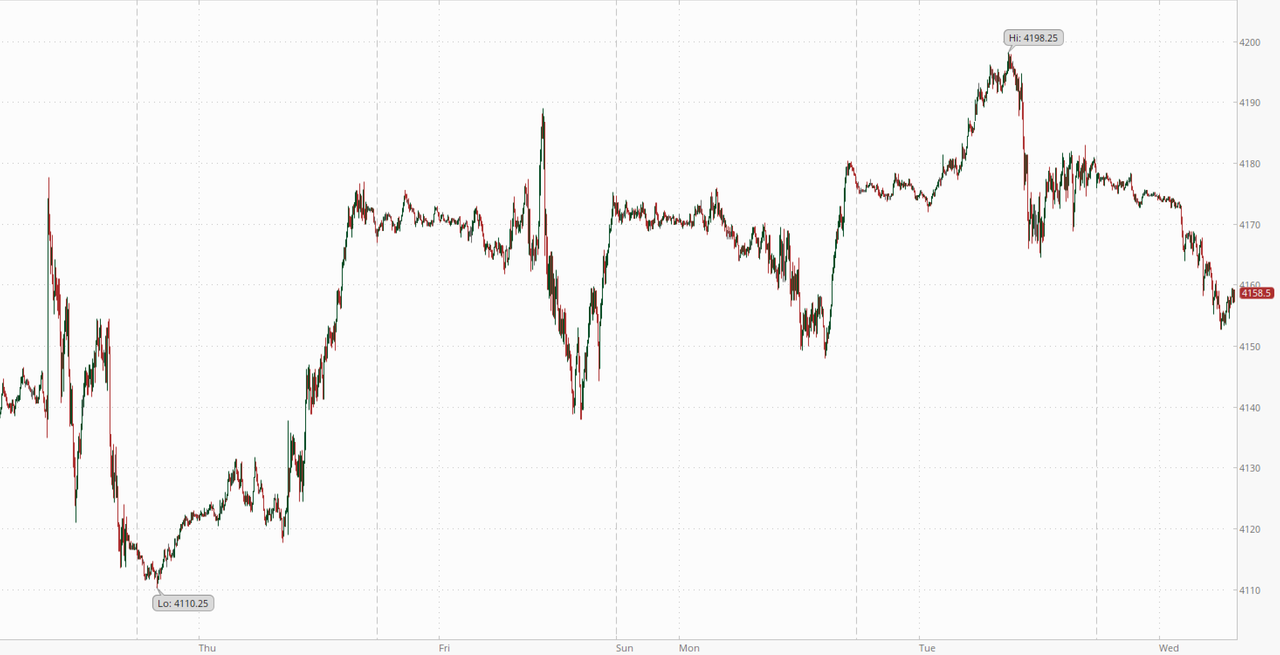

**Futures Slide After Hawkish Bullard Comments, Red Hot UK Inflation**

Futures Slide After Hawkish Bullard Comments, Red Hot UK Inflation

US equity futures fell following hawkish comments from FOMC non-voter Jim Bullard and another double digit CPI print out of the UK; China was weak with property names dropping -2% led by Hong Kong developers which dropped after city leader John Lee dismissed calls by the industry to scrap property cooling measures. Sentiment was also dented by news Tesla cut prices again - just hours before it reports Q1 earnings -which is likely to not be well received by auto sector. Netflix tumbled as much as 12% on Tuesday before recouping almost all losses after a miss on subscribers but after boosting cash flow. Regional banks within a hair of new lows but WAL numbers overnight should give some support to the sector.

Contracts on the S&P 500 fell 0.5% at 7:15 a.m. ET Nasdaq 100 futures slipped 0.8% as the yield on the 10-year Treasury rose to nearly 3.62%, mirroring larger moves in UK gilts following the abovementioned CPI print. The Bloomberg Dollar Spot Index traded near the day’s highs, pressuring most Group-of-10 currencies. Oil, gold and Bitcoin all fall in tandem.

?itok=MgkhgMza (

?itok=MgkhgMza ( ?itok=MgkhgMza)

?itok=MgkhgMza)

In premarket trading, Tesla dropped 2% after further cutting prices on some models in what is an increasingly bitter price war to capture EV market share ahead of first-quarter results due later Wednesday. Netflix dipped after the video-streaming firm added fewer subscribers than anticipated in the first quarter. Here are some other notable premarket movers:

- Western Alliance rises as much as 18%, boosting shares in fellow regional lenders, as analysts viewed the bank’s balance-sheet repositioning positively, highlighting measures to improve liquidity. The company said deposits rose $2 billion this month through April 14, an encouraging signal given March’s turmoil in the industry following the collapse of SVB.

- Netflix falls 1.3% after the video-streaming company added fewer subscribers than had been anticipated in the first quarter. However, analysts remain positive on the stock’s long-term prospects as the company raised its full-year free cash flow forecast. UBS upgraded to buy from neutral. Shares of video streaming companies were lower after Netflix added fewer subscribers than had been anticipated in the first quarter. FuboTV -3.2%, Roku -1.3%.

- Intuitive Surgical jumps 7.1% after the maker of surgical tools reported procedure growth for the first quarter that beat the average analyst estimate, sending analyst price targets higher. Brokers said Intuitive’s results bode well for peers, and show the environment is improving for such companies as they recover from pandemic-related disruptions to medical procedures.

- United Airlines climbs as much as 0.8% after the carrier reported a narrower-than-estimated loss for the first quarter. Analysts said the company’s outlook was strong and showed that demand for travel is holding up.

- Riot Platforms and Marathon Digital lead fellow cryptocurrency- exposed stocks lower as Bitcoin records its biggest drop in over a month, falling back below the $30,000 mark.

With tax receipts filtering in expect to see a broad based liquidity drain over the next few weeks. CTA positioning is approaching fully long, macro buying has persisted for 6 weeks (nets have crept higher ) and the Goldman trading desk has already seen quite substantial vol control demand with vix back to a 16 handle.

Investors are monitoring earnings to assess how companies have grappled with headwinds including slowing demand and higher interest rates. At the same time, they’re looking for clues if and when the Federal Reserve will end its tightening policy amid fears of a recession and more bank failures.

**“Central banks, for now, will keep hiking until they see more evidence of lower inflation down the road,”** Barclays Plc strategist Emmanuel Cau said on Bloomberg Television. “Inflation is still high and to some extent growth is resilient at the same time, so I think the resolve of central banks to hike and to see more evidence of inflation coming down is still here.” Separately, Cau said in a note that there’s scope for first-quarter earnings to beat estimates given that growth momentum has rebounded in China, and held up better than expected in the US and Europe.

Globally, volatility has remained at low levels leading many bearish strategists to warn of complacency. Bank of Atlanta President Raphael Bostic said he favors raising rates one more time and then holding them above 5% for some time to curb inflation, while his St. Louis counterpart James Bullard said he prefers getting rates into a 5.5% to 5.75% range. Global…

https://www.zerohedge.com/markets/futures-slide-after-hawkish-bullard-comments-red-hot-uk-inflation