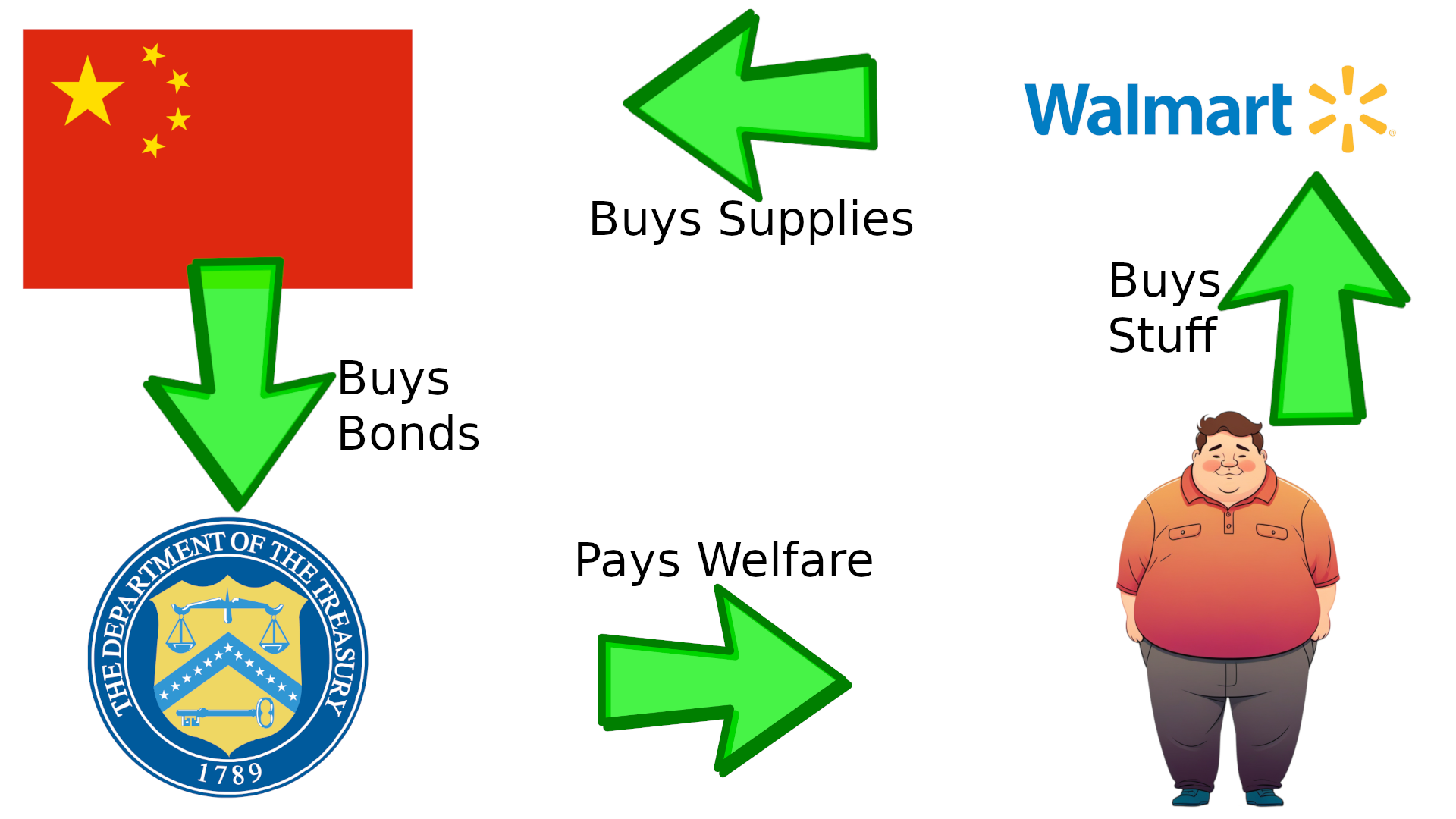

I realize it's a minor point, as your circle is correct, but your starting point is wrong.

The US buys goods from China is actually the starting point. The excess dollars created by the US buying their products causes them to buy us land, equities, energy, us goods, and of course treasuries.

China doesn't just have a bunch of dollars randomly to buy treasuries they can't create them out of thin air like the fed does.