there is a limit on how many concurrent self-custodial users the bitcoin network can support. if you go over this limit people have to use it through a financial institution. nothing has actually been done to scale self-custody including lightning. it's not open for anyone to use.

Discussion

What is the limit?

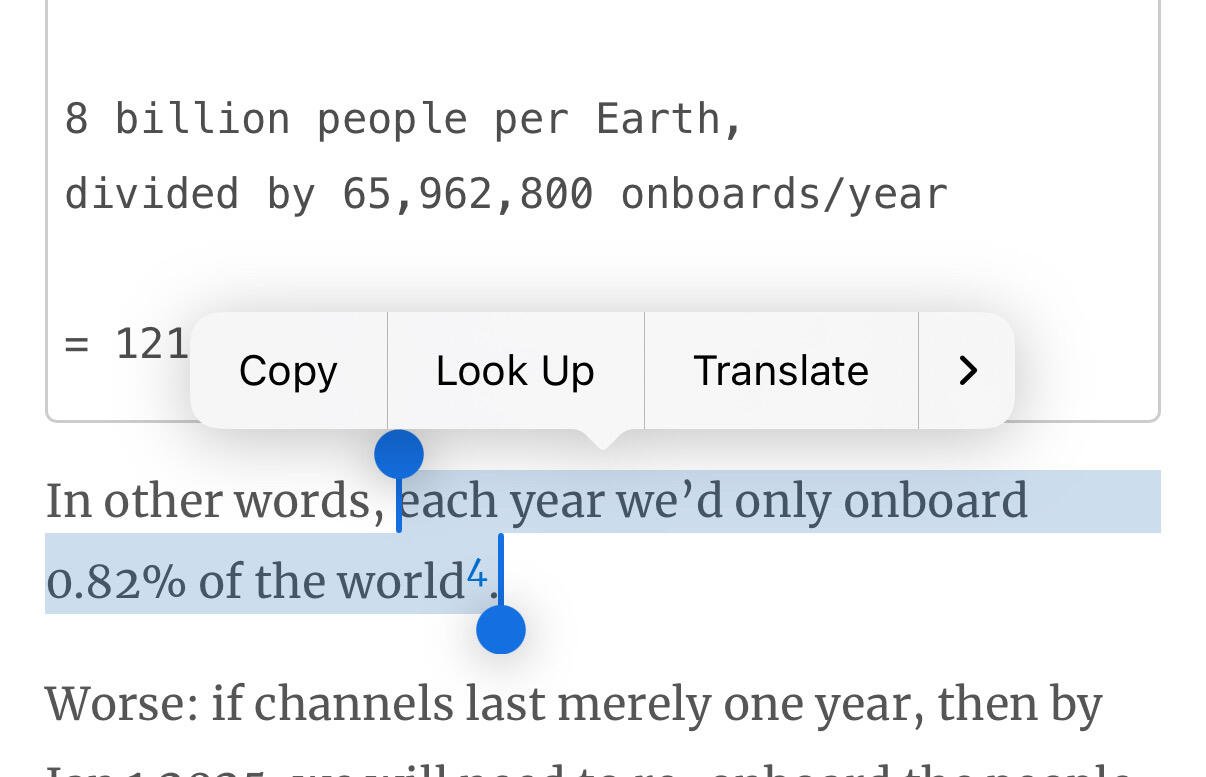

Paul Sztork (the drivechain guy) did these

>only 0.82% of Earth’s population, max, can be bona fide Bitcoin users (at any one time).

on the off chance that you get a bitcoin maxi to realize that this is true, they immediately switch over to "yeah well it's not actually bad if most people use a custodian. it still counts as bitcoin."

Per year not total according to that article*

which is over 65 million new users per year. I don’t think the demand for new users is close to that. There are only estimated 106 million users in 16 years so. 106/16 =6.625 million new users per year average. 6.625/65=0.102. So average demand for new users is about 10% of its limit so 90% unused.

no, it's total, go read it again

This is awkward…

yes, scroll down like three more lines. are you just pretending you didn't see it?

you're not seriously suggesting that a person will keep all their channels for the rest of their life are you? you wouldn't be able to find me anyone who can keep all their channels for that long because it doesn't work like that.

Ok assuming this is all correct this is talking about lightning limitations. So according to this limit if bitcoin users all use lightning and we continue to grow at the same rate 100M users in 16 years it will take another 80 years to hit that limit of lightning channels on based on all those assumptions. What is the theoretical upper limit of bitcoin layer 1 aren’t seeds basically infinite? Like 10^27 or something insane?

it's not anything to do with seeds. when you create a lightning channel, it occupies L1 blockspace. paul's napkin math aims to simulate the maximum number of people who can simultaneously maintain a reasonable number of their own channels. less than 1% of the earth's population can interact with bitcoin without going through a custodian, even in the presence of lightning under optimistic laboratory conditions. the real number is much lower. paul is suggesting that lightning is a dead end and drivechains should be used instead. I much prefer rollups, but I hate lightning so much that I would happily accept drivechains instead.

What about mints?

