**Retail Sector One Of Best Ways To Hedge A Recession**

Retail Sector One Of Best Ways To Hedge A Recession

_Authored by Simon White, Bloomberg macro strategist,_

**The US retail sector will be an effective portfolio hedge for a recession.**

We got a check in on how the consumer is doing on Friday with March’s retail sales data (https://www.zerohedge.com/markets/retail-sales-tumble-more-expected-grow-weakest-annual-pace-june-2020). Emblematic of the weakening economic backdrop, **consumers’ retail spending is falling sharply from the surge it saw as pandemic restrictions were eased.**

Leading data anticipate that this sharp fall will continue. In the short term, higher-frequency data, such as the weekly Redbook index, points to a weaker retail-sales print today.

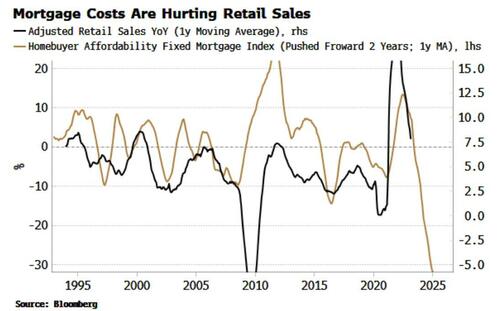

**Longer term - over the rest of this year and into next - discretionary spending will continue to suffer as essential costs, such as energy and mortgages, keep rising.** The sharp fall in homebuyer affordability is a bad omen for retail sales.

?itok=aGG4LY8U (

?itok=aGG4LY8U ( ?itok=aGG4LY8U)

?itok=aGG4LY8U)

Furthermore, even though the retail sector has worked inventories lower from the glut incurred after Covid, sales-to-inventory levels are barely back to pre-pandemic levels, while a recession would knock them lower again.

**The US economy is beginning to look very recessionary,**with some signs that one could already be here, (https://www.zerohedge.com/economics/continuing-claims-data-suggests-recession-may-almost-be-upon-us)or very close to starting.

That would, historically, lead to a further decline in equities. That may end up happening, but **this is an odd cycle.**At least one rare and reliable technical signal for the S&P recently triggered, (https://www.zerohedge.com/markets/rare-buy-signal-hints-worst-over-stocks) telling us that price action is pointing to a constructive picture for stocks over the longer term.

**Therefore shorting the overall index or even buying downside protection may not be the most efficient way to hedge for a recession.**

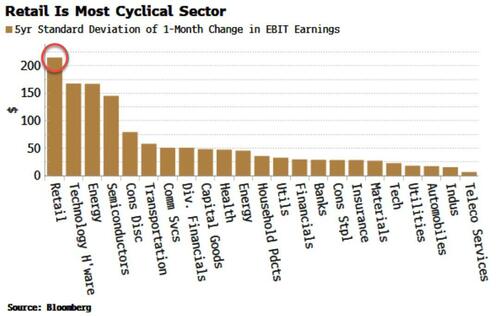

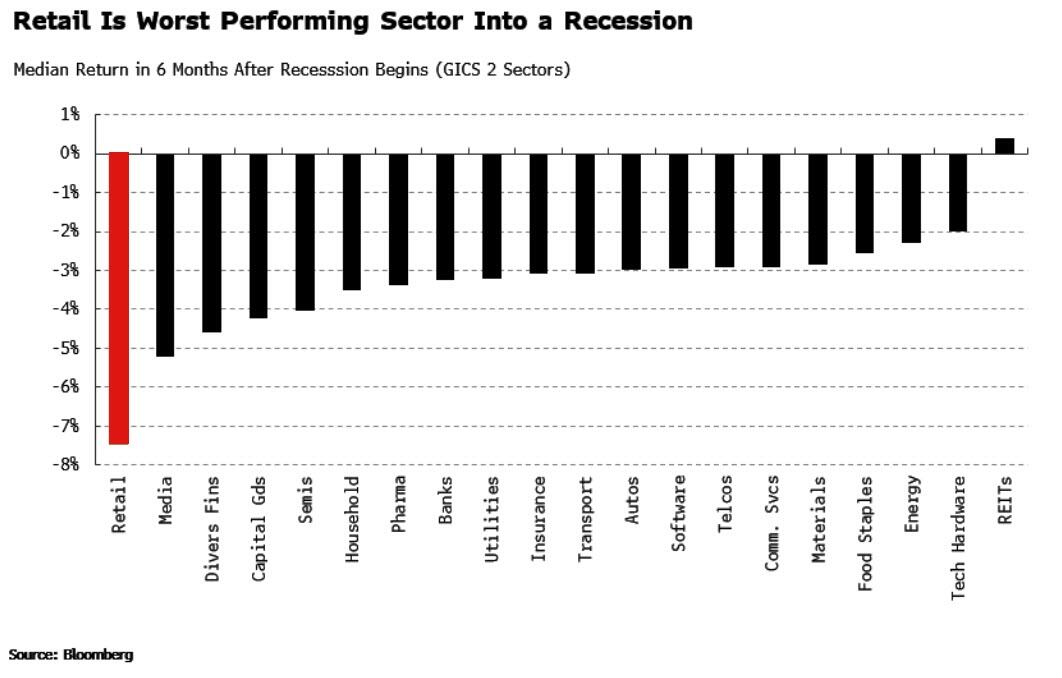

However, retail is primed to be one of the most underperforming sectors in any recession.

?itok=AsUdk2HM (

?itok=AsUdk2HM ( ?itok=AsUdk2HM)

?itok=AsUdk2HM)

Firstly, it is highly cyclical. Indeed, currently, it is the most cyclical of the GICS Level 2 sectors, based on variability of earnings. Cyclical stocks underperform in downturns.

**Secondly, looking at past recessions, the retail sector has on average fallen by the most in the six months after a recession starts.**

?itok=trpfC3pc (

?itok=trpfC3pc ( ?itok=trpfC3pc)

?itok=trpfC3pc)

Retail has only slightly underperformed the index this year, but if the runes are correct and a recession is almost upon us, this underperformance will intensify.

**The semis sector should also see significant underperformance in a recession,** with the added benefit it has also outperformed more than most sectors this year.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 04/17/2023 - 07:20

https://www.zerohedge.com/markets/retail-sector-one-best-ways-hedge-recession