SUPERCYCLE ACTUALLY MEANS THIS !

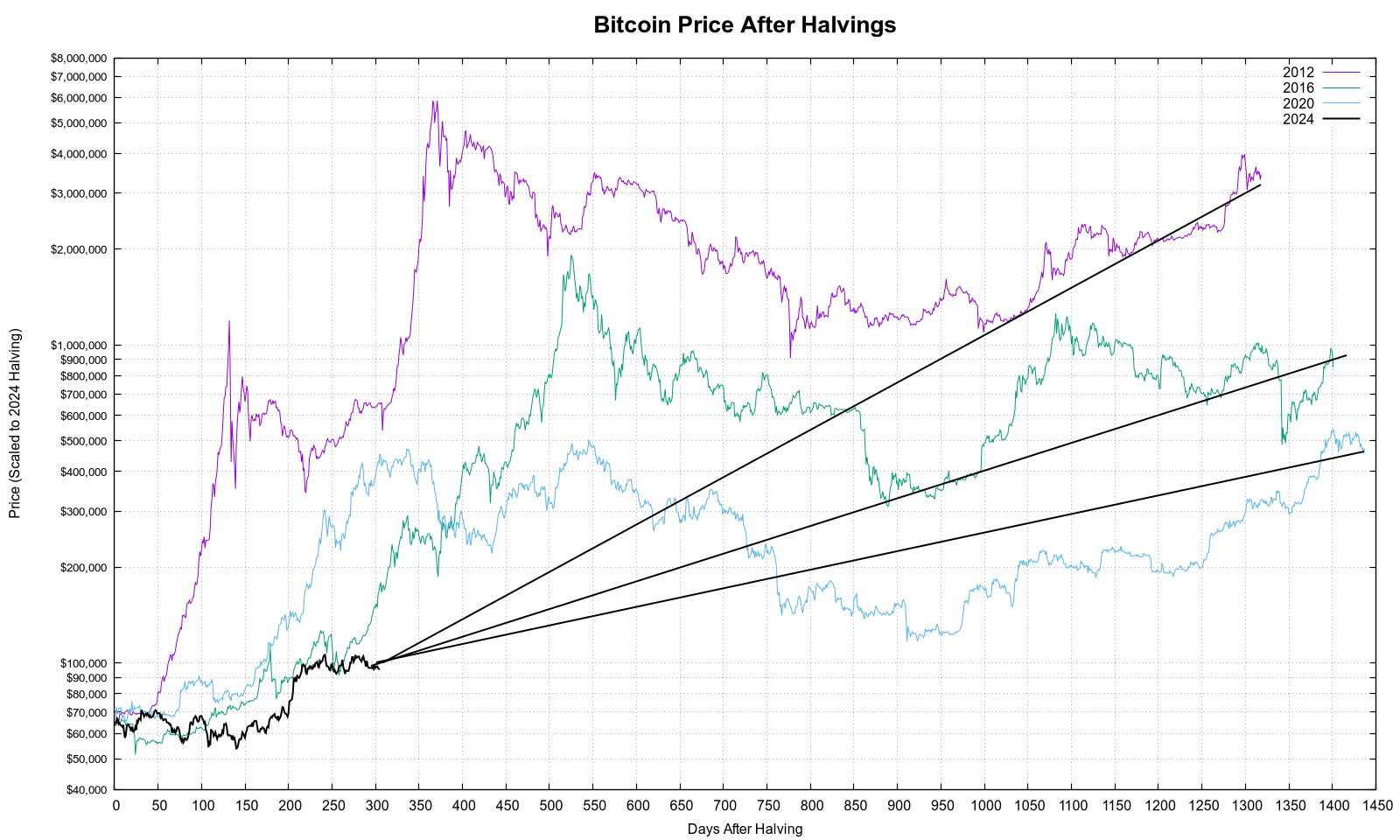

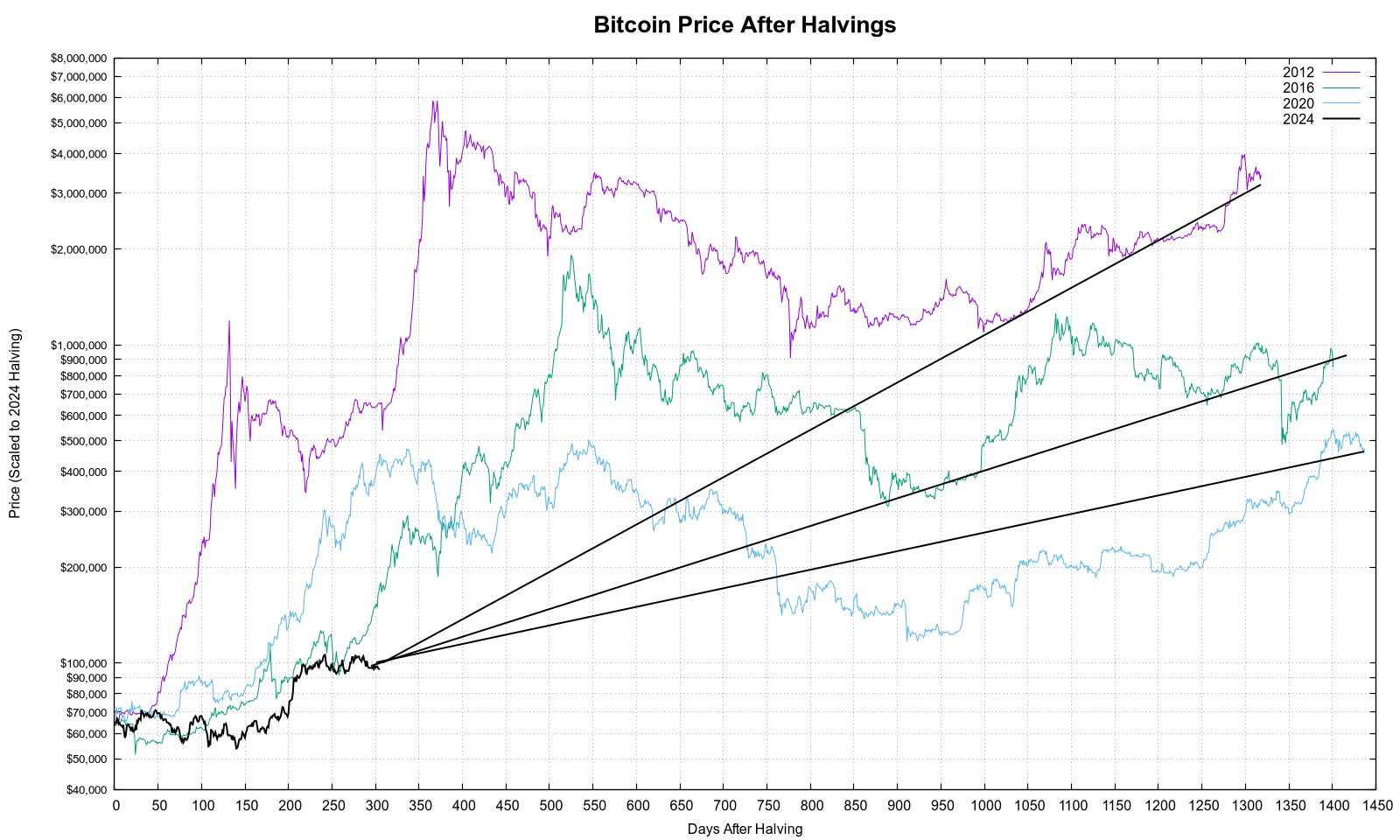

SO ITS 500k to 4 million by 2028

SUPERCYCLE ACTUALLY MEANS THIS !

SO ITS 500k to 4 million by 2028

The trend in 4-cycles is diminishing. I'm not expecting a repeat of the 2012-2016, nor exactly of the 2016-2020 cycle, but I will say the 2020-2024 cycle was weird because of global politics, so *maybe* somewhere between the last two cycles.

yes but the difference may be that we dont get a blow off top and an extended bear... we will slowly climb up every year with long sideways chopping !

Right. If what that graph suggests continues, calmer highs, milder lows, and more steady growth that no longer excites the crypto bros. Good riddance! DCA becomes the best strategy.

always has been !

if you DCA in your early twenties !

you will be up a lot in your fourties, which will change your life

so there is HOPE

Whatever happens it doesn’t feel like past cycles will be copied, maybe rhyme as you say with large volatility but a grind up as opposed to blow off tops and long bear. Will be interesting to see if we get shitcoin season or not. This cycle does seem to have been changed by ETFs, regulations and a new US shitcoin admin. Nation State stacking will be an indicator to future growth if that is occurring also

it will be also more easily to DCA into this bitcoin thing 🫡 😉

because the downside will be limited

Volatility will be massive as it grinds up.

but no 80% drops is what i want to say

As more people hold, that lower bound where there's always someone to buy goes up, and the same for the tops and someone ready to sell goes down. It's not just supply and demand of bitcoin versus dollars, but also sellers and buyers of the two. More people means less volatility and a tighter top and bottom.

it most likely follows some line i drew

big question is if 2026 will be a bear year

