**Analyzing Ethereum's Big Week**

Analyzing Ethereum's Big Week

_Authored by Ben Giove and Jack Inabinet via Bankless.com,_ (https://www.bankless.com/shapella-ethereum-staking-shanghai-eth)

How did crypto markets react to Shapella?

?itok=ishI6TJ2 (

?itok=ishI6TJ2 ( ?itok=ishI6TJ2)

?itok=ishI6TJ2)

**We now live in a post-Shapella world!**

One of the largest upgrades in Etheruem’s history officially arrived this week, with Shapella completing Ethereum's transition to Proof-Of-Stake (https://www.bankless.com/guide-what-is-shanghai-capella-shapella?ref=bankless.ghost.io) (PoS) by enabling withdrawals from staking. Leading up to the event, there was rampant speculation on how the upgrade would impact the markets, the staking landscape and DeFi.

In one corner you had the **bulls**, who felt that the upgrade represented a significant de-risking event for ETH, believing that the removal of the technical risk around withdrawals would lead to an influx of users who would buy-and-stake.

In the other camp, you had the **bears,** who thought that Shapella represented a major supply overhang for ETH, believing that mass withdrawals would lead to persistent sell pressure on the asset.

_**Who was right?** Let’s dive in._

Market Reaction

It’s been under 48 hours since Shapella hit mainnet, but so far it certainly seems to be a “bullish unlock.”

ETH has roared since the upgrade went live, surging 13.1% from $1871 to $2117 at the time of writing.

?itok=HHwe_Khx (

?itok=HHwe_Khx ( ?itok=HHwe_Khx)

?itok=HHwe_Khx)

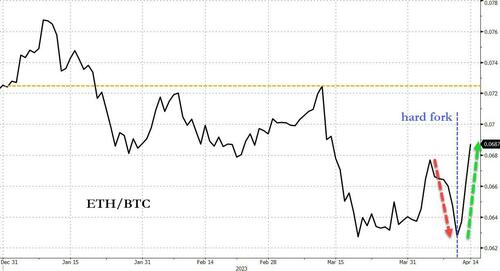

_\[ZH: ETH's underperformance is most clear when judged against BTC into and out of the fork...\]_

?itok=zbMpntMi (

?itok=zbMpntMi ( ?itok=zbMpntMi)

?itok=zbMpntMi)

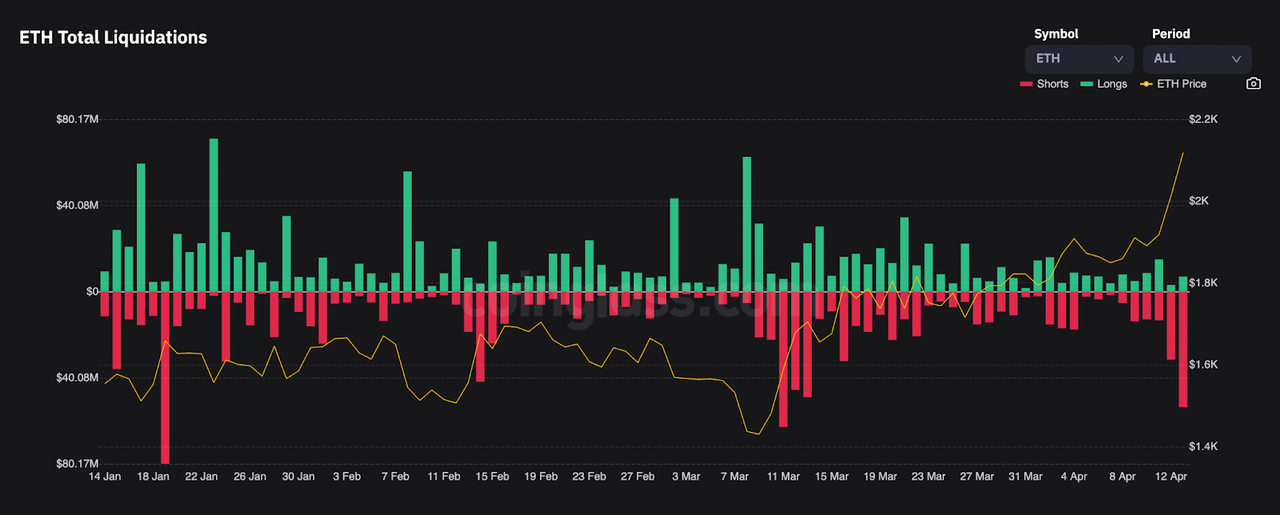

This move has left a trail of bear carcasses in its wake, leading to more than $84.7M worth of short liquidations between April 12-13. This is the most we’ve seen in a two-day period since March 12-13, when ETH rallied in the wake of the USDC de-peg and banking crisis (https://www.bankless.com/stablecoin-pandemonium?ref=bankless.ghost.io).

?itok=N0oVx5jY (

?itok=N0oVx5jY ( ?itok=N0oVx5jY)

?itok=N0oVx5jY)

_Source: CoinGlass (https://www.coinglass.com/LiquidationData?ref=bankless.ghost.io)_

Ethereum ecosystem tokens have experienced monster rallies since Shapella, with – unsurprisingly -- staking-related tokens leading the charge.

