**Goldman Slides After FICC Revenue Unexpectedly Tumbles**

Goldman Slides After FICC Revenue Unexpectedly Tumbles

Goldman stock is tumbling this morning when the lack of a proper Net Interest Income revenue stream and overreliance on trading has - for once - come back to bite it, as the company's all-important FICC division reported far uglier results than most had expected, leading to a big and very rare miss in Goldman's revenue line.

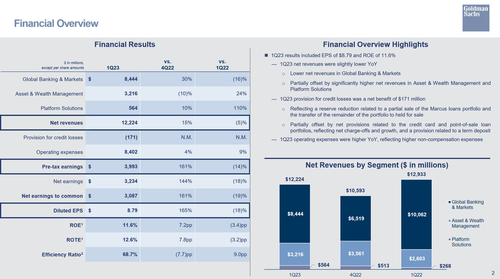

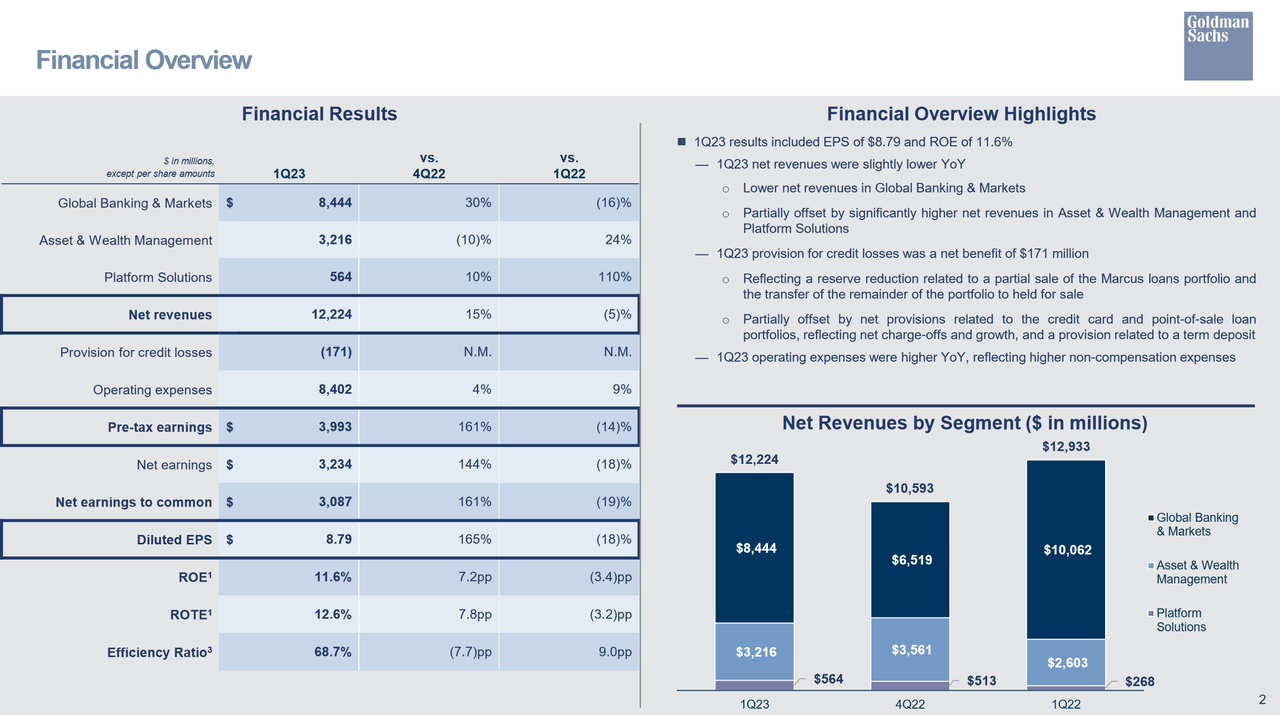

Here is what the bank reported in Q1:

- EPS $8.79, _**beating**_ the estimate $8.21, and down 21% Y/Y

- Net revenue $12.22 billion, _**missing**_ estimate $12.8 billion, and down 5% Y/Y

- _The drop was due to lower net revenues in Global Banking & Markets, partially offset by significantly higher net revenues in Asset & Wealth Management andPlatform Solutions_

- Net interest income $1.78 billion, estimate $2.18 billion

So Net Interest Income missed; how did non-interest income do? Here is the top-line detail:

