**Bank Bailout Facility Usage Soars For 2nd Straight Week, Money Market Inflows Resume**

Bank Bailout Facility Usage Soars For 2nd Straight Week, Money Market Inflows Resume

After last week saw The Fed's balance sheet continue is decline (https://www.zerohedge.com/markets/fed-balance-sheet-shrinks-4th-week-money-market-funds-see-largest-outflows-almost-2-years) back from its bank-bailout resurgence,all eyes will be back on H.4.1. report (https://www.federalreserve.gov/releases/h41/) this evening to see if things have continued to 'improve' or re-worsened amid regional bank shares re-testing post-SVB amid earnings disappointments.

Following the unexpected OUTFLOW the previous week, this week saw **money market funds resume their trend with a $53.8 billion INFLOW**...

?itok=8Hcl2_kc (

?itok=8Hcl2_kc ( ?itok=8Hcl2_kc)

?itok=8Hcl2_kc)

_Source: Bloomberg_

The breakdown was **$48.9 billion from Institutional funds** and **$4.98 billion from retail funds.**

That pushed assets back up near their $5.277 trillion record high and **suggests last week's deposit OUTFLOWS may be about to re-accelerate - not good news for banks?**

?itok=iJxewkCY (

?itok=iJxewkCY ( ?itok=iJxewkCY)

?itok=iJxewkCY)

_Source: Bloomberg_

On top of the news from First Republic this week, one could argue that Round 2 of the banking crisis (bank superwalk as Jim Bianco has put it) is just beginning.

Bear in mind though that it's tax-time and their are some odd seasonal impacts to the data.

Though not wanting to piss all over those hopeful fireworks, we note that **reverse repo continues to rise...**

?itok=nX8_PFxK (

?itok=nX8_PFxK ( ?itok=nX8_PFxK)

?itok=nX8_PFxK)

_Source: Bloomberg_

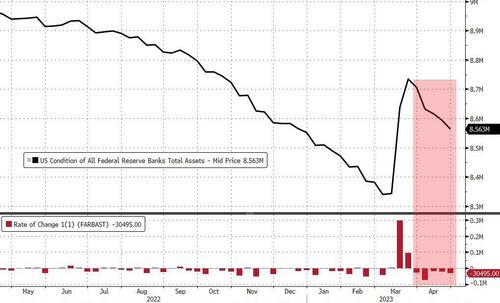

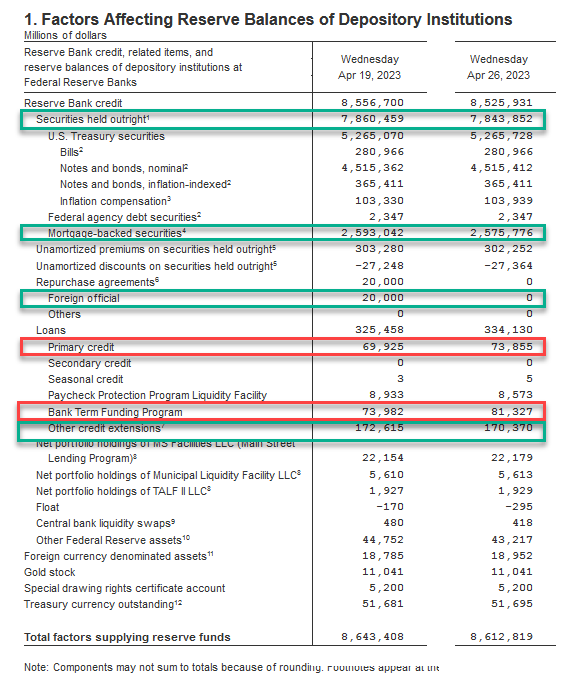

However, **the most anticipated financial update of the week** \- the infamous H.4.1. showed the **world's most important balance sheet shrank for the 5th straight week last week, by $30.5 billion**, notably more than last week's tumble (helped by a $16.6bn QT)...

?itok=AV-zOzZq (

?itok=AV-zOzZq ( ?itok=AV-zOzZq)

?itok=AV-zOzZq)

