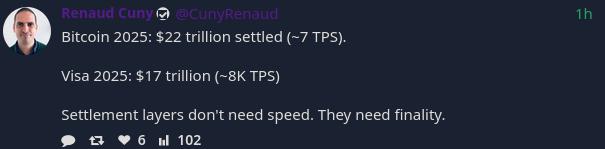

Bitcoin settled ~30% more value than Visa during 2025.

Bitcoin settled ~30% more value than Visa during 2025.

That's cool

but I'm curious how much of that is just exchanges consolidating their UTXOs

considering the mempool is basically empty, thinking at some point we're going to have the P2P usage so chain analysis is futile is hopium

There is enough P2P usage even if some of the transactions are consolidations.

The chain analysis can't stop the P2P Bitcoin transactions.

It can affect some exchanges in certain juristdictions that must comply with certain regulations and that would be only in case the government is working against Bitcoin like Bidens Chokepoint policies. And as you well know there are ways to confuse that analysis.

I'm not concerned about them being able to stop transactions (at this point anyway),

I just don't want them to know who is transacting with who. The fewer P2P transactions there are, the smaller the data set they have to deanonymize.

it goes back to the fungibility conversation. The more KYCed and known-by chainanalysis transactions exist, the lower the fungibility is on Bitcoin.

but like you say, we don't have enough clear data to really know what the proportion of self-sovereign usage/custodial or KYC usage is.

but unless people start making positive steps to increase their privacy, that proportion will turn toward zero.

Coinjoin also goes a very long way to solving this. Ideally every block would only have one transaction in it, a very large coinjoin transaction that fills the whole block.

ideally i could flap my arms and fly to the moon.

as they are now, coinjoins being such a small amount of the total transaction outputs just makes them another category of non-fungibles.