**Shorts Steamrolled As Late Day Squeeze Sends Stocks To Session High, VIX Plummets**

Shorts Steamrolled As Late Day Squeeze Sends Stocks To Session High, VIX Plummets

First, some context from Goldman's Prime Brokerage: "our franchise flows have shifted to local selling of tech this week and Nasdaq is only up in two of the past ten sessions ( _**also note that it stands exactly where it stood in ... the spring of 2021).**_"

?itok=tgxZDPBL (

?itok=tgxZDPBL ( ?itok=tgxZDPBL)

?itok=tgxZDPBL)

In other words, might as well have sold in May _**of 2021**_ and gone away for two years, enjoying all the hikes, golfing and trips and you'd still be right where you left off. Instead, you overtraded every market move and lost money.

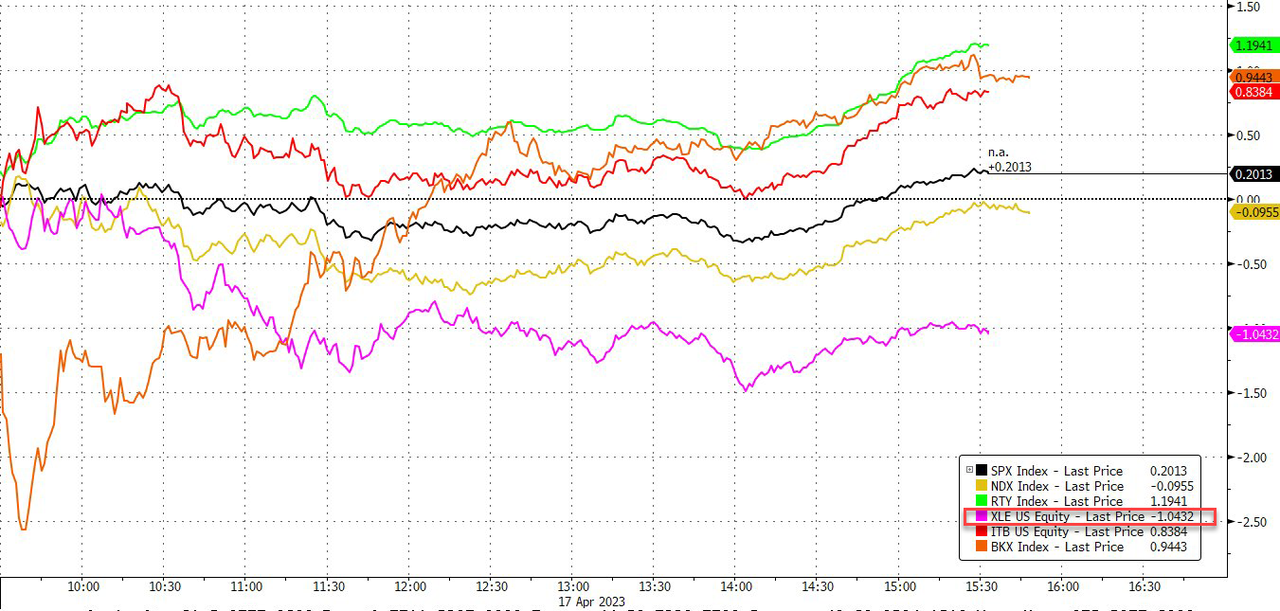

Today was a micro snapshot of this entire dynamic: after some terrible results from large custody bank State Street, at a time when everyone is on edge about anything negative news out of banks, which sent State Street shares plunging by as much as 18%, the most intraday since March 2020...

?itok=oKQbGf-1 (

?itok=oKQbGf-1 ( ?itok=oKQbGf-1)

?itok=oKQbGf-1)

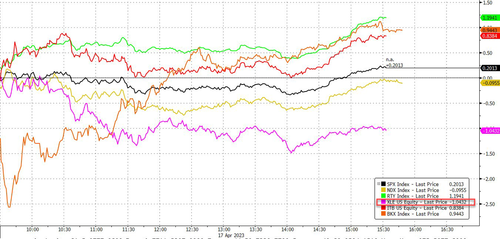

... following the sharp early selloff, we say bank stocks gradually recover all losses before eventually trading near session highs by the close, as the massive hedge fund short overhang we discussed last week (https://www.zerohedge.com/markets/why-non-stop-squeezes-stubborn-hedge-funds-are-most-short-sp-12-years)remains intact.

?itok=hwOyfzEQ (

?itok=hwOyfzEQ ( ?itok=hwOyfzEQ)

?itok=hwOyfzEQ)