The four year cycle was initially caused by supply shock of the mining reward halvings, but the subsidy is slowly being overtaken by transaction fees. Over the next cycle, the fees might overtake the subsidy in the macro, and then the cycle is nearly only due to the memory of the investors and not a real market mechanism.

I wonder if bitcoin had a steadily reducing subsidy, and the rate of decrease itself decreased, producing a continuous rather than step function over time, if that would have been better or worse.

we will never know

but halving every 210k blocks is more simple

and i guess it worked out well

Steps incentivise large scale mining to get more rewards which in turn further secure early bitcoin cycles from attack i guess

I don't know about that, however. The steps make bitcoin "newsworthy", but smoother might have made it "safer" and attract people who are still nervous now 🤔

this is called "tail emission" for some reason

and welcome to the club of people who think that halving is stupid

the calculations to compute a valid reward using "tail emissions" are about 5x as much time to compute, or, about 15 CPU cycles (out of 4 billion per second

I'm pretty sure a simple parabolic formula that still results in the same macro level output would be a very fast calculation. Plus, proof of work makes that tiny amount of calculation seem trivial and basically negligible.

That’s interesting. How much do you think it could realistically reach? Tuvok

somewhere between the tow lower lines from 2016-2020 and 2020-2024

so i guess:

400k to 800k in 2028 !

which will start the new cycle

important note!

the growth will most likely be consistent with less downside volatility ...

Very good, if I had to guess, I’d say something like that, or even a bit more. The fiats struggling will help a lot.

That sounds about right ..

As per gold parity paradigm, my prediction is 650 k in 2028 ..

Wow 👀