My reaction to some of your points

1) Why does a nym have to doxx himself? Idk who you personally are but your reputation online is sufficient enough for me to take the risk of joining your mint. The amount of sats I would put in your mint is proportional to the amount of trust I have in you. I think the important thing to keep in mind is that I am not putting my entire net worth in this one mint. I am putting a small portion that I am using for day to day transactions and may put more sats in another mint.

2) People want purchasing power, not bitcoin. There aren't enough sats for everyone on earth to open a lightning channel. What good is holding bitcoin if you can't buy anything with it? The important thing is that your savings are under your custody. Having a couple hundred dollars worth of sats in ecash is not going to get me rekt. And you don't have to put all your eggs in one basket. Have some sats in ecash, some in liquid, some on WoS.

3) Tough shit

4) We don't need custodians to switch to ecash. It is an additional tool that you can benefit from. More tools is better. It allows people to make decisions based on the tradeoffs they are comfortable making.

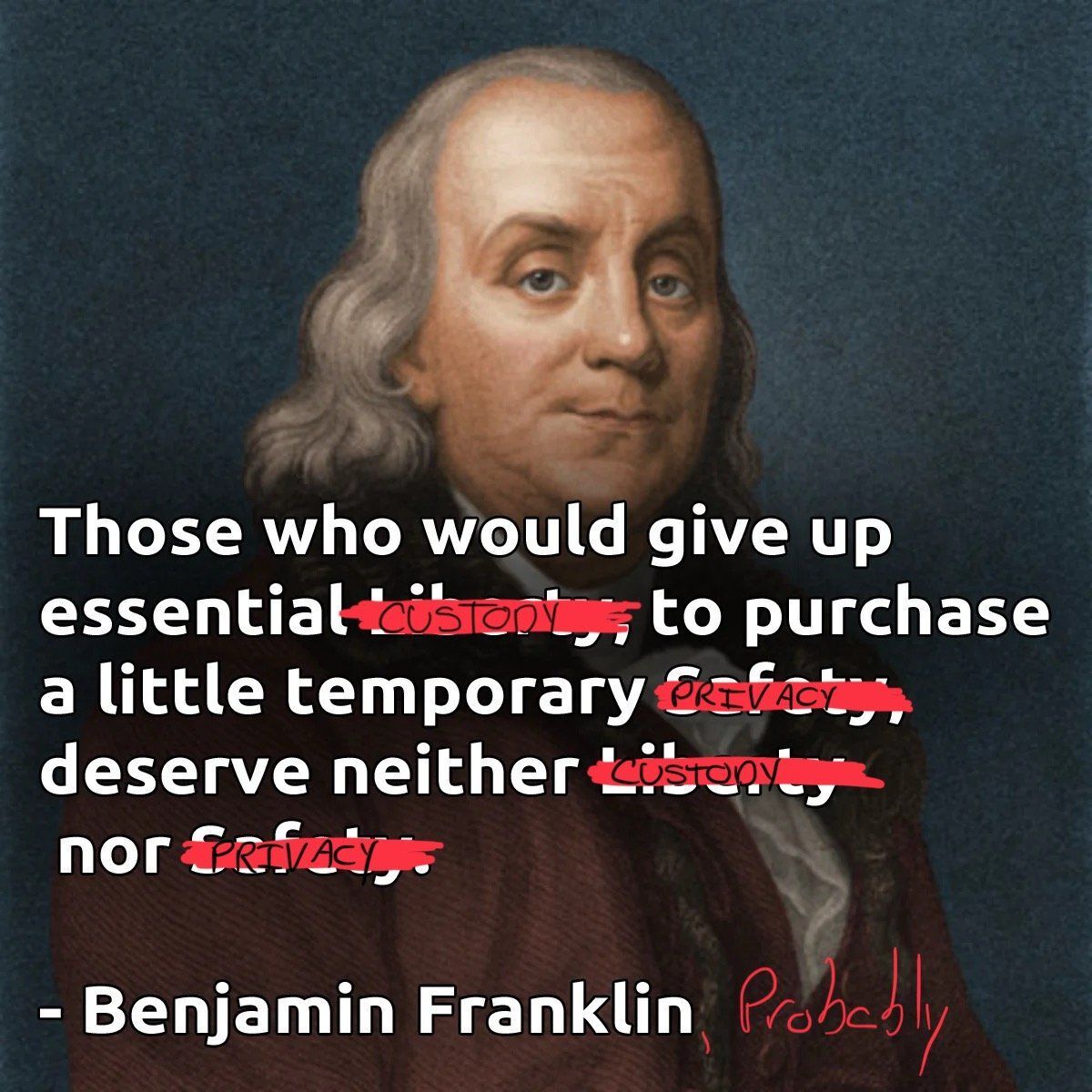

5) Putting some of your bitcoin in an ecash mint is not the same as giving up custody of your bitcoin. And making the bitcoin base chain more private would not work. The reason the blockchain is open and transparent is because Satoshi wanted to make sure there would be no inflation. That was literally the point. If you made the bitcoin blockchain more private, it would be no different from monero. There would be no way to confirm that the supply cap hasn't changed.

Final thoughts

The big difference between a bitcoin standard and a gold standard that most people haven't realized are the custody dynamics. During the gold standard, banks held most or all of people's gold. Getting rugged meant you would lose everything. In a bitcoin standard, these mints would only hold a small portion of your wealth. Getting rugged would suck but it wouldn't ruin your life.

There are no solutions, only tradeoffs. Determine what your risk tolerance is and act accordingly.