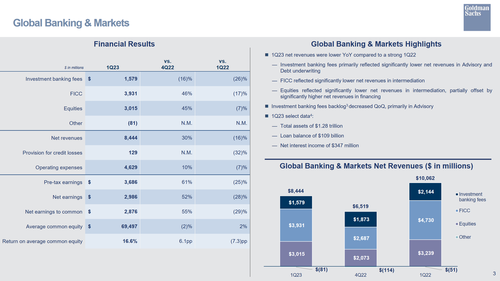

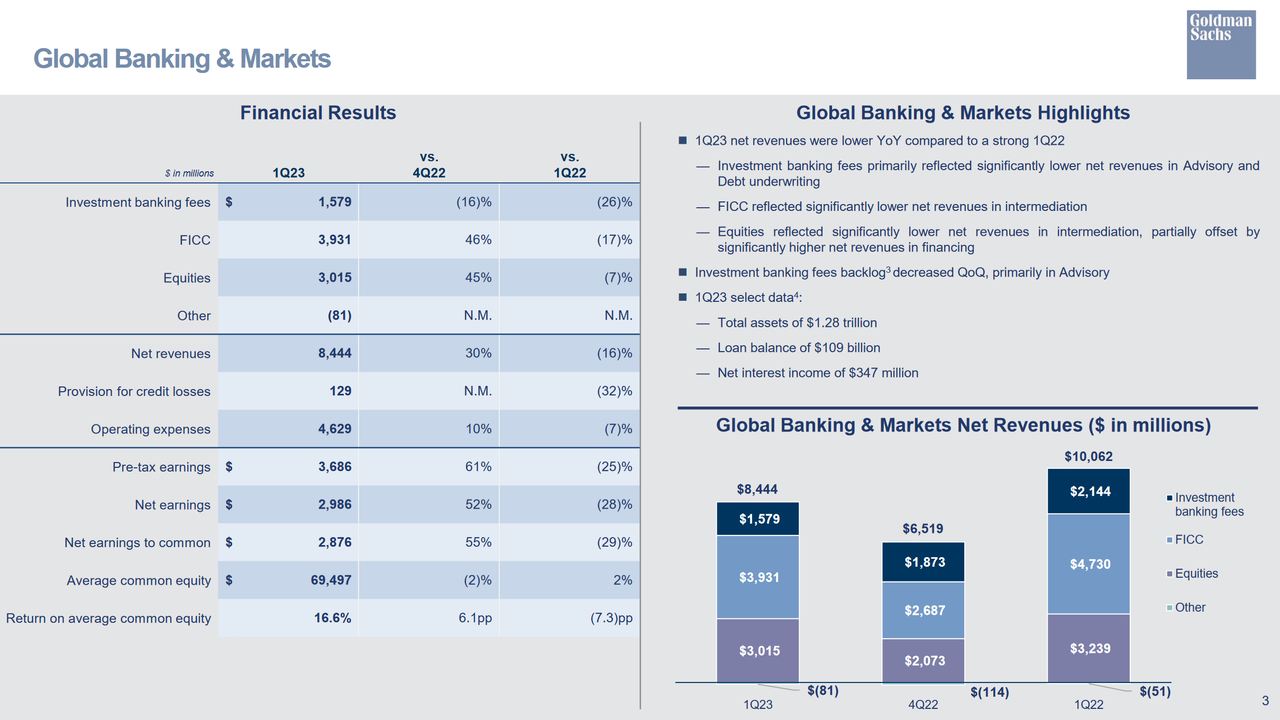

- FICC sales & trading revenue $3.93 billion, _**badly missing**_ the estimate $4.19 billion

- Global Banking & Markets net revenues $8.44 billion, _**missing**_ estimate $8.79 billion

- Investment banking revenue $1.58 billion, _**beating**_ estimate $1.54 billion

- Equities sales & trading revenue $3.02 billion, _**beating**_ estimate $2.83 billion

- Advisory revenue $818 million, _**beating**_ estimate $816.4 million

- Equity underwriting rev. $255 million, _**missing**_ estimate $250.4 million

- Debt underwriting rev. $506 million, beating estimate $477 million

?itok=_alabC8m (

?itok=_alabC8m ( ?itok=_alabC8m)

?itok=_alabC8m)

Goldman also offloaded a chunk of its $4 billion Marcus loan book, which led to a $440 million reserve release. **That helped boost profit more than analysts expected,** but earnings were still down 19% from a year earlier. Net revenue included a loss of approximately $470 million related to the partial sale of the portfolio and the transfer of the remainder to held-for-sale status.

Unlike other banks which suffered credit losses, for Goldman the Q1 credit loss provision was for a **net benefit** of $171 million; a vast improvement to the consensus estimate of a $828 million loss.

The gain reflected a reserve reduction related to a partial sale of the Marcus loans portfolio andthe transfer of the remainder of the portfolio to held for sale, and was partiallyoffsetbynetprovisionsrelatedtothecreditcardandpoint-of-saleloanportfolios, reflecting net charge-offs and growth, and a provision related to a term deposit.

But while the confusion over the Marcus loan book sale was bad, the big miss in FICC was the gut punch: fixed-income trading revenue tumbled 17%, and badly missing expectations, **leaving Goldman the only major Wall Street bank so far to have posted a drop for that business.** Incidentally, the revenue figure for FICC for the same period last year was up more than 20%.

?itok=Z27YqMBM (

?itok=Z27YqMBM ( ?itok=Z27YqMBM)

?itok=Z27YqMBM)

According to the bank, the drop in FICC revenue "reflected significantly lower net revenues in intermediation"

That said, the modest beat in equities-trading revenue helping to soften the blow; equities revenue reflected significantly lower net revenues in intermediation, partially offset by significantly higher net revenues in financing.

Investment banking revenue of $1.58BN beat expectations of $1.54BN, but was down a whopping 26% Y/Y "primarily reflected significantly lower net revenues in Advisory and Debt underwriting." The investment banking fees backlog also decreased QoQ, primarily in Advisory.

Here is some other select Q1 2023 data:

- Total assets of $1.28 trillion

- Loan balance of $109 billion

- Net interest income of $347 million

Turning to Goldman's Asset and Wealth Management business, which is the closest thing GS now has to a prop desk, the bank reported Q1 net revenues that were "significantly higher". It is also here that we find some more detail on the $470 million loss incurred as part of selling the Marcus loan portfolio.

Management and other fees primarily reflected the inclusion of NN Investment Partners (NNIP) and a reduction in fee waivers on money market funds

Private banking and lending included **a loss of ~$470 million related to a partial sale of the Marcus loans portfolio and the transfer of the remainder of the portfolio to held for sale,** partially offset by the impact of higher deposit spreads

Equity investments also reflected mark-to-market net gains from investments in public equities compared with significant mark-to-market net losses in 1Q22 (and most previous quarters), partially offset by significantly lower net gains from investments in private equiti…

https://www.zerohedge.com/markets/goldman-slides-after-ficc-revenue-unexpectedly-tumbles