Touching up my slides for TABConf. I think this graph was the most challenging for me to explain and for the audience to understand. Looking much better now!

Touching up my slides for TABConf. I think this graph was the most challenging for me to explain and for the audience to understand. Looking much better now!

I understood the previous graph with your explanation during the talk.

I don't understand 'realized share value' here, but maybe because it lacks explanation now 😅

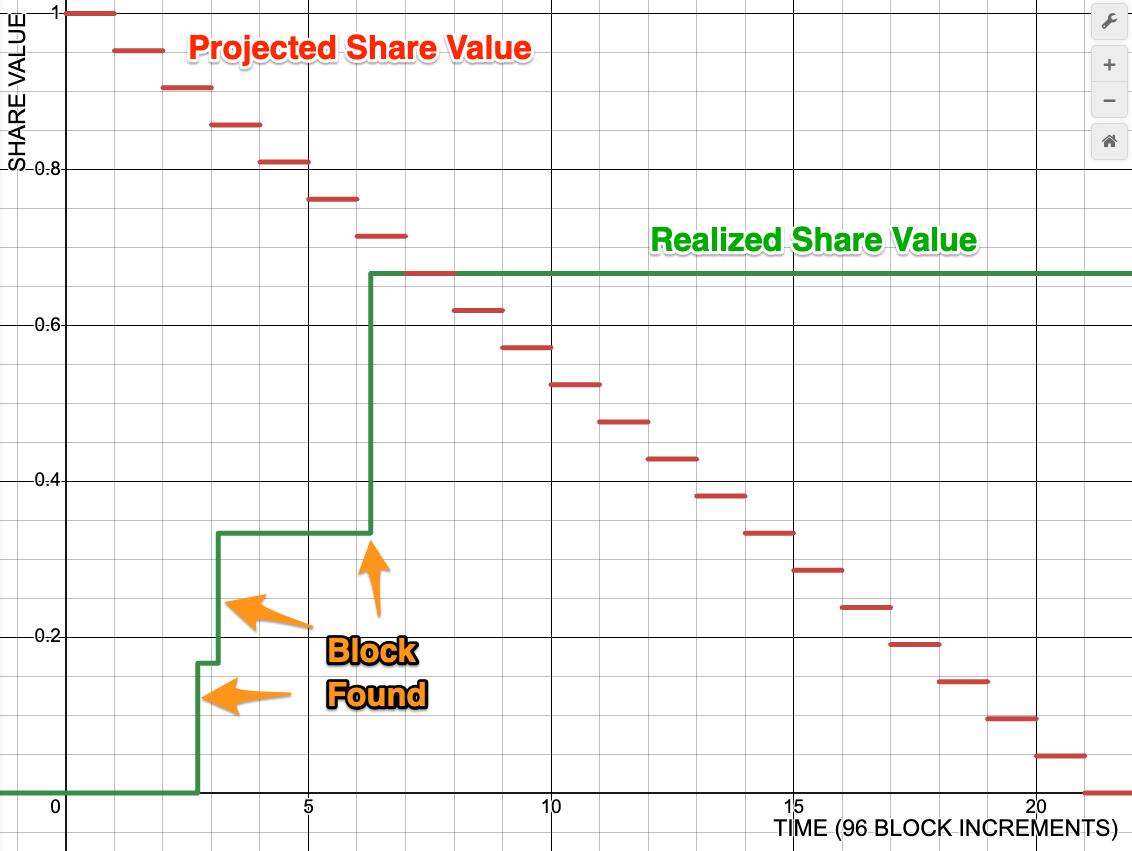

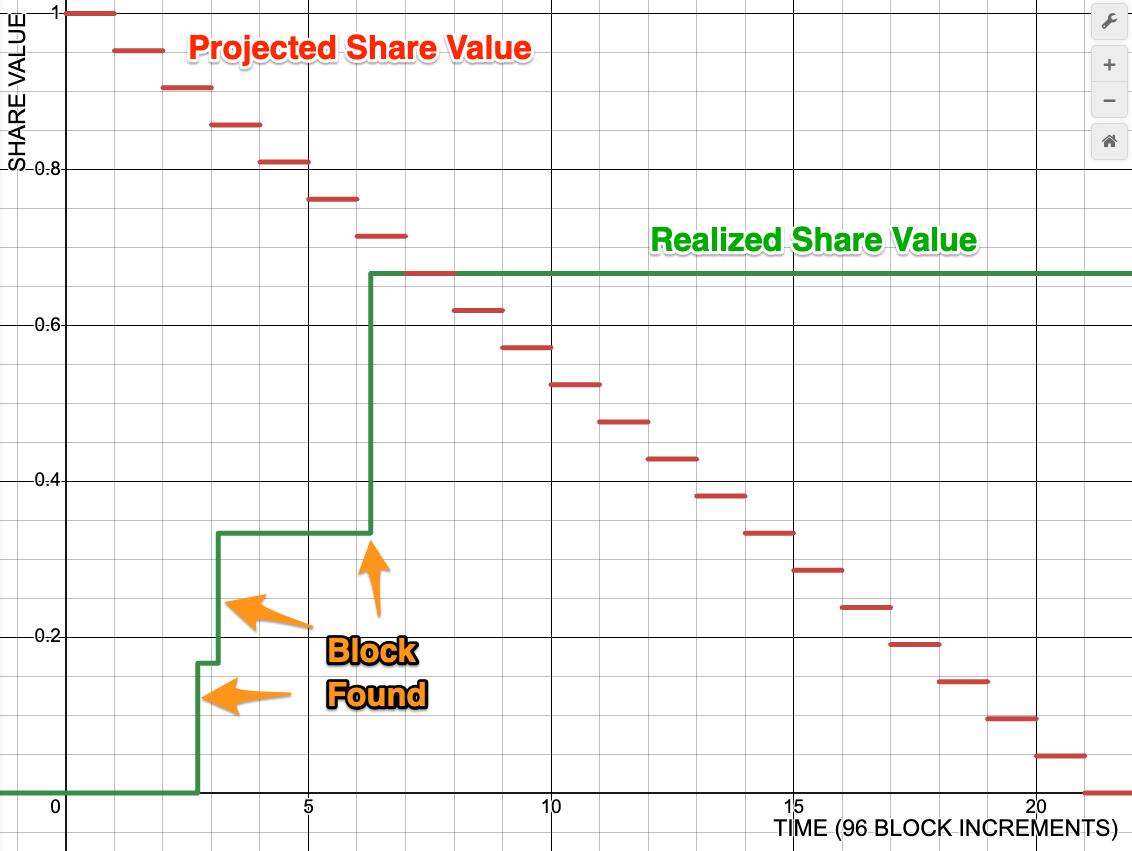

This graph is drawn from the context of a newly accepted share submitted to the pool at time 0. The share is worthless at first but it has an expected future value that can be calculated by comparing the expected rate that the pool finds blocks to the 'accrual period' or 'swap window' for this share. I need to hammer out the terminology still.

Whenever the pool finds a block this share is entitled to some of the block reward for that block. This is calculated by dividing the coinbase reward amount by the total number of shares for which this block is in their swap window. Basically how many outstanding shares are there with a red step function still above 0.

In this graph the share in question scores three blocks so the 'realized value' as the pool calculates it jumps up three times before the swap window closes.

If the owner of this ehash token (let's keep it simple and assume no swaps have taken place) redeems it early at any point they can claim the value of the green line at that time.

