If you DCA a stack how do you know the purchase price for taxes? Just use a average?

Discussion

Have you seen what they want to do for next year yet?

No, what?

I haven’t yet either that’s why I asked?

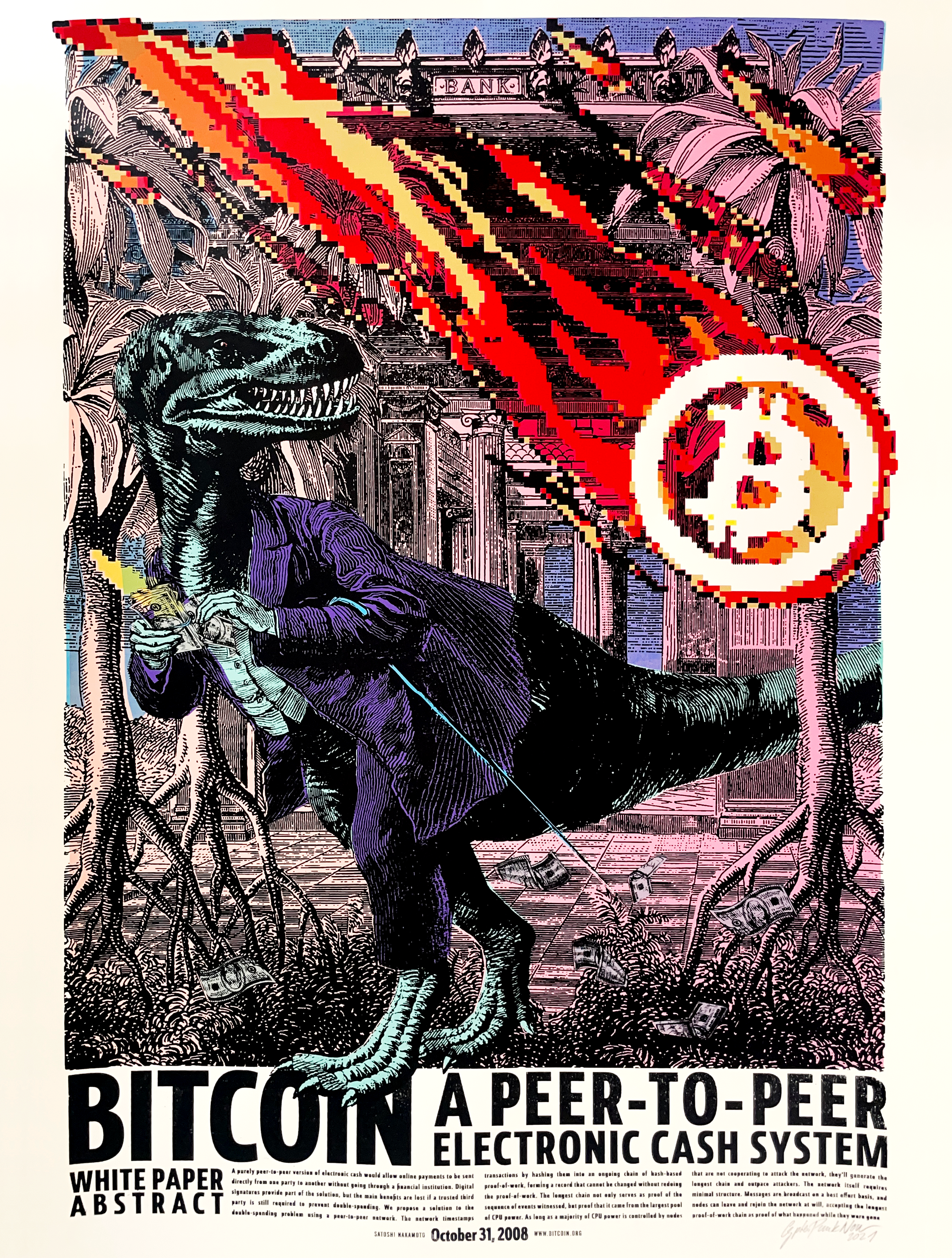

Who knows? Who cares? I don't. Fuck 'em. https://nostpic.com/media/c3ae4ad8e06a91c200475d69ca90440d6d54de729d3d1e5afacfbdb6e54d46cb/d2f564c180e38016380c22b7dbf388073c49a11ce1c623f9aa751d0c59b2f4ec.webp

🤣

Always wondered this, when if I spend a UTXO that I bought at a loss but my overall stack is in profit?

A few different valid accounting methods but I would reccomend telling them to GFY.

Dollars spent / BTC purchased would be my guess (so average price).

I'm sure there's some accounting method that pretends money isn't fungible and prices different sats differently.

Also there's this: https://x.com/michelleweekley/status/1868762579742462387

This recent video from Andreas Antonopoulos covers some of that. Only two weeks left for “safe harbor” 😵💫

In our country it's FIFO. And you need to tax accordingly. At least that's what accountants say.

IDC, I never sell. At least as far as the mafia knows.

Never sell

I have a principal of being honest to those who are honest back.

My government is not honest.

I agree but I have no interest in being locked in a box for 109 years

I would claim a loss due to the boating accident I had last August.

My boat sank with my private keys but magically someone bought me a brand new pick up truck as a gift for my bday.

I think he said his name was Satoshi Nakomoto. You'll have to contact him about any taxes.

People trade me btc sats for goods and services, and I use sats as my currency... sats pay for my purchases and bills. I don't know if that's considered selling since I don't have any real gains or dividends from the activity. I don't plan on reporting the activity. It's frankly no one's business, especially not of the alphabet bois.

Pretend to sale your corn, and whatever calculation comes out of that is your cost basis.