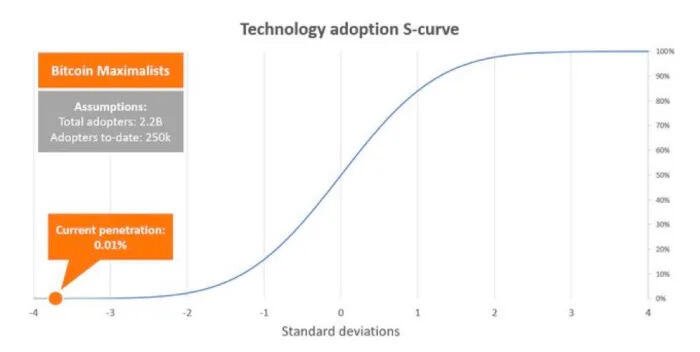

I read Jeff’s book years ago and he leans far closer to what I’m saying. You aren’t grasping the nature of absolute scarcity, exponential growth, and simple mathematics. This is a new paradigm in terms of inelastic supply meeting expanding fiat demand. You are assuming there will be a slower price appreciation for more average people to buy. Obviously this may help certain people, but it will also delay others. They will get in either way, and far easier with a bigger price shock. Bitcoin does not care and natural selection is part of life. Educate your family and friends before the smart ones gain a larger advantage. This is part of evolution and a healthy society. My thesis is positive, as I see good people accumulating wealth and helping others. This is what #Bitcoin allows. Fiat corruption will fade the faster bitcoin gets adopted. This train is accelerating — 1% to 30% of wealth absorption happens faster than 0% to 1%.

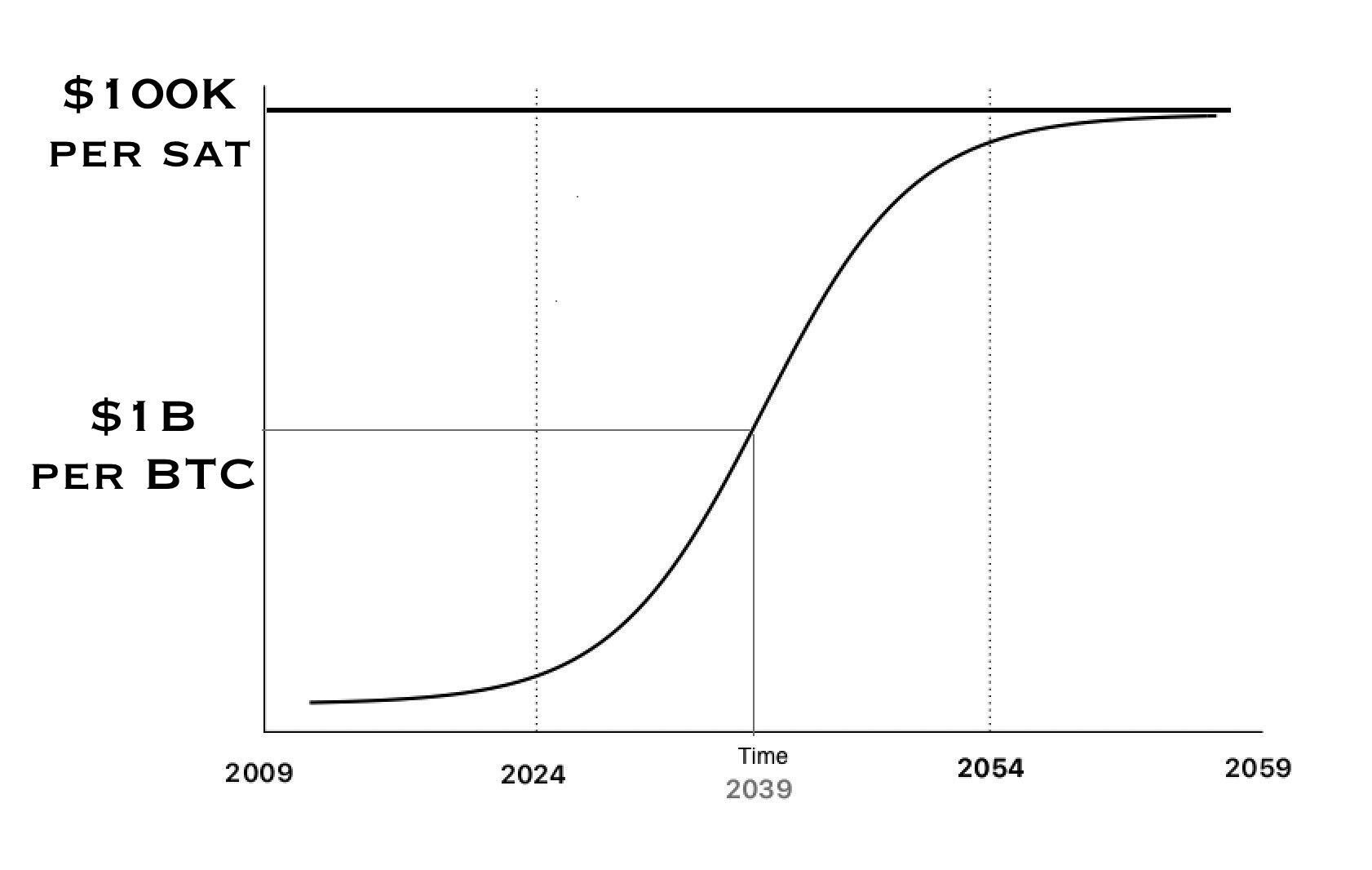

You’re saying $100 million per #bitcoin ($1=1sat) in 4 years? If that were true that would put Bitcoin’s market cap at 2 quadrillion in 4 years? (Current total wealth $600-900 trillion). You see now how unlikely this scenario is. Mathematically impossible.

2024 to 2029 is 5 years. Total global wealth is currently $2Q and will be double that by 2030, especially with derivatives and digital monetary expansion. Available BTC will be insanely low, making price higher. Market cap means nothing. So, mathematically likely.

1. Global wealth is not $2Q

2. Derivatives don’t create wealth

3. The fed likes to print but not that much (quadrillions, would mean collapse)

But let’s just assume your assumptions are correct. That illustrates the destruction of the fiat world in an unnecessary way. You don’t need one system to completely blowup for the other to thrive in such a short amount of time. I hate the fiat world just as the next bitcoiner, but your proposed market cap assumes an unneeded destruction too quickly.

I am not talking destruction at all. You again aren’t understanding the current *global* situation of the debt spiral. We are reaching the inflection point of exponential growth and exponential amounts of fiat *that need to be* printed. Again, globally, not just the FED. Money supply is up 50% in six years.

https://goldbroker.com/news/two-quadrillion-dollars-global-timebomb-2261

Thread collapsed

Thread collapsed

Thread collapsed

Thread collapsed