Okay, everyone is staring at me like I'm confused, but think about it this way:

The economy is collapsing.

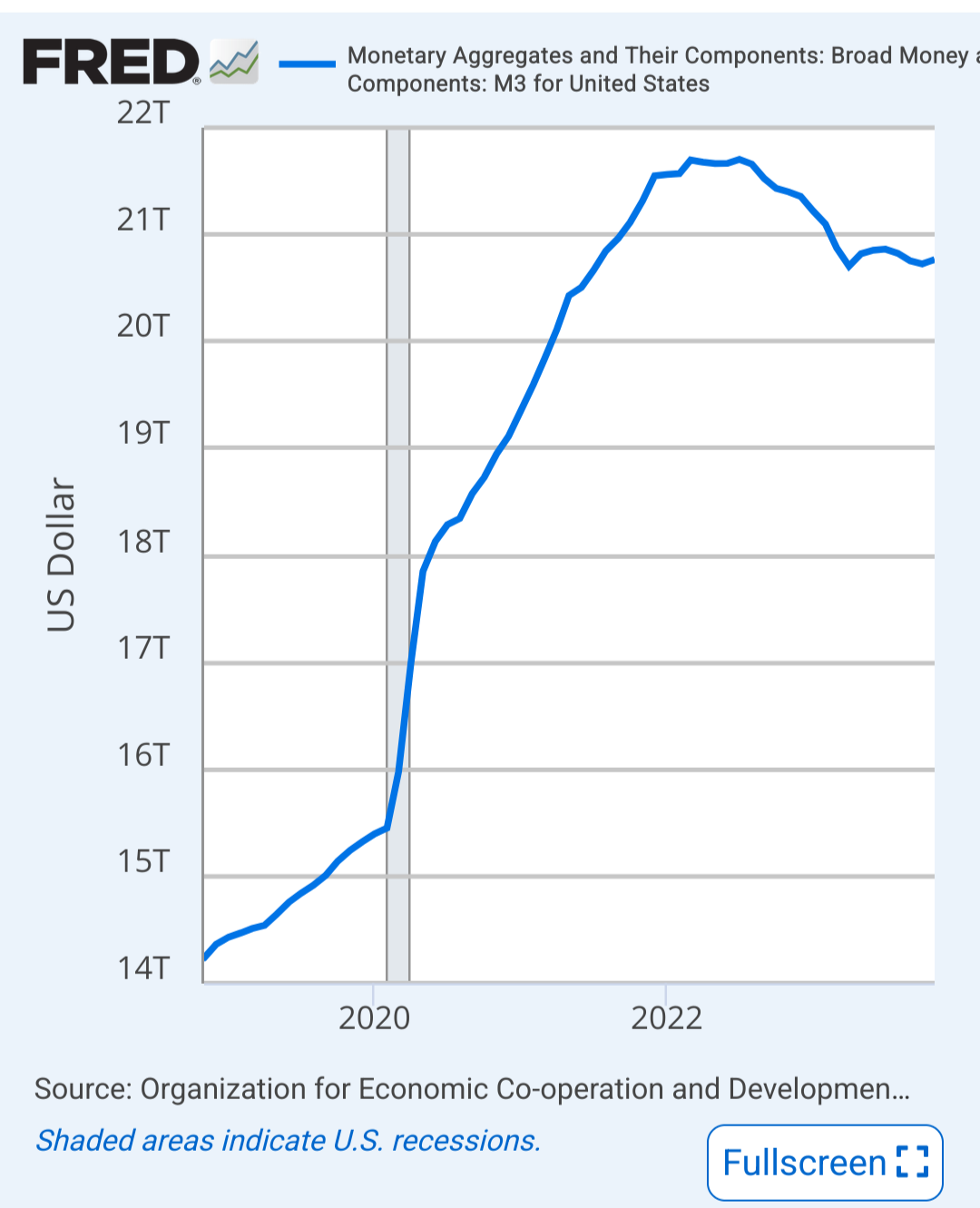

