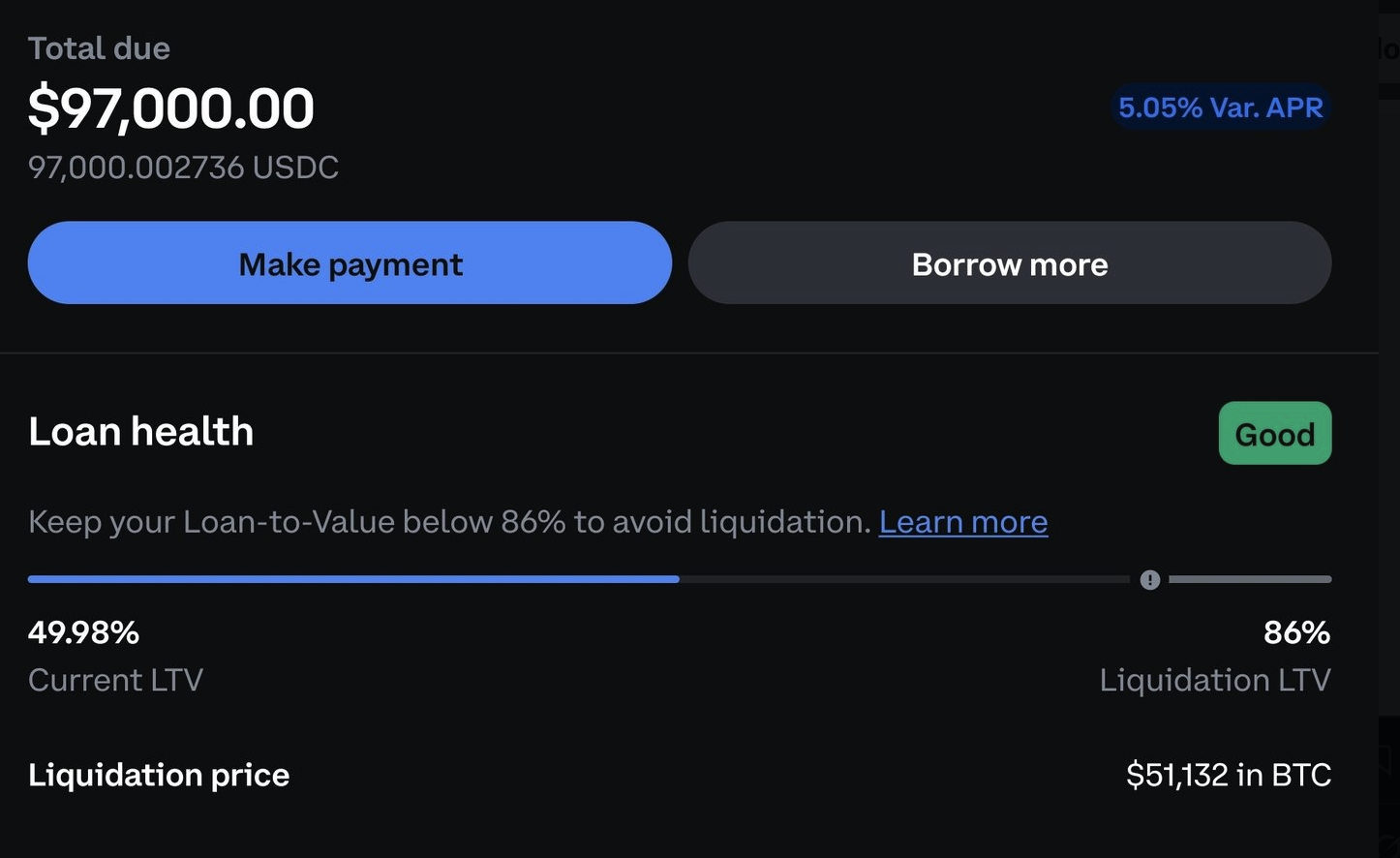

Borrowing against your Bitcoin example:

Here is a breakdown of the key elements of the Loan:

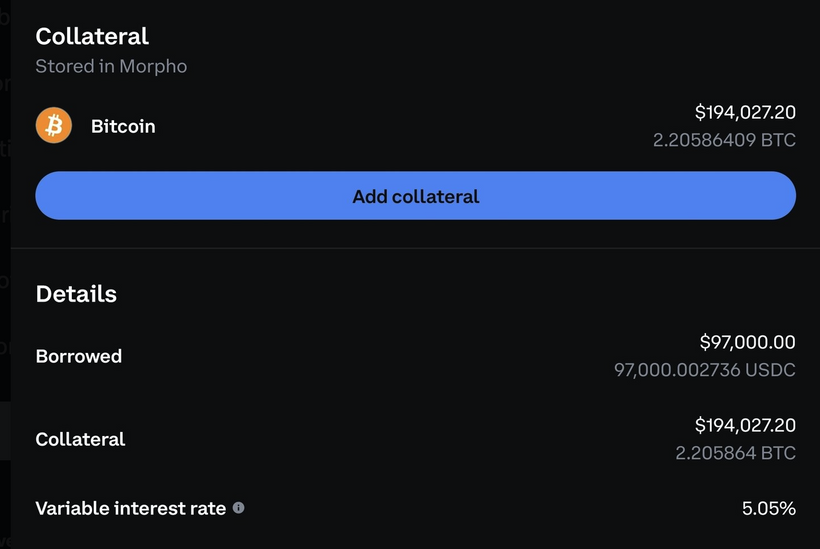

Loan Amount (Borrowed):

$97,000 (or 97,000.002736 USDC - which can be used to do anything include buy more BTC, Real Estate, Car... etc)

Collateral:

2.20586409 BTC, valued at $194,027.20 at the time of the loan.

Stored in Morpho, a decentralized lending protocol.

Loan-to-Value (LTV) Ratio:

Current LTV: 49.98% ($97,000 borrowed / $194,027.20 collateral).

Liquidation LTV: 86%. If the LTV exceeds 86%, the collateral may be liquidated. THIS PART IS KEY!!!

Interest Rate:

5.05% variable APR (Annual Percentage Rate), meaning the rate can change over time. This is very low compared to trad banks

Loan Health:

Currently marked as "Good," as the LTV is well below the liquidation threshold of 86%.

Liquidation Price:

$51,132 per BTC. If Bitcoin’s price drops to this level, the LTV will hit 86%, triggering liquidation of the collateral. This loan is very far away from liquidation, which is the most important point of this type of borrowing.

Repayment Terms:

Flexible repayment schedule ("pay back on my own schedule").

Options to make payments or borrow more are available.

Tax Advantage:

The loan is normally a non-taxable event, as borrowing against crypto typically doesn’t trigger a taxable sale (unlike selling BTC).

Process:

No credit check, only BTC collateral required.

Funded immediately, taking just 5 minutes.

Source: Invest Answers