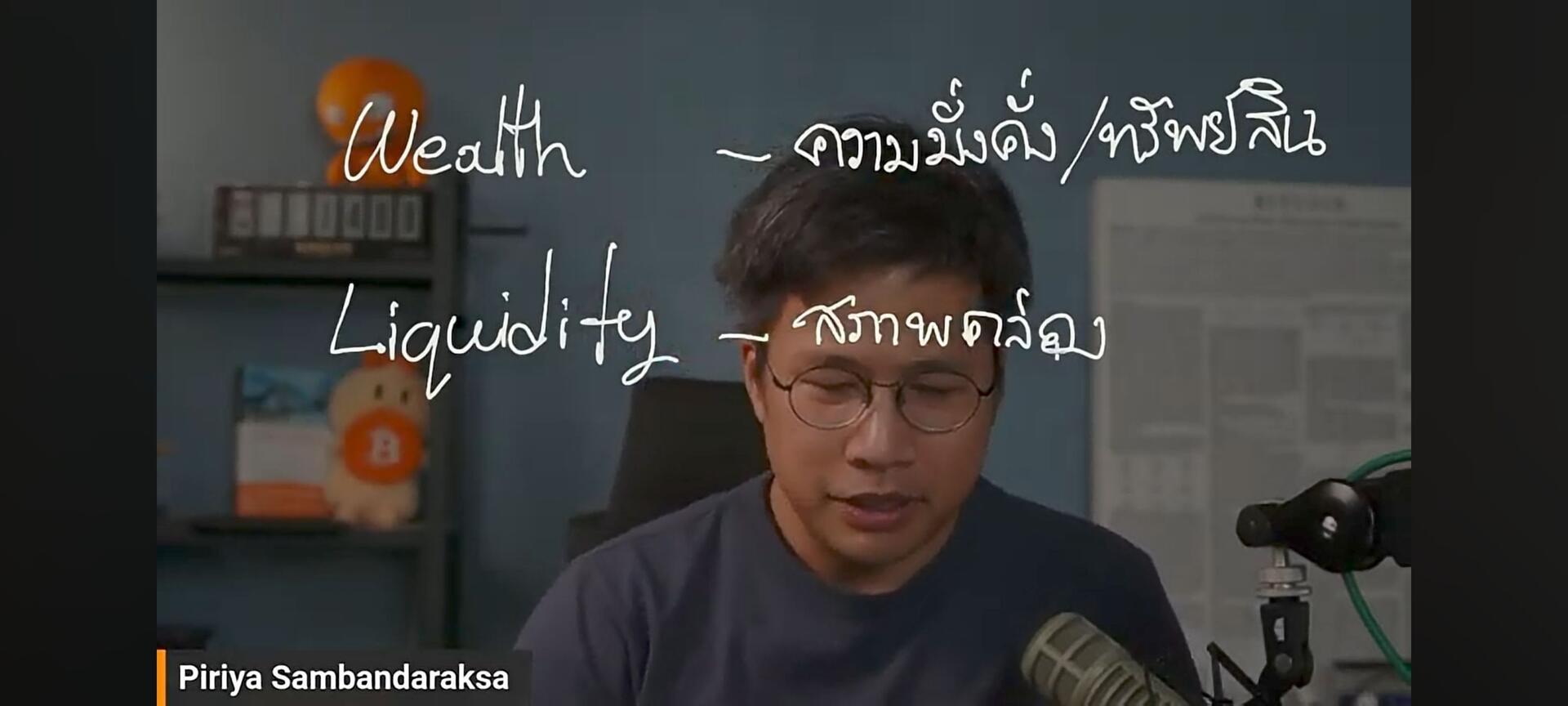

## Wealth and Liquidity

**Wealth** refers to the total value of all assets owned minus the total value of all liabilities.

**Liquidity** refers to the ease with which an asset can be converted into cash without significantly losing value.

**Key Differences:**

* **Wealth** focuses on the total value of assets, regardless of how easily they can be converted into cash.

* **Liquidity** focuses on the ease and speed of converting an asset into cash without losing value.

**Example:**

* **Wealth:**

* Owns a house worth 10 million baht

* Owns a car worth 2 million baht

* Has 1 million baht in bank deposits

* Has 2 million baht in debt

**Wealth** of this person = (10 + 2 + 1) - 2 = 11 million baht

* **Liquidity:**

* 1 million baht in bank deposits has high liquidity and can be converted into cash immediately.

* The house and car have low liquidity and it takes time to sell them.

**Summary:**

* **Wealth** indicates overall financial status.

* **Liquidity** indicates the ability to access cash.

**Both Wealth and Liquidity are important:**

* **Wealth** helps achieve long-term financial goals.

* **Liquidity** helps cope with emergencies.

**It is important to have a suitable balance between Wealth and Liquidity:**

* **Too much Wealth** can lead to a lack of liquidity.

* **Too much Liquidity** can lead to missing out on high-return investment opportunities.

**It is important to consider financial goals, risk tolerance, and personal preferences.**

#siamstr

#nostr

#bitcoin