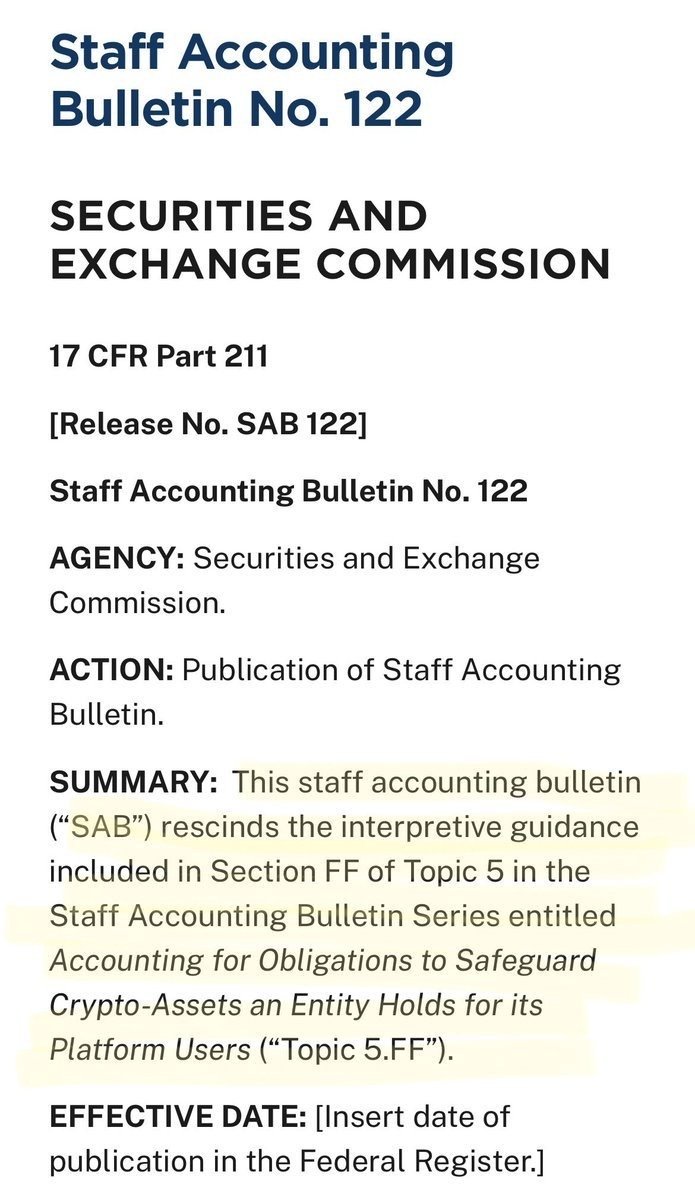

They don't have an effective date listed on the SEC's website. Do you know how that process generally goes?

Discussion

From what I understand, it’s immediate.

Anything I’m missing nostr:npub15dnln6cukw3yrflnv3hnrntdt9amh0uw466u6tns05ymqp3nal4qzz3lfc?

Looks like that's how the news is reporting it.

Beginning immediately, banks can now list bitcoin and as “assets” on a balance sheet, rather than a liability, which required them to match the equivalent amount in fiat.

This is only SEC guidance, but it shaped all FDIC policy and internal procedures for banks.

This is also useful for Bitcoin brokerages and exchanges, as they were required to also match all bitcoin deposits with fiat.

It will likely take until the first of Q1 (April) to really see the impact once publicly listed banks have to post their deposits and assets.

I’d also assume many management boards of directors will slowly start to green-light bitcoin as an asset.

Next up is policy changes at FDIC

I’m writing a post later today on Bitcoin Policy Institute’s website to give some analysis