This includes liquid-staking derivative (LSD) governance tokens, with Lido (LDO), Rocket Pool (RPL), Frax (FXS) and StakeWise (SWISE) surging 14.3%, 17.1%, 12.9% and 19.2% respectively at the time of writing. LSD-Fi protocols have also soared, with Pendle (PENDLE) rallying 19.9%, Flashstake (FLASH) ripping 47.1% and unshETH (USH) mooning 56.1%. Layer 2 tokens have also surged on the back of the move in ETH, with Arbitrum (ARB), and Optimism (OP) rallying 30.8% and 18.0%.

?itok=_-XWXNNw (

?itok=_-XWXNNw ( ?itok=_-XWXNNw)

?itok=_-XWXNNw)

_Source: TradingView (https://www.tradingview.com/?ref=bankless.ghost.io)_

These monster moves suggest that fears of a post-Shapella dump were overblown. Instead, early signs point towards those in the bullish de-risking camp being in the right, as the upgrade has been treated as a buy-the-news event.

Withdrawal Activity

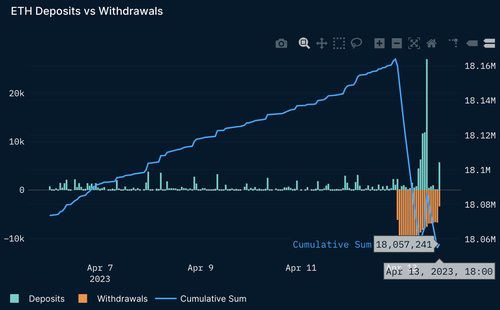

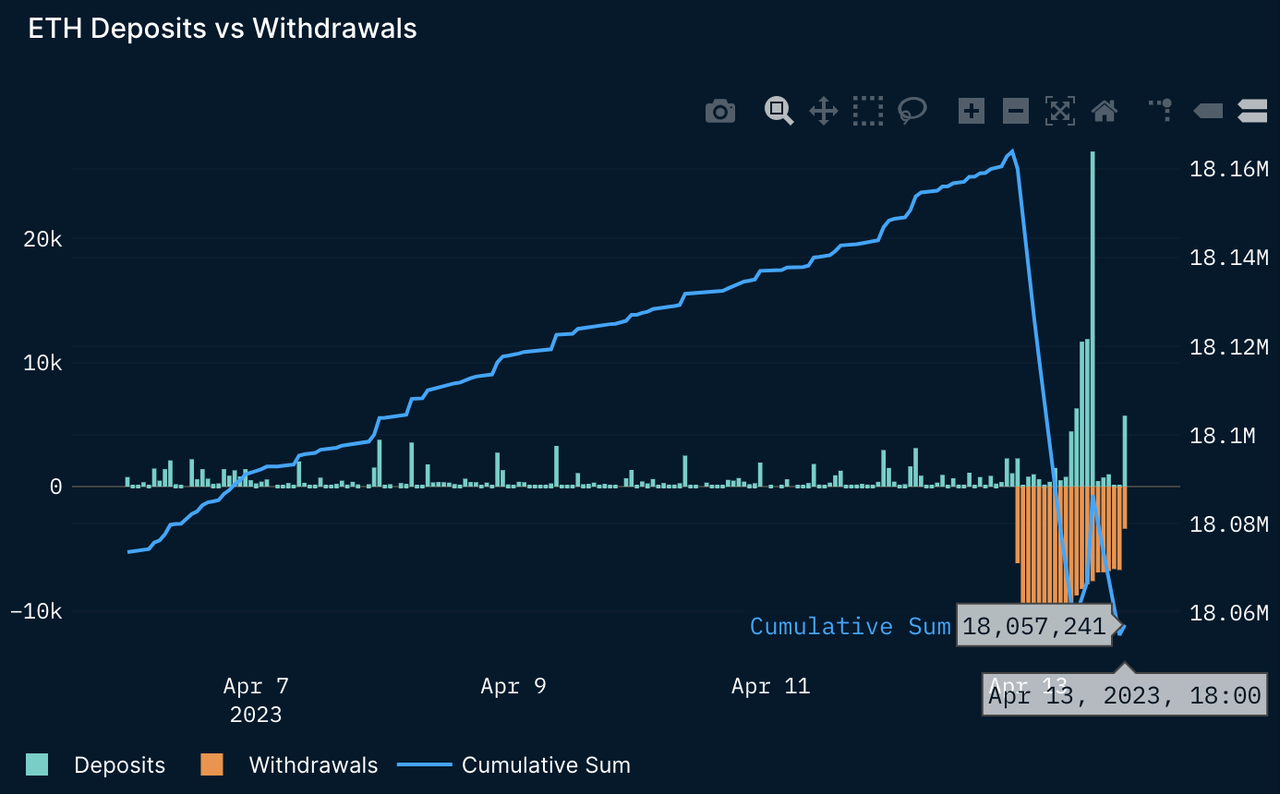

Outflows have overpowered deposits and the Beacon Chain has seen 106k in net Ether outflows since Shapella went live. While the impacts of Shapella are just beginning to be felt, it appears prophecies of catastrophe were overblown.

?itok=lwLbxL3t (

?itok=lwLbxL3t ( ?itok=lwLbxL3t)

?itok=lwLbxL3t)

Ethereum’s exit queue is live and full of stakers looking to withdraw. At the time of analysis, there was 827k ETH across 23k validators in the queue, representing 4.1% of the validator set.

Kraken represents the vast majority of exits (65.9%) as its settlement (https://www.sec.gov/news/press-release/2023-25?…

https://www.zerohedge.com/crypto/analyzing-ethereums-big-week