My guess is miners. My sense is that the industry has been particularly cutthroat since the halving in April; but that over the preceding year+, the rapid rise in value of their BTC reserves has provided them with quite the war chest to slowly sell off in order to sustain operations during a down and/or chopping sideways market... at least for a while.

Seriously, who TF is selling right now??

Also follow nostr:nprofile1qqsq52wnak9tu2uu7r0zk2xqla03zrk9ac7z4j9j4lf7zcws3s5jeygpzpmhxue69uhkummnw3ezumt0d5hsg8adhv and join his telegram group for 🔥 takes and insights on Bitcoin and macro.

Discussion

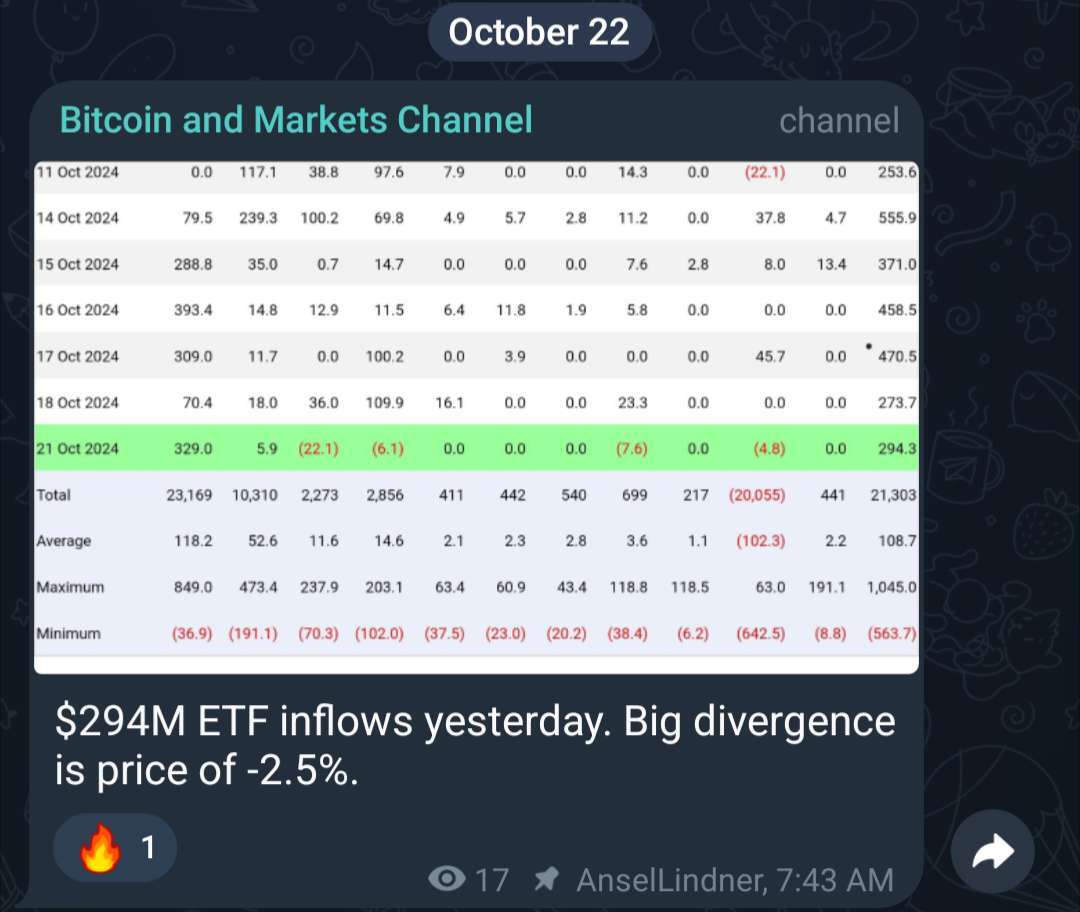

Well, there were $249M in ETF inflows alone yesterday and the price dropped. There has been billions in inflows for the ETFs alone in the last week...

How much do you think they are selling? Kinda seems like coordinated price suppression to me.

The daily volume has consistently been in the $10s of billions (well over $30B yesterday alone). It doesn't seem particularly productive to me to try to draw such conclusions regarding price coordination from < 1% of overall trading volume. Different market participants have different buy/sell pressures. ETF investors likely skew one direction. Miners skew in another. Taken together, they still only represent a mere sliver of the overall market.

Ah good thought to compare inflows to volume. I guess I am underestimating the amount of trading that is actually going on. Still seems crazy to me that so much is coming in on net (at least for the ETFs) without significant price appreciation, but obviously I don't know enough about these market dynamics.

Thanks for your thoughts!

Yeah, I find market dynamics overall to be a big mystery myself. Clearly day traders know something that I don't (or at least they think they do).