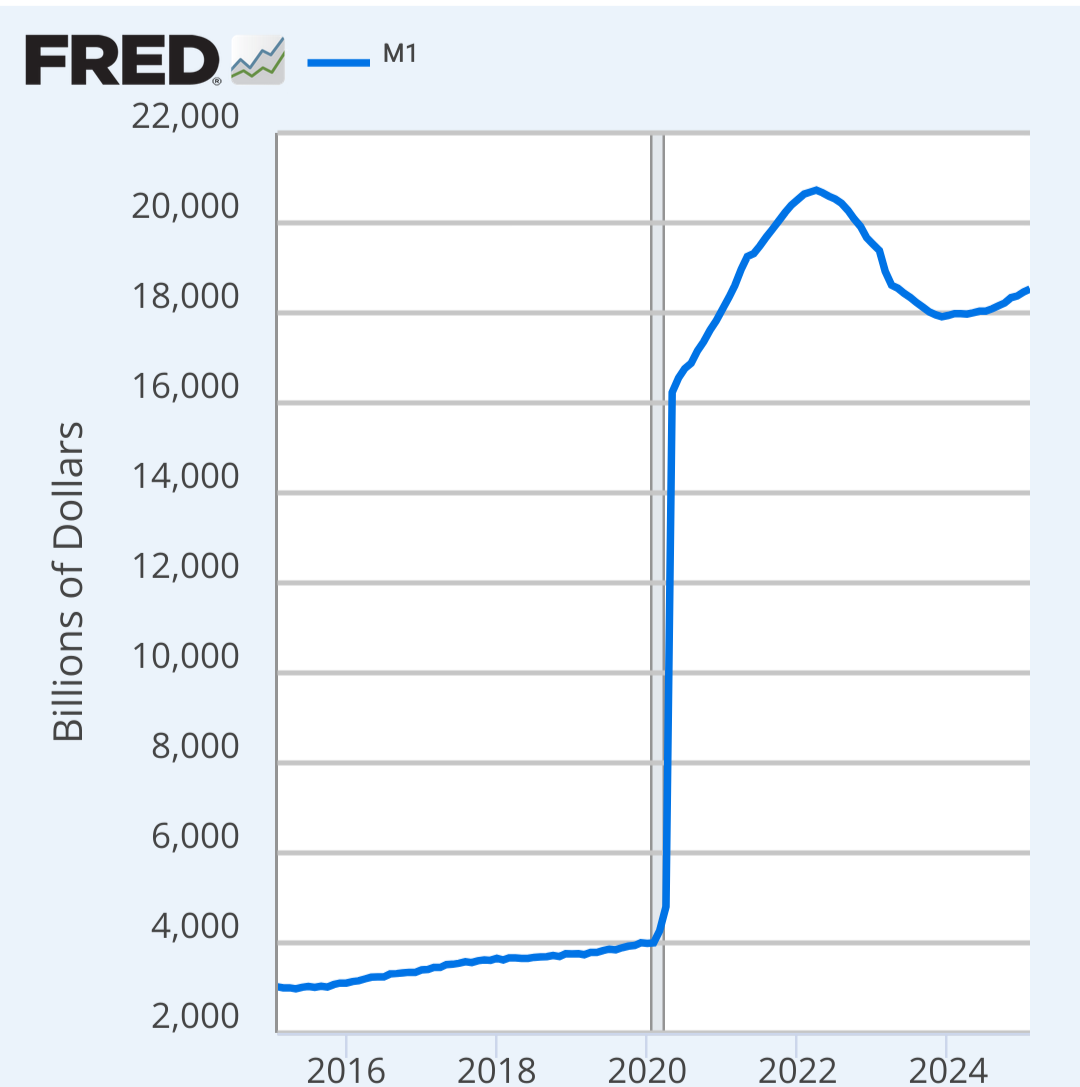

They want to inject it with cash, to push it up, again, at least in nominal terms, so that they can cover their debts with cheaper money.

