**US Equity Futures Slide As Global Risk Sentiment Turns Sour**

US Equity Futures Slide As Global Risk Sentiment Turns Sour

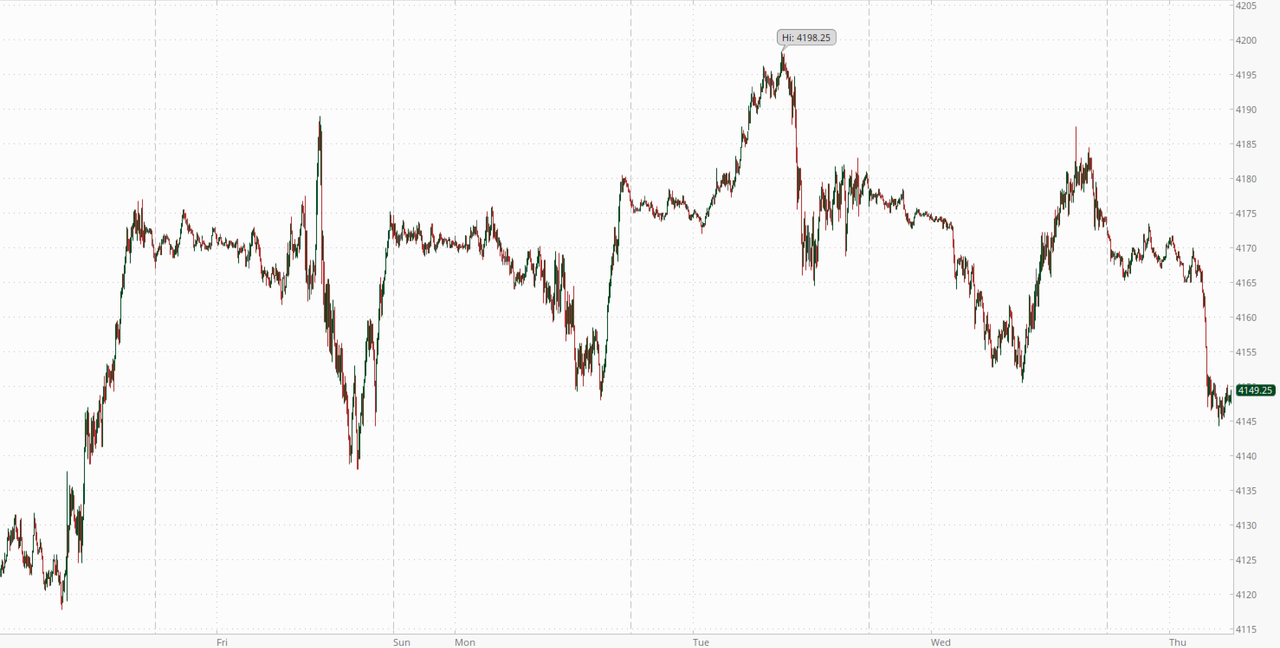

US equity futures suffered their biggest overnight drop this week as a premarket slide in Tesla shares added to uncertainties surrounding the future of US monetary policy as well as the overall quality of the first-quarter earnings season. Contracts on the S&P 500 fell 0.7% as of 7:00 a.m. in New York while Nasdaq 100 futures took a 1% hit. Elsewhere, bond yields were lower, the USD was lower, and commodities were weaker on global demand fears.

?itok=1cbEm2mL (

?itok=1cbEm2mL ( ?itok=1cbEm2mL)

?itok=1cbEm2mL)

In premarket trading, Tesla slid as much as 8.5% and were down -6% at last check, after the EV maker’s first-quarter results were hit by a slew of price cuts, denting profit margins and prompting at least six analysts - including Morgan Stanley's Adam Jonas - to cut their price targets. MegaCap techs are also dragging indices lower with most names down 1%, or more. Bed Bath & Beyond shares tumbled 19% in premarket trading after Dow Jones reported that the retailer is preparing a bankruptcy filing for as early as this weekend. The stock had soared almost 100% in the three days prior. Here are some other premarket movers:

- Chip stocks decline in after Asian bellwether TSMC gave a disappointing revenue forecast for the current quarter amid a slump in demand for electronics.

- IBM rises as much as 2.2% after the IT services company reported first-quarter results that analysts say show positive growth trends.

- Las Vegas Sands rises as much as 4.8%, after the casino operator’s first-quarter earnings beat expectations and boosted hopes that a recovery in Macau and in Singapore is gaining momentum. Analysts hiked their price targets on the stock.

- Bath & Body Works drops 3.7% after Piper Sandler cuts its rating to neutral, with consensus estimates for the personal care products maker seen as “simply just too high.”

- Charles Schwab shares fall as much as 1.7% after Redburn downgraded the brokerage to sell from neutral, citing challenges from the Fed’s tightening cycle and the re-regulation of midsize banks.

- Cryptocurrency-exposed stocks fall and are poised to extend losses as Bitcoin dives further below the closely watched $30,000 level.

With better Bank earnings and a lackluster start from Tech earnings, the market seemingly remains stuck in near-term range of 3800 – 4200, with the SPX failing at 4150 level. Next week’s tech earnings will be the litmus test for bears and bulls.

Meanwhile, hawkish Fedspeak continues with some estimating 25bps – 50bps, or more, hikes remaining. Investors are seeking comfort whether policymakers will address growing recession worries, such as those flagged by the Federal Reserve’s monthly Beige Book survey which clearly noted that a credit crunch has arrived, or keep on fighting inflation as suggested by Fed Bank of New York President John Williams, who said price gains remained too high.

**“We’re in a paradoxical situation,”** said Alexandre Hezez, chief investment officer at Group Richelieu, a Paris-based asset manager. “ **If the Fed keeps on raising rates it’s not positive as it would mean we’re not done with inflation yet, but if it cuts, that would mean there are recessionary forces around.”** The best path forward would be “a status quo” for the coming months, after a 25 basis-point hike in May, Hezez said, noting strong divergences on the matter among the Federal Open Market Committee.

European stocks are on course for their largest fall in almost four weeks amid tepid earnings and the prospect of additional monetary tightening. The Stoxx 600 is down 0.3% with autos, miners and tech the worst performing sectors while Renault and Nokia have fallen sharply after their respective quarterly updates. Here are the most notable European movers:

- Renault shares fall as much as 7.9% as pricing concerns offset positives from the first-quarter sales beat, with analysts questioning the sustainability of the French carmaker’s pricing

- Tryg shares rise as much as 4.7% with analysts saying the Danish insurer’s better-than-expected profit, dividend and combined operating ratio all make for a reassuring update

- Haleon shares rise as much as 3% in early trading to hit a record high. The consumer health group’s first-quarter update is strong and shows good momentum for the group, analysts say

- Bankinter jumps as much as 5%, kicking off 1Q earnings season for European banks with a strong set of numbers and analysts pointing to a net interest income beat

- Getlink shares gain as much as 2.8% after the French cross-channel transport operator reported a 1Q revenue beat and management maintained its Ebitda outlook

- Rexel shares rise as much as 3.8% after it re…

https://www.zerohedge.com/markets/us-equity-futures-slide-global-risk-sentiment-turns-sour