_Source: Bloomberg_

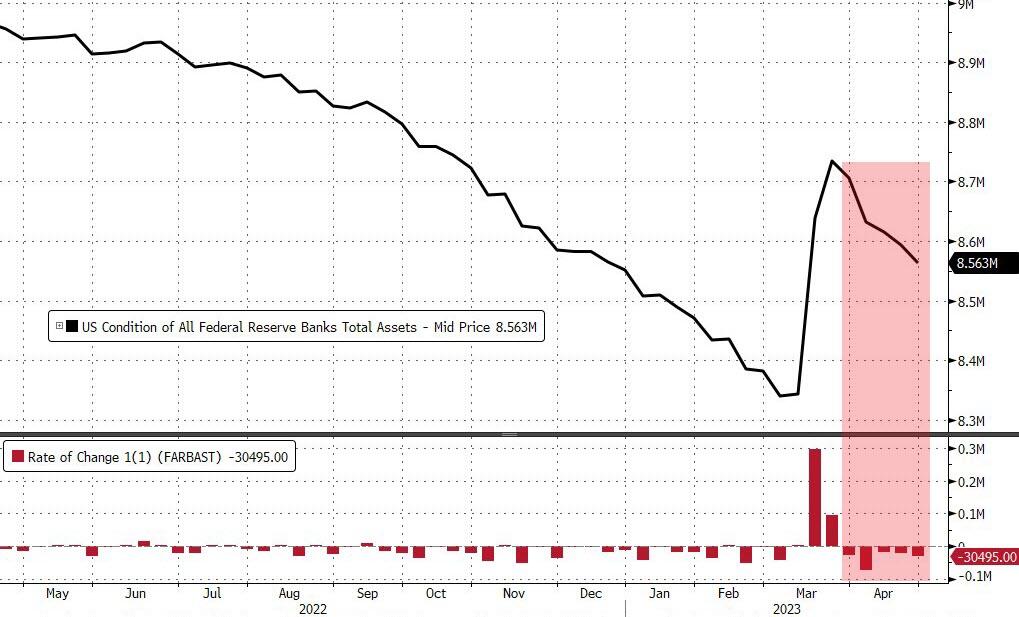

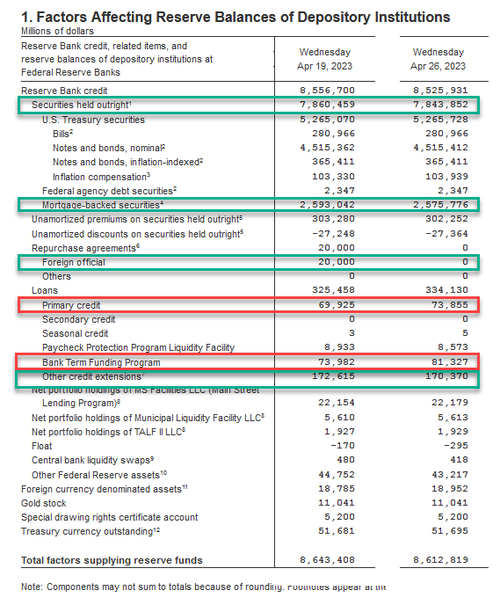

The Total Securities held outright on The Fed balance sheet fell to $7.84 trillion, the lowest since Sept 2021...

?itok=2dSvJGLE (

?itok=2dSvJGLE ( ?itok=2dSvJGLE)

?itok=2dSvJGLE)