This has been informing to read btw. Thanks to all y'all.

what about mints? FUCK mints. this is exactly what paul is talking about. if you don't activate any new opcodes, and you run out of room for people to have their own channels, everyone else has to go through a custodian. custodial wallets are not even bitcoin wallets, they are bank accounts, and they are not freedom tech. mints are not bitcoin. like at all.

not to mention, lightning has other problems besides not scaling self-custody. payments often fail. I have tried transferring between minibits, river, and trocador using lightning and it just doesn't fucking work. payments fail more often the more decentralized the network topology gets. it's just a braindead idea and mints are a complete joke.

Weird I haven't had any problems with it at all yet. Unless the address is messed up. I think I've had maybe a couple failed payments through the years but not enough to be aggravated by it. I don't use it constantly for large amounts either though. I've had failed payments in the fiat realm with issues too though. Nothing is perfect. I'm not angry about it. I just know that's life.

payments I have made between large centralized exchanges and the most popular custodial wallet services have never failed. that's because they are "near" each other in a payment channel sense. their proximity to each other more closely resembles a hub and spoke model. the problem is that payment channel architecture is the ONLY cryptocurrency architecture where alice needs to be "close enough to" bob or "have enough liquidity between herself and" bob for a payment to succeed. lightning is the ONLY cryptocurrency tech that makes this sacrifice. it is impossible for payments to always work when the payment channel topology to be nice and distributed. you pick any other offchain scaling solution and alice can pay bob any amount whenever she wants and it always gets there.

Okay that makes sense. So then what is the solution to that? I have no clue. I'm just starting to delve into this world and I am not very tech savvy. So thanks for bearing with me. I'm not being a smart-ass I honestly don't know

bitcoin needs a softfork to get more capabilities, then you can have different types of L2 networks besides lightning, such as rollups or drivechains. there are different proposed softforks that would unlock different capabilities. unless there is a softfork, the only alternative to lightning right now is federated sidechains like liquid and rootstock, which require too much trust. there is some talk about attempting to build a rollup without relying on a softfork, but I don't think it's worth attempting because it wouldn't work that well.

the benefits of building a proper drivechain or rollup are pretty high because they would scale self-custody and actually kill altcoins like monero and ethereum. I don't look down on people who are using monero and ethereum right now because bitcoin doesn't have anything that can perfectly replace them yet. I use monero and ethereum myself, but I would be happy to stop.

I think there is a perverse incentive for some entities in the bitcoin ecosystem to obstruct any softforks that would give us something better than lightning. they want bitcoin to be something that is controlled by financial institutions. they want 99% of bitcoin users to go through a bank account to use it and they want lightning to serve as a sort of ACH between custodial wallet providers. governments would also be very happy if it works like that. it's just a bunch of parasitic rent seeking and it's the exact thing that caused gold to fail as a form of commodity money.

Wasn’t taproot supposed to enable this kind of stuff?

taproot mostly just enables transactions to be constructed differently so that they are more efficient and can do more things at the same time. there are also a few fancy tricks it unlocks. most of the articles discussing it are using language that oversells it. taproot doesn't instantly transform bitcoin into something that can do anything the EVM can do. it doesn't give you full defi, or the ability to validate ZK proofs or optimistic fraud proofs. you can't use it to construct a drivechain either.

for drivechains you would need a different enhancement called BIP300 which includes several new opcodes. BIP300 specifically targets the ability to have drivechains. for rollups you would need a more general purpose scripting enhancement such as OP_CAT, which would end up enabling other things in addition to rollups. OP_CAT is already enabled on other chains like liquid. satoshi created OP_CAT on bitcoin but he didn't make it safe enough at the time, so it was disabled as a precaution. if it is turned back on, it cannot work the way satoshi first designed it to work.

Also wouldn't you want opcodes to be very slow to be implemented in the first place. It helps keep things from catastrophic failure which would be much worse

Self custody is about private keys, you brought lightning into the convo. I was purely talking about bitcoin as a store of value for saving your time/labour. A user could have one utxo or many. So it doesn’t have this theoretical limit of channels of how many users can self custody on chain. You are assuming all users will use lightning. So we are kind of talking about different things. Likely there will be multiple solutions maybe Lightning or other layers. 16 years in it’s hard to say for certain what can and will be built on top of the network. But as of right now Bitcoin is the best store of value.

buying a UTXO also takes up blockspace. there's a theoretical limit on how often people can buy UTXOs. the same exact napkin math applies.

there's a reason why I try (and often fail) to spend every single zap I receive on altcoins. devs from other chains already assessed payment channel architecture and immediately abandoned it in favor of things that look more like rollups and drivechains. they were right to do that. the fact that bitcoin developers can waste eight whole years on a dead end solution like lightning is extremely alarming. some of them are eagerly trying to stonewall the introduction of any new opcodes, asserting that bitcoin is fine the way it is, and that no more than a few million people even deserve to interact with bitcoin outside of a fucking bank account.

I am not ready to accept that bitcoin has actually earned its rightful place as the best store of value until something actually gets implemented to scale self-custody past 0.8% of the earth's population. I want it to happen but it has not happened.

This theoretical 0.8% is not true. Once a user has a utxo they are a user it doesn’t reset every year like your channel math states that is a function of lightning. Block space limits tx not self custody yes a new user needs a tx to become a use but they don’t stop being a user if they continue to hold that utxo. So it’s bogus. To be a user you need a private key and one or more utxo’s.