Of course the default play is to hold it to maturity. But what if they sold it for a premium right after the 3rd block was found? In other words, what if someone pays slightly more than the green line to buy this mining share? That would be a winning trade for the seller because we can see the future. If another block landed in the 21st epoch it might be a winning trade for the buyer.

Hashpool enables a class of professional traders to develop who will create a super efficient hashrate market. Efficient markets lead to prosperity and human flourishing. Let's fucking go!

The one thing that confuses me still about this visual is why the realized share value (green line) jumps higher at the 3rd block found than at the other 2.

Is that because they got more ehash by that time?

That's what is less clear to me still, since I though this visual was about a single ehash 'reward block share value(?)'

And I forgot to say, I loved your talk! Exciting stuff 🔥

Payouts are not uniform across blocks. It could be that the third block had a lot more fees or maybe there were less miners contributing hashrate or for some reason the other ehash holders cashed out early, leaving more reward for this share to claim.

I did not intend to make it higher, that was actually a mistake lol. It is actually even higher now in the slide deck to clear the red line. In practice, hashrate tends to remain steady and rewards look very similar across blocks with PPLNS even if the blocks come faster than expected.

Ah yes of course, I forgot possible fluctuations in mining fees, but hashrate fluctuations also make sense, although maybe not to scale here like you mentioned 😂

I'm looking forward to your next talk!