With $4.6 billion in volume just in the ETFs (ignoring spot volume) on the first trading day of a thinly traded asset (even with market makers and futures) still surprises me how quiet it was price wise. It is odd.

Discussion

Well they aren’t buying or selling bitcoin.

They are buying or selling shares of a bitcoin @ spot prices + fees.

MM and the APs need to locate the underlying asset. Should absolutely have impact on price. Especially given the volumes.

Need 10,000 bitcoin in collateral at $46k, assuming they expected this volume. If they didn’t anticipate this volume, then they would be either in violation or screwed. Maybe the MM did their job very effectively. Just surprising is all.

Are you assuming they just bought this bitcoin?

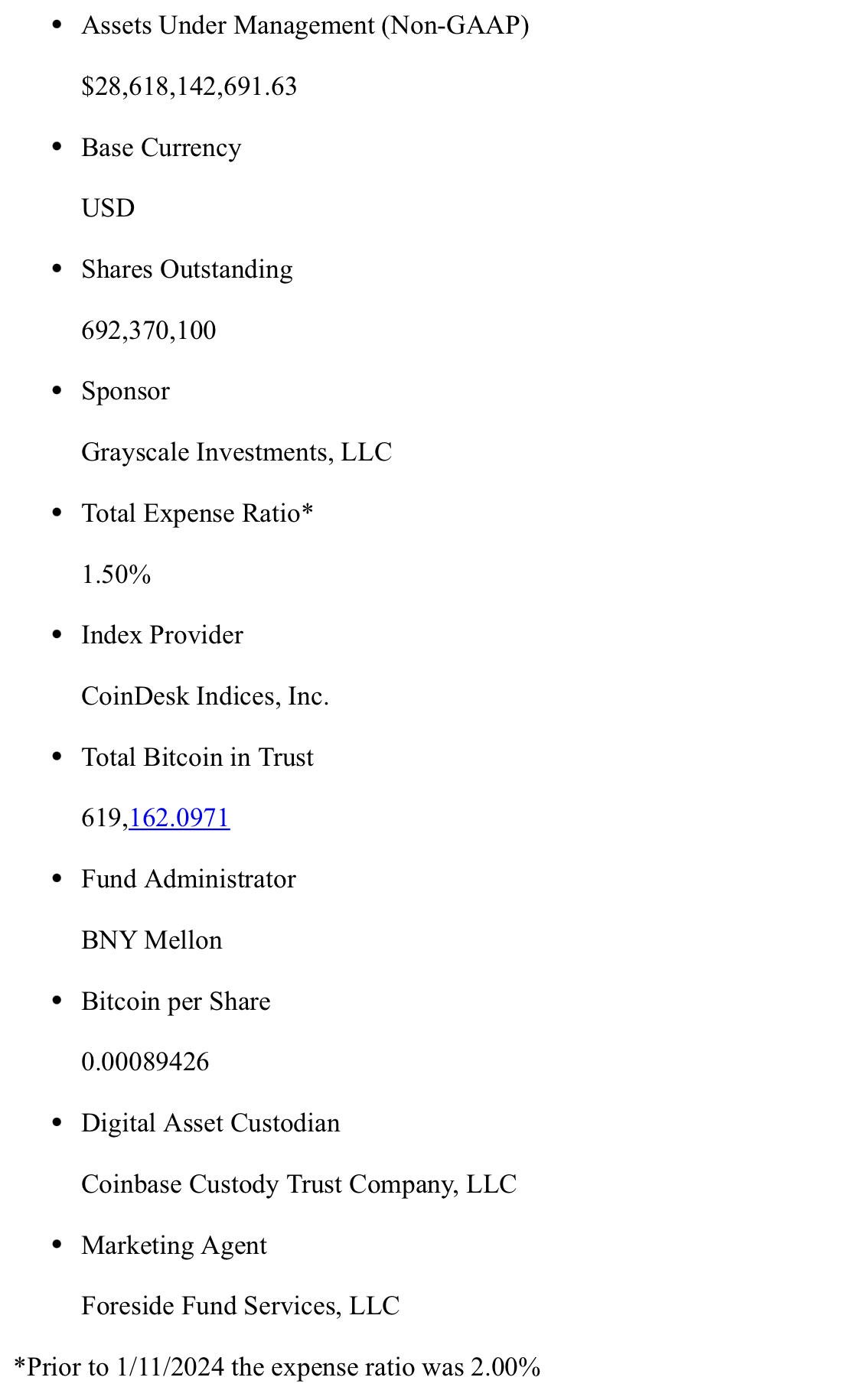

Grayscale has been around since 2013. They have over 600k bitcoin

Not really sure where they sourced it. Could just be all the bitcoin circulating out of GBTC - very possible. Not sure if Bitcoin held in a trust for a vehicle that is also converting to and ETF is permissible. Thats said, seems like GBTC is just milking their vehicle and fees and not interested in competing on low fees, so maybe they just accepted their fate and knew Capital would rotate out so collected on the fees? Possible I guess.