None of that has anything to with what I stated.

I am not sure you understand the current market. People, banks, pensions, family offices, etc.. are voluntarily loaning money to the federal government to continue defecit spending. Nothing is being raided. People want to loan the government money.

There is nothing inherently designed with or into fiat money that says the purchasing power must be lower over time.

That's a myth. It happens to be that governments cannot control spending, and issue more into circulation than otherwise would exist.

0% inflation or deflation is absolutely possible over time. Just not with governments being governments.

If the US ran a surplus every year like we did for a few years a few decades ago, the inflation rate would be zero, as they would just bank the surplus, pay down the debt without new debt, and be on their merry way. M2 would not need to go up.

They won't of course... But they could

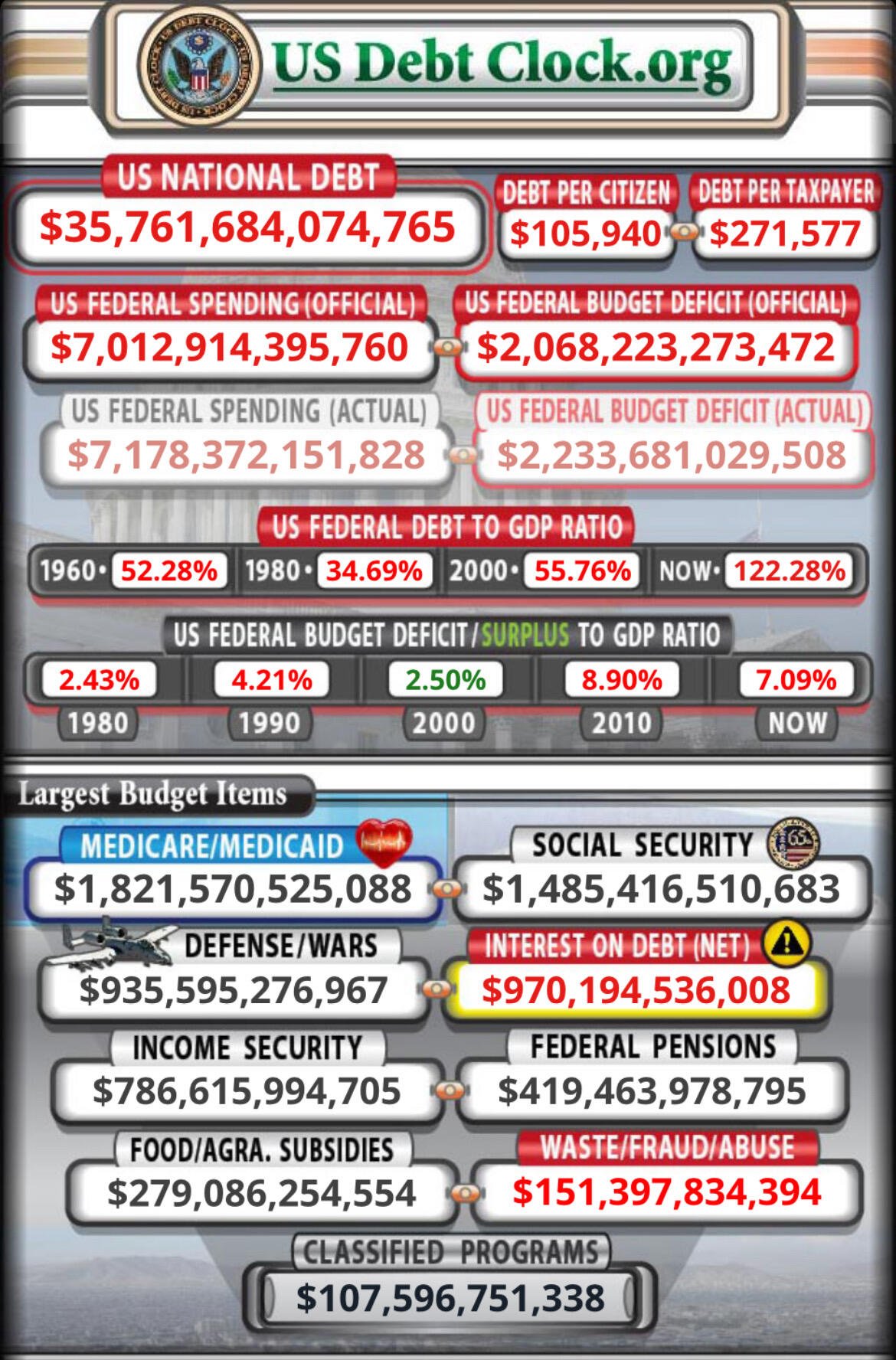

Clueless People are still eager to loan the government money, but let’s not pretend it’s a sign of a healthy system. Sure, in theory, fiat could maintain its value if the government ran a tight ship—balanced budgets, no new debt, zero inflation. That’s possible on paper. But in the real world? Governments will never control their spending. They’ll never choose to live within their means because it’s far too easy to just borrow more.

So your pensions, banks, and family offices keep throwing money at a government that will eventually be forced to print its way out of the mess. Voluntarily loaning them money today just means you’ll get paid back with inflated, devalued dollars tomorrow. It’s not a question of if, it’s when. Fiat is designed to fail because the people managing it are incapable of restraint. You can dream of zero inflation all you want, but as long as governments are involved, inflation is the only guarantee.

Thread collapsed