Give me $100.

I'll pay you 5% a year and after ten years I'll give you the $100 back.

This is how the government borrows money.

But when it's time to pay the $100 back, they don't have it, because they already spent it.

So they sell another $100 IOU onto the market and use that $100 to pay you back.

They're always selling more of these IOUs both to pay back older ones and to finance their current budget deficit.

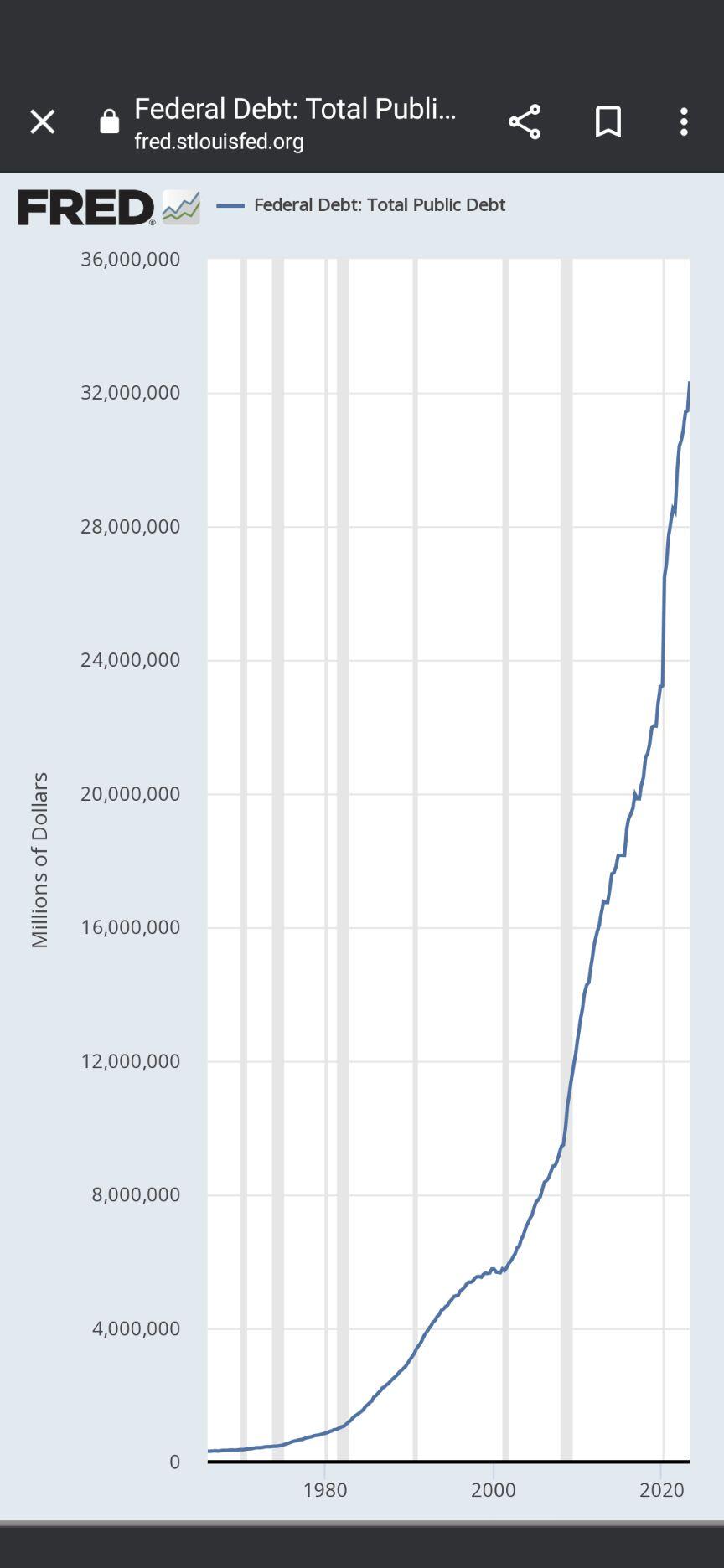

Never do they pay anything back without issuing new debt, so the debt grows year after year.

If this sounds like a scam, you're starting to get it.