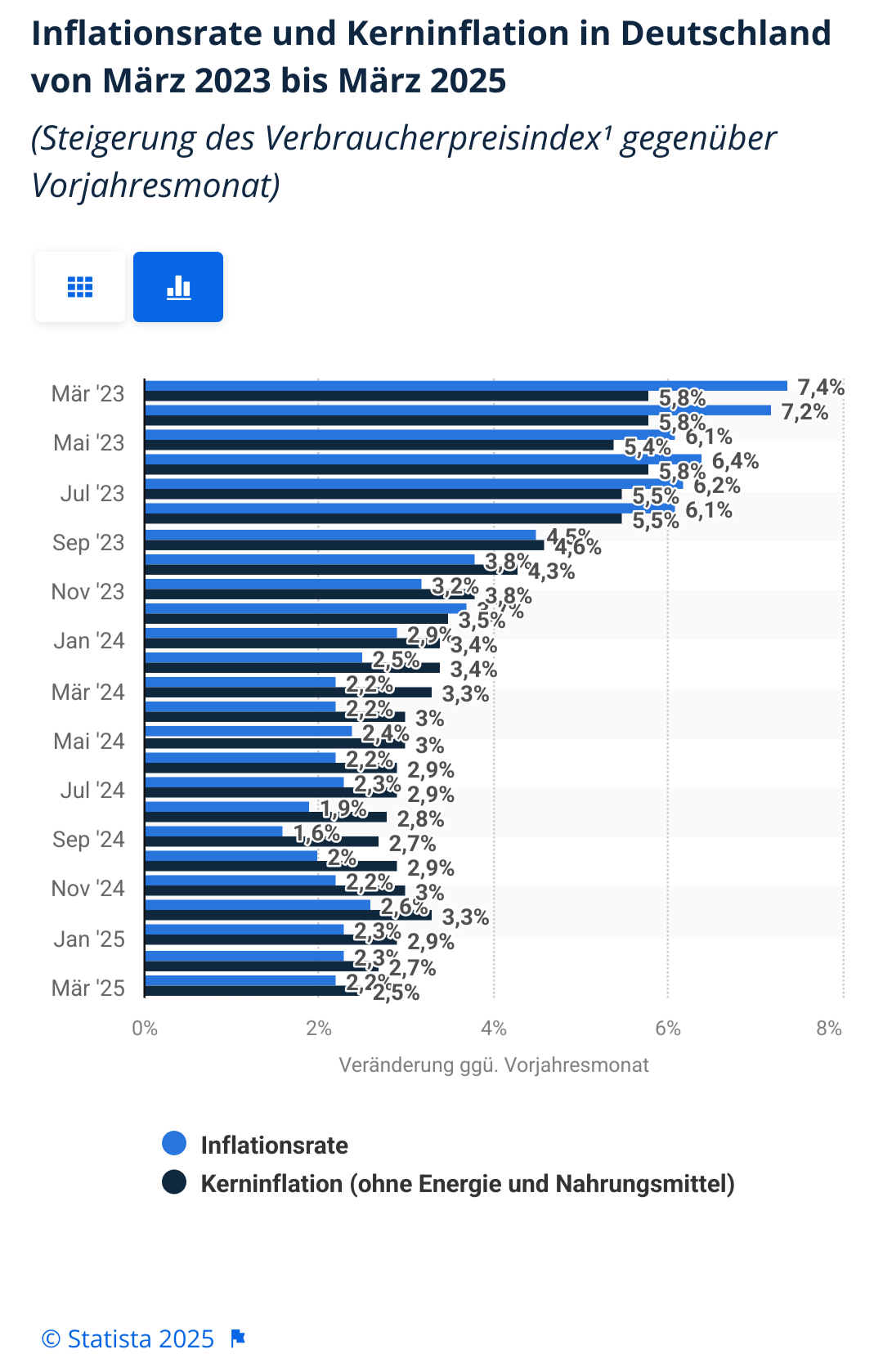

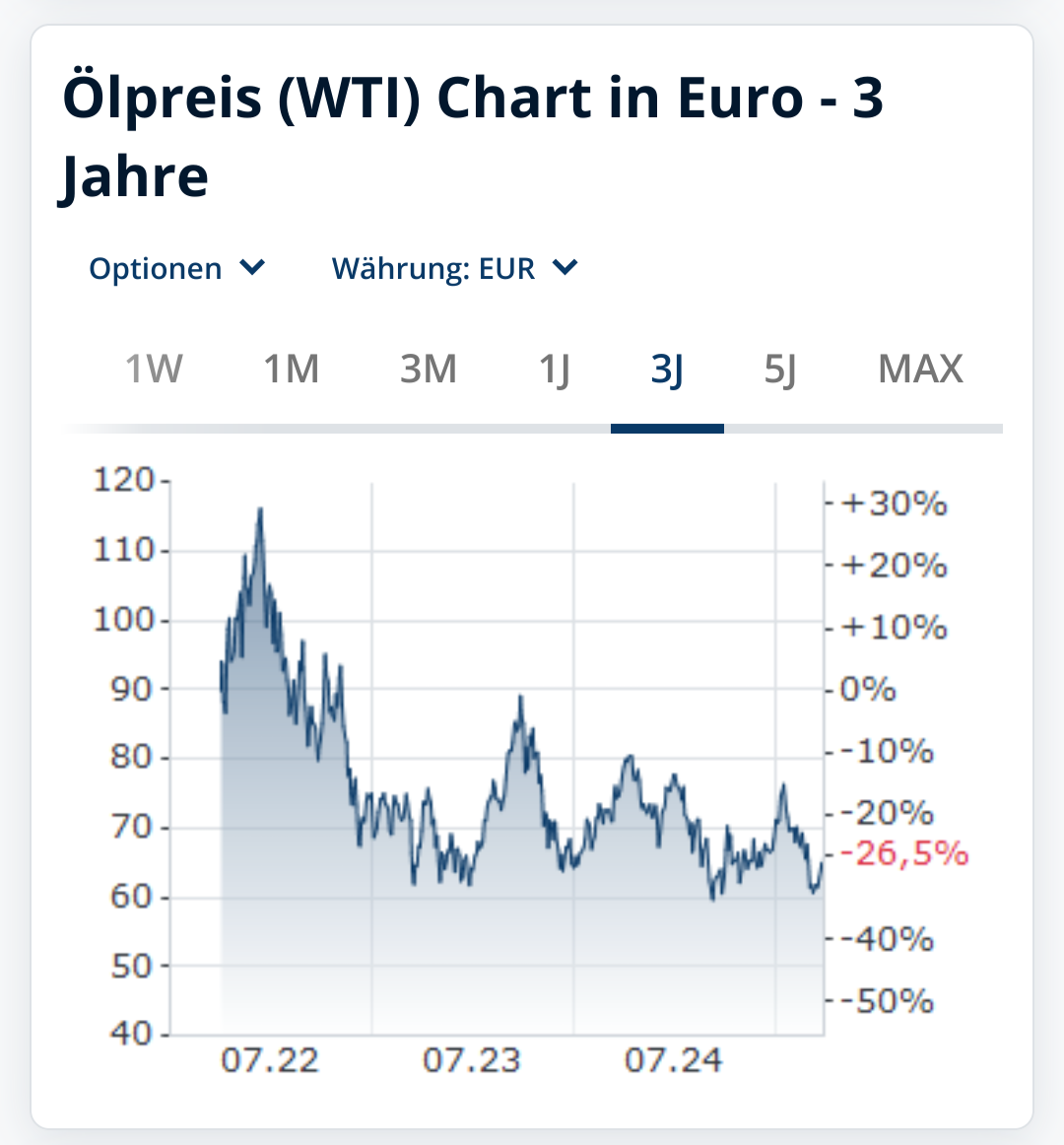

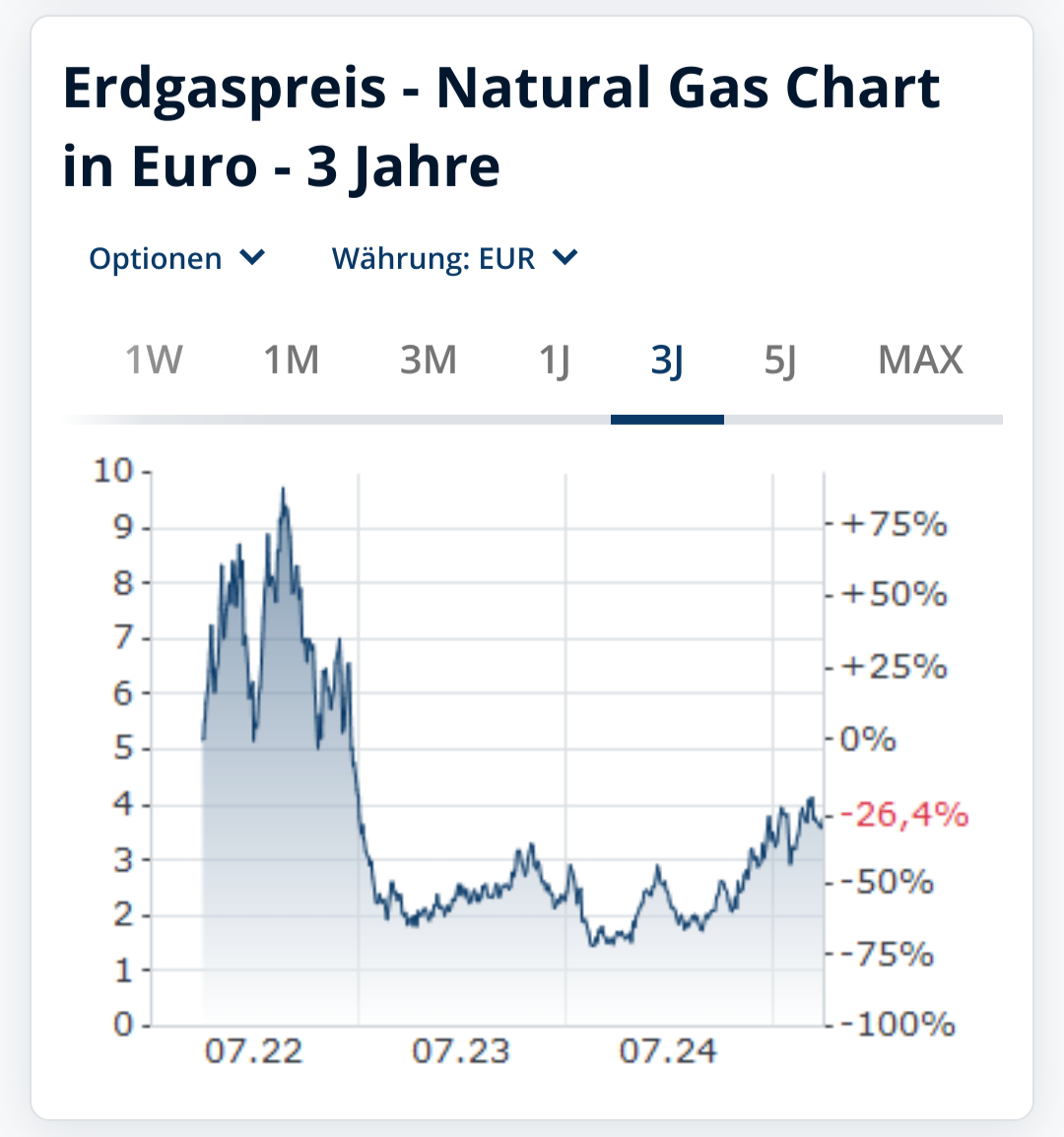

But the inflation trend is ↘️. They keep trying to hype it up, by announcing "whatever it takes", but the market just hears "economy ded, we're panicking, everyone shut down production and fire your workers".