_Source: Bloomberg_

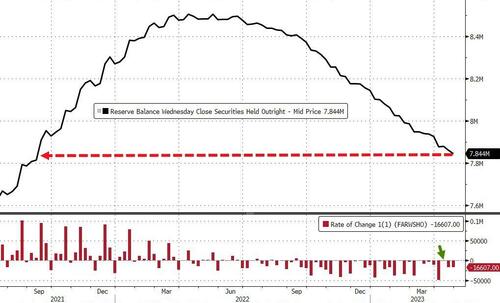

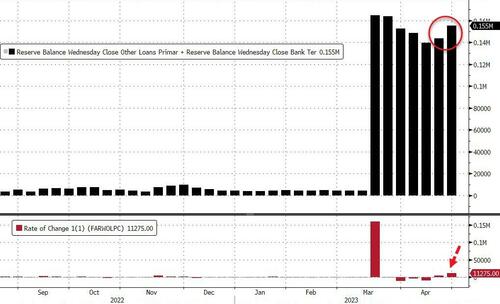

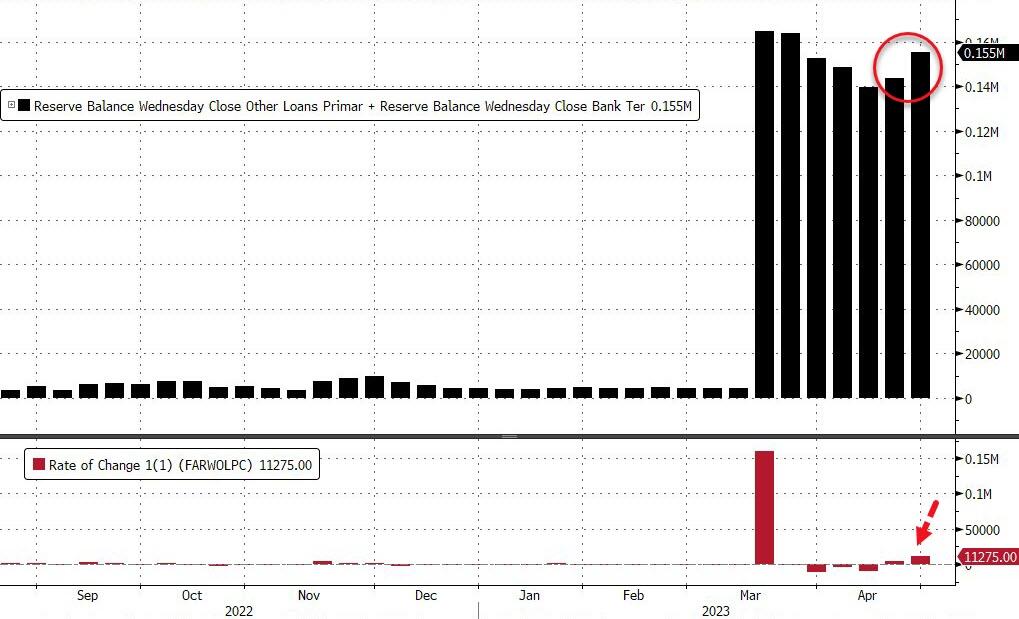

Looking at the actual reserve components that were provided by the Fed, we find that **Fed backstopped facility borrowings ROSE AGAIN last week from $144 billion to $155.2 billion** (still massively higher than the $4.5 billion pre-SVB)...

?itok=jU90g1fZ (

?itok=jU90g1fZ ( ?itok=jU90g1fZ)

?itok=jU90g1fZ)

_Source: Bloomberg_

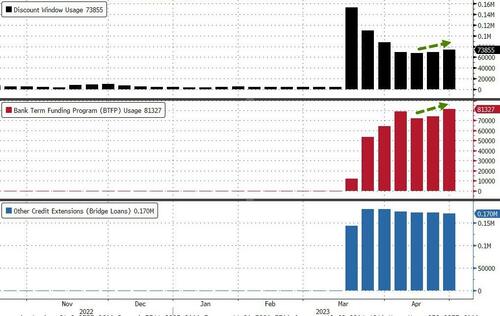

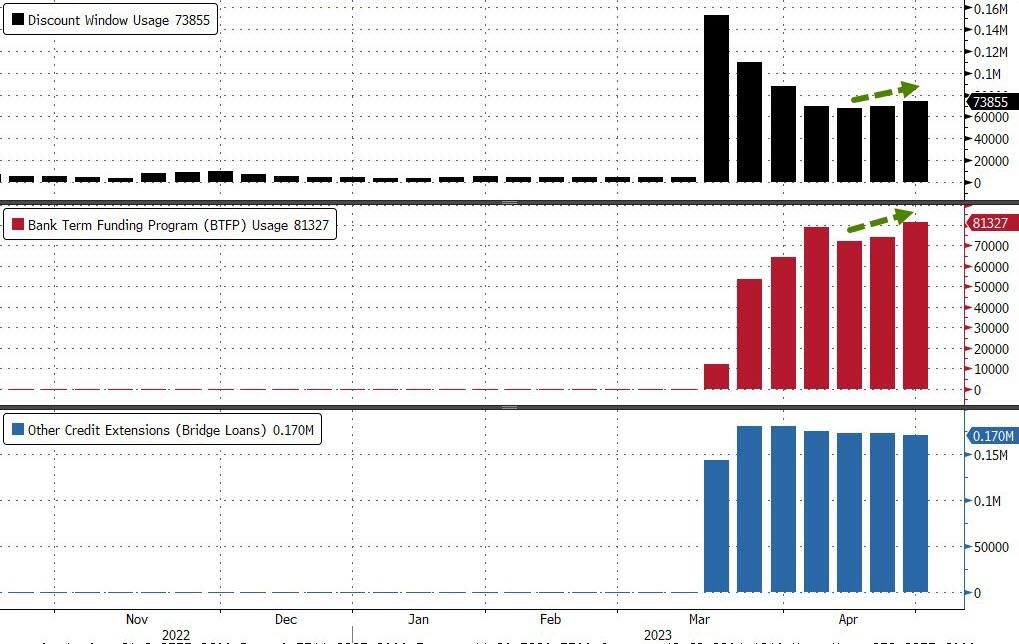

...but the composition shifted, as **usage of the Discount Window rose by $4 billion to $73.8 billion** (upper pane below) along with an **$8 billion increase in usage of the Fed's brand new Bank Term Funding Program, or BTFP, to $81.3 billion** (middle pane) from $79.0 billion last week. Meanwhile, other credit extensions - consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank were relatively unchanged at around $170BN (lower pane)...

?itok=MescS5zu (

?itok=MescS5zu ( ?itok=MescS5zu)

?itok=MescS5zu)

_Source: Bloomberg_

Scanning down the H.4.1, we note that **Foreign repo down another $20 billion back to $0 finally** and **Other Fed Assets (loans to FDIC etc) rose $2.3 billion to $170.4 billion**...

?itok=yujWGsKN (

?itok=yujWGsKN ( ?itok=yujWGsKN)

?itok=yujWGsKN)

Of course we get to see the actual deposit outflows (or inflows) tomorrow after the bell, but it appears the hopeful bounce was nothing more than the tax-related seasonal we warned about last week.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Thu, 04/27/2023 - 16:41