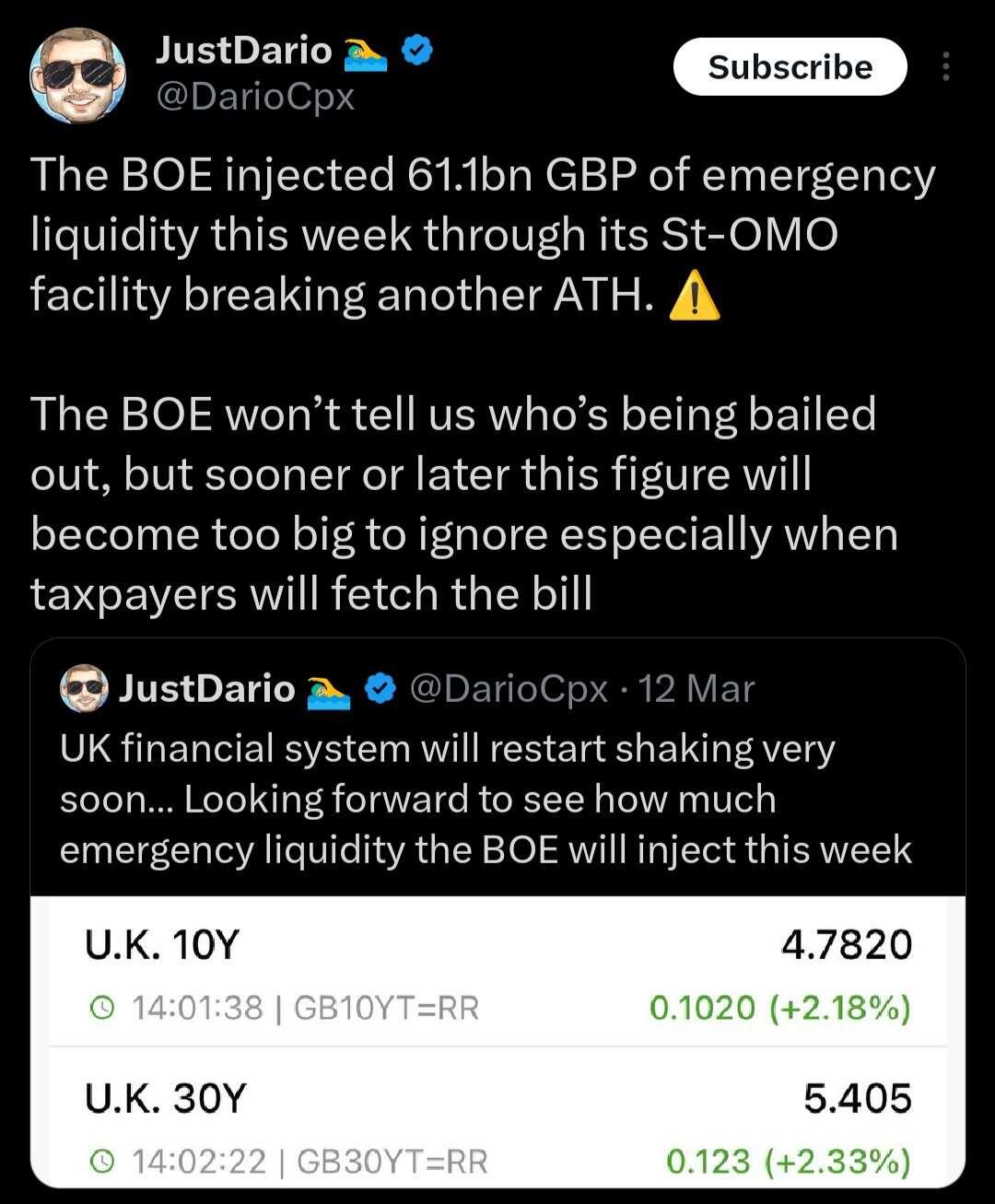

There are definitely issues in the commercial banking system at the moment. Never gets much coverage when the BoE uses its repo (repurchase) operation tool to “manage” liquidity problems in the financial / commercial banking system (it’s a bit like short-term QE). The BoE does it quite regularly (monthly or so) by lending money against securities, buying them back at a higher price a little while later (influences interest rates too). All to try and stave off bank funding stress and credit crunches but it’s the size! It just keeps growing. I think the amount was around £17bn a year ago and £3bn a couple of years ago. Bonkers.