Are you thinking if bitcoin is a strategic national asset for many other countries it could be hit with all sorts of regulations and central control attempts? Can you dive a little deeper into your last sentence…

Discussion

My thinking is if the US goes first, by the time Western allies work out the game they’re in they will be too late.

They will go hunt down HODLers using exchange KYC lists and shake them down hard which is going to hurt Bitcoin’s decentralisation:

nostr:note1dh22hye0yqvs3nw96utzdwa9tpd8v3ja0yq6h74pnzpj6rr39rws402jfc

“Hunting down hodlers” comes at a cost. That’s the beauty of NGU … it imposes efficiency on every entity. If the United States government legitimizes bitcoin and then it goes to $1M/btc … the people who they’d hire to run all the processes would want to get paid in bitcoin, not the USD. And the existing laws on the books would mean lengthy court battles, etc.

These agencies wouldn’t be able to afford to chase after individuals because they’d be spending resources they don’t have. They’re better served by promoting bitcoin and getting the benefit of the NGU on their stack.

Yes, I have said as much before: nostr:note1g5lqh4sshaw6a7y7snt682f33sdqzj6y0cfef303t60jyzntchtqevwfpy

But that’s not the point I was making here.

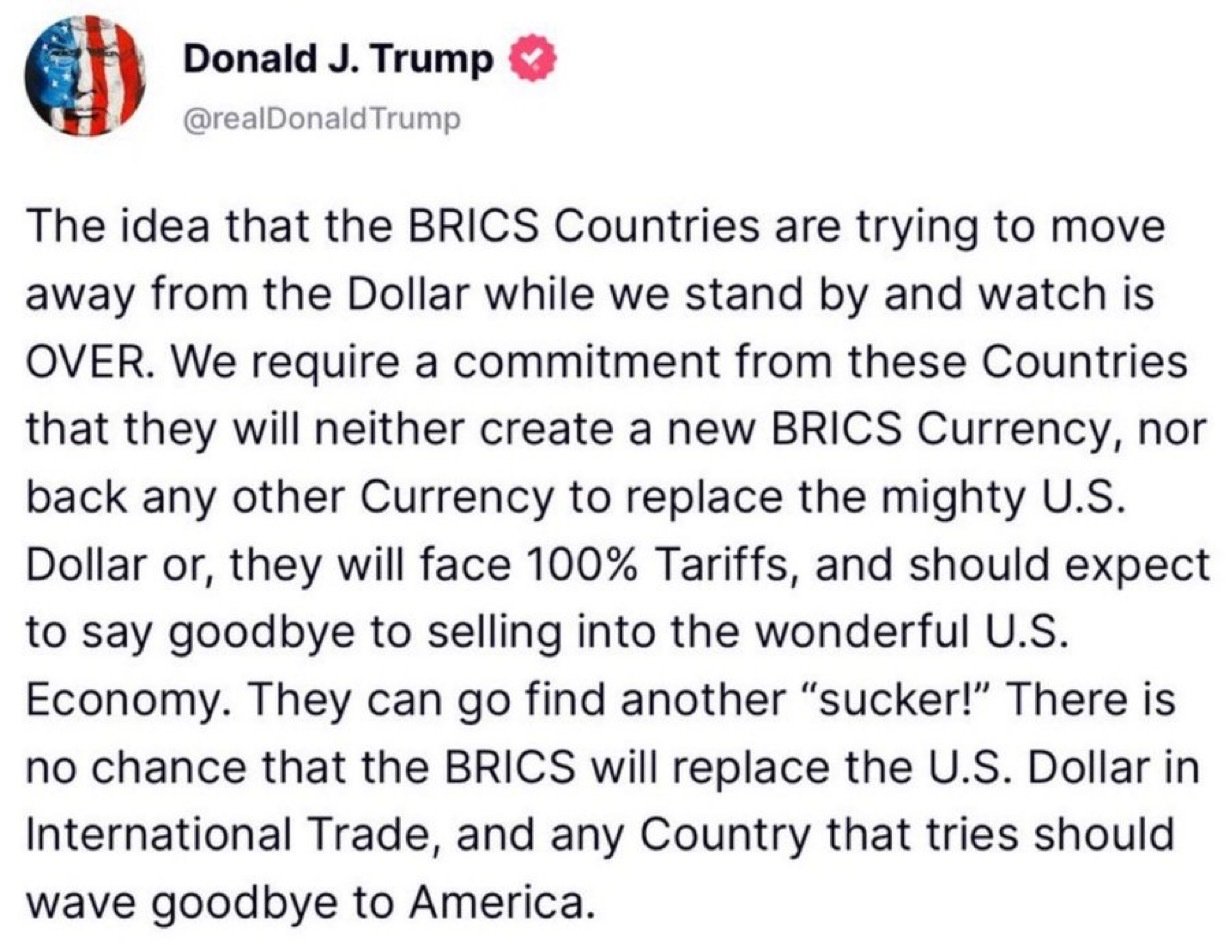

In the short term, before $1M corn, there is a new forcing factor for US allied states who don’t have any corn and have delusions of grandeur (being run by literal retards as they all are) that they’re going to stack a million coins or something stupid once they commit to the game theory.

Their path of least resistance will be to go after HODLers. I’m talking in Europe, UK, Aus, Canada etc.

Nation States adopting once the price is $1M+ looks very different than the Trump regime igniting the spark to kickoff the race at $100k.

nostr:note19n8u3mkj5hmuzg4pg9ne7xhpld7ryqvgec6u7gxstnqn0x5w0z9qlv9evl

nostr:note19n8u3mkj5hmuzg4pg9ne7xhpld7ryqvgec6u7gxstnqn0x5w0z9qlv9evl