**Key Events This week: CPI, PPI And The All-Important SLOOS**

Key Events This week: CPI, PPI And The All-Important SLOOS

With the bulk of Q1 corporate earnings now in the history books - and coming in much stronger than most, certainly permabear Mike Wilson, had expected - and with the key central bank decisions and econ data out of the way for the near future, two calendar highlights stand out this week: Wednesday's CPI report in the US and today's senior loan officer opinion survey (SLOOS).

While we believe that today's SLOOS will be the week's most important event, many still are focusing on the CPI report, which according to economic consensus will rise by 0.4% leading to an annual increase of 5.0%; for core inflation, consensus expects a 0.3% print, and a 5.5% annual increase. Within core inflation, BofA expects core goods inflation rose by 0.2% m/m and core services inflation increased by 0.4% m/m.

One day after the CPI, on Thursday we get the PPI where consensus expects a 0.3% M/M headline PPI increase following the 0.5% drop in March. This would result in the y/y rate falling to 2.5% from 2.7%. The increase should be driven by a rise in energy and food prices. Excluding food and energy, core PPI will rise by a modest 0.2% m/m, reversing the prior month’s decline. However, this would lead the y/y rate to fall to 3.3% from 3.4%. Trade services (margins) were a big drag on core PPI in March, declining by 0.9% m/m, but BofA expects a more modest decline of 0.2% m/m this month. Last, look for core-core PPI, which excludes food, energy and trade services, to rise by 0.2% m/m or 3.4% y/y.

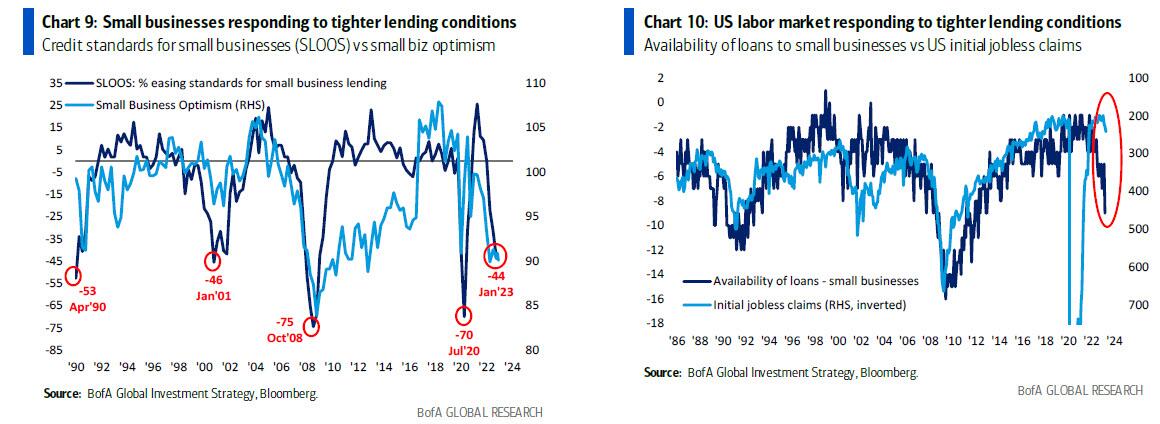

Turning to the all important SLOOS, which as Michael Hartnett shows last Friday is a leading indicator to virtually every key US data metric...

?itok=GceHrnv6 (

?itok=GceHrnv6 ( ?itok=GceHrnv6)

?itok=GceHrnv6)

... Goldman expects that the lending standards measure for commercial and industrial (C&I) loans in the Fed’s April Senior Loan Officer Opinion Survey tightened by 15.4pt to 60.2, reflecting an increase of 33.3pt to 77.0 for small banks and a more modest increase of 10.3pt to 56.0 for large banks. **This would bring the SLOOS’s measure of C&I lending standards to a level tighter than the dot-com crisis,** if still less extreme than during the financial crisis or the height of the pandemic. A few more bank failures, however, and we will have a new record print. The April SLOOS typically reflects responses collected between the last week of March and the first week of April.

_A day by day recap of the biggest global events is below courtesy of Rabobank_

- **Today:** has the minutes of the BOJ March meeting, NAB business confidence/conditions in Australia along with building approvals. Germany has industrial production, seen -1.5% m-o-m. The ECB’s Lane speaks, and the Fed releases a senior loan officer opinion survey and the --ironic-- 2023 financial stability report. The Fed’s Kashkari speaks on US minimum wages.

- **Tuesday:** has Aussie Westpac consumer confidence and Q1 retail sales ex-inflation as a feed into GDP, seen -0.5% q-o-q. China has trade data excepted to underline that it exports lots and imports less, and runs a staggering surplus that it sits on. The ECB’s Rehn, Centeneo, Lane, Vasle, Vujicic, and Schnabel all speak. We also get the Aussie budget, with the usual flourish of political theatre. The US NFIB small business survey has less flourish but is often as political – let’s see what it says about credit availability. The Fed’s Jefferson and Williams speak too. Chinese aggregate financing data will be out at some point from Tuesday onwards.

- **Wednesday:** sees final April German CPI, Canadian building permits, and the week’s highlight – US CPI, where the y-o-y headline is seen sticky at 5.0%, and the m-o-m is seen up 0.4% vs. just 0.1% in March. Core CPI is seen even higher at 5.8% vs. 5.6% in March, albeit up 0.3% m-o-m vs. 0.4% last time. The ECB’s Centeneo speaks again, and the US monthly budget statement is out.

- **Thursday:** has Chinese CPI, seen falling from 0.7% to just 0.3% y-o-y – which is what happens when supply vastly exceeds demand both at home and abroad. PPI is seen dipping from -2.5% to -3.2% y-o-y. Yes, deflation is an emerging problem in China. Imagine what happens if the US fully adopts industrial strategy and/or mercantilism! The ECB’s De Cos, Schnabel, and Guindos all speak, and the BOE meet to set rates. The US has weekly initial claims data and PPI, seen 0.2% m-o-m and 0.3% core, 2.5% and 3.3% y-o-y.

- **Friday:** closes the week with Kiwi inflation expectations, UK monthly GDP and March industrial production and trade data, and provisional Q1 GDP (seen 0.1% q-o-q, 0.2% y-o-y). The BOE’s Pill speaks, and we shall see how many he manages to offend this time round. The US has import and…

https://www.zerohedge.com/economics/key-events-week-cpi-ppi-and-all-important-sloos