purple is the best

purple is the best

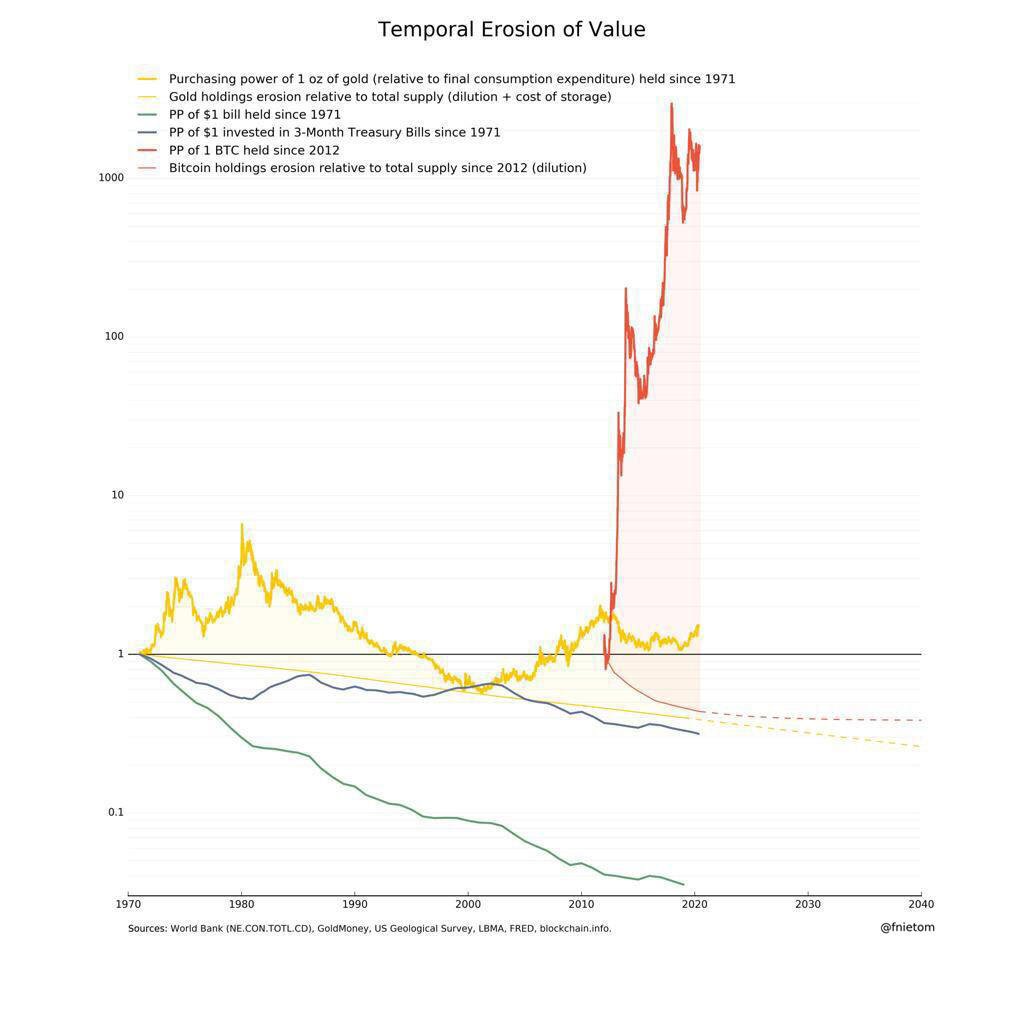

Gold has been undergoing a process of homeopathic de-monetization since 1980. There is another asset that seems to be undergoing an opposite process – hyper-monetization.

Purchasing power of gold hasn't changed since 1971 - as per your chart .. That is what a true store of value is - is it not ?

I know you love #bitcoin .. me too ..

Steady gold means steady bitcoin .. because they are same ..

Some people (eg Mr Saylor :-) are trying to push a narrative that somehow gold can be demonetized .. that is a wrong notion - gold stayed steady even after fiat was unpegged in 1971- why ?

If you bought gold in 1980, at its historic peak, and ended up losing money for two decades, can it really be considered a store of value?

If you are comparing peaks ( gold in 1980 ) , then you should consider the peak of Bitcoin when it hit 72 K couple of months back - comparison should be apple to apple :-) ..

Therefore, with the creation of Bitcoin, I believe that gold will continue on a path similar to that of silver since the end of the bimetallic standard in 1853—undergoing a long process of demonetization, increasing volatility, and diminishing liquidity. With a weighty current.

The dollar has lost 97% of its purchasing power since 1913. Starting from the same year, the stock of gold has increased enormously. Gold has been losing about 82% of its purchasing power since 1980; one is used as a unit of account for the other, and gold's liquidity is in dollars...

The U.S. is by far the country with the most gold in the world, and it is also the 4th largest miner of the metal. Additionally, it controls and issues the currency that is the unit of account for gold and has the highest liquidity in global trade.

Your chart starts in 1971 - why do you pick 1980 ?