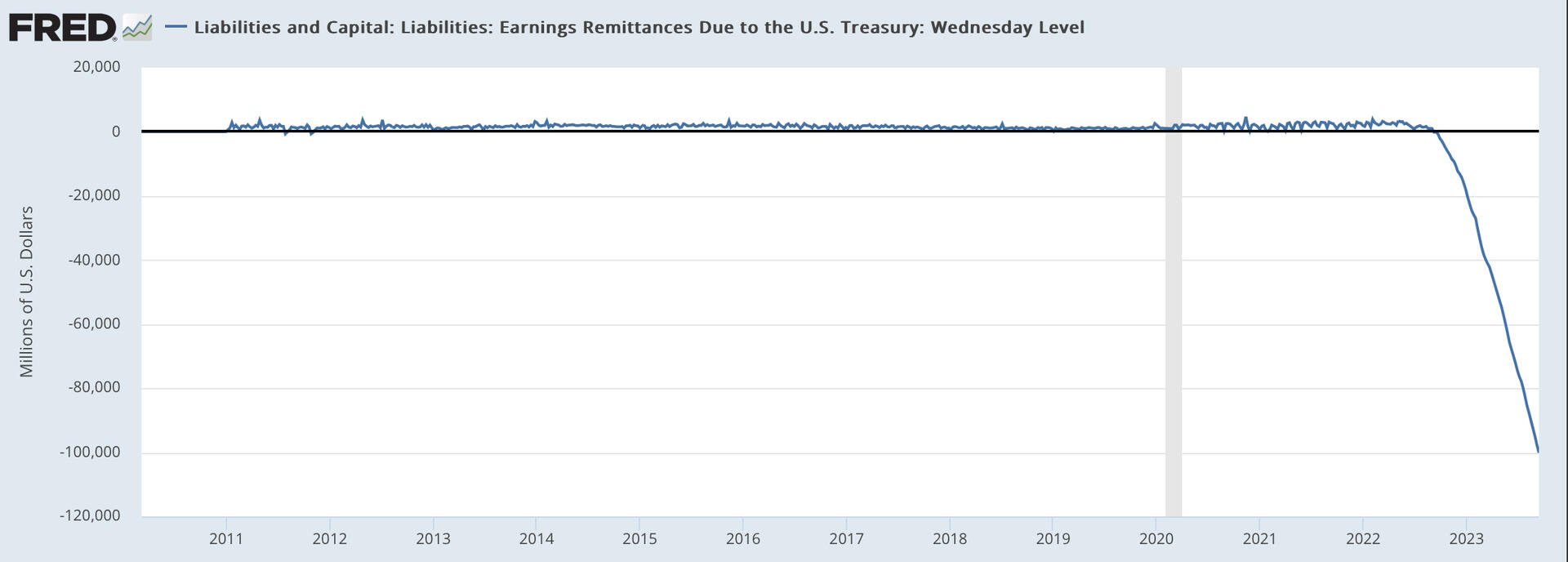

BREAKING: The FED has accumulated a $100 billion loss and those losses are likely to get much higher before the red ink stops. And guess who's paying for it? Taxpayers, of course, either indirectly through more money printing or higher taxes.

What's the problem?

During Covid (actually since 2008, QE), the Fed aggressively purchased bonds and mortgage backed securities to "flood the fiat system with money“ on which it must pay interest. Because of the rapid rate hikes, it has to pay out more interest than it earns on these assets. MUCH MORE.

If interest rates remain at current levels or higher, the Fed's operating losses will impact the federal budget for several years, requiring new tax revenues to offset the continued loss of billions of dollars, or further money printing.

Either way, this is just further proof that we are witnessing the end of central banking and the fiat system as a whole.