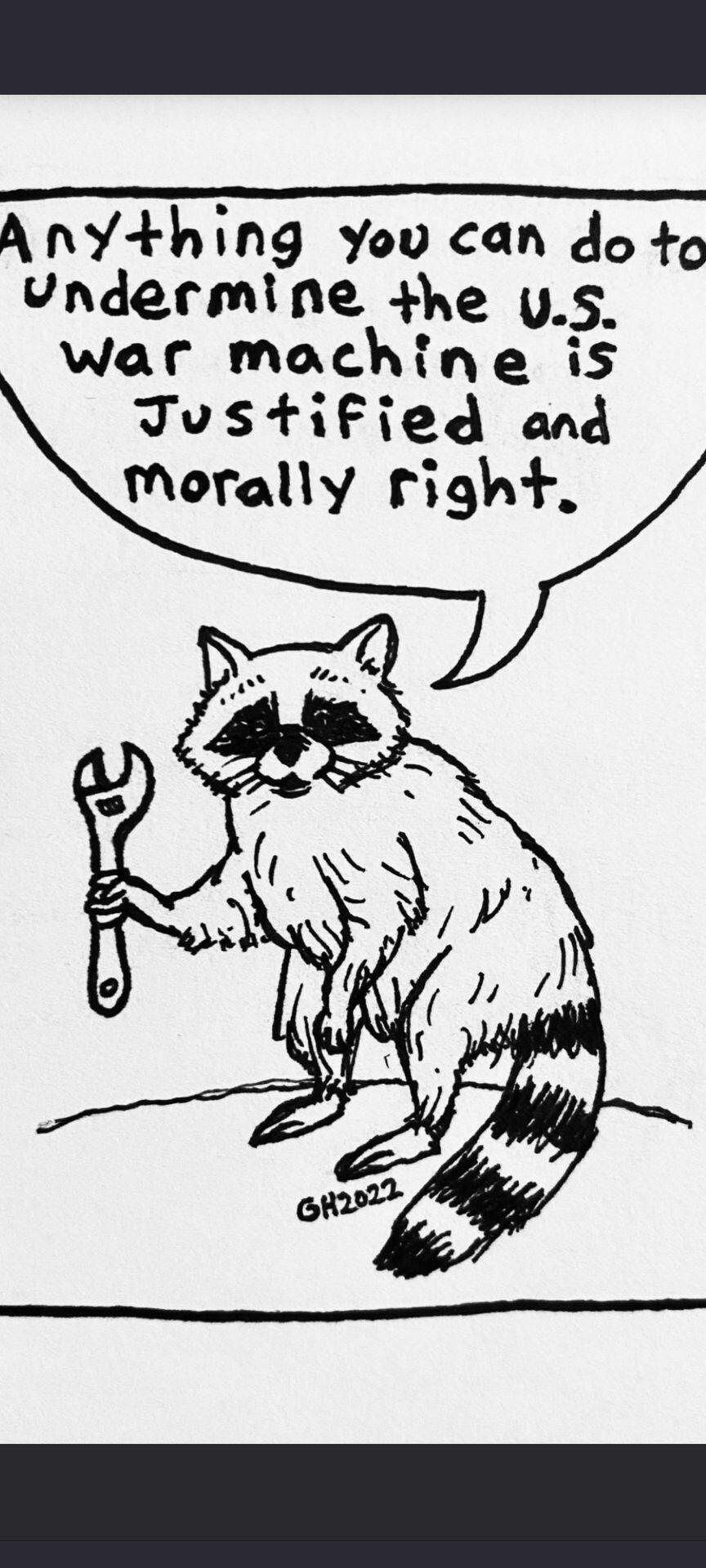

Proper Bitcoining will perhaps “look like” civil disobedience...

Discussion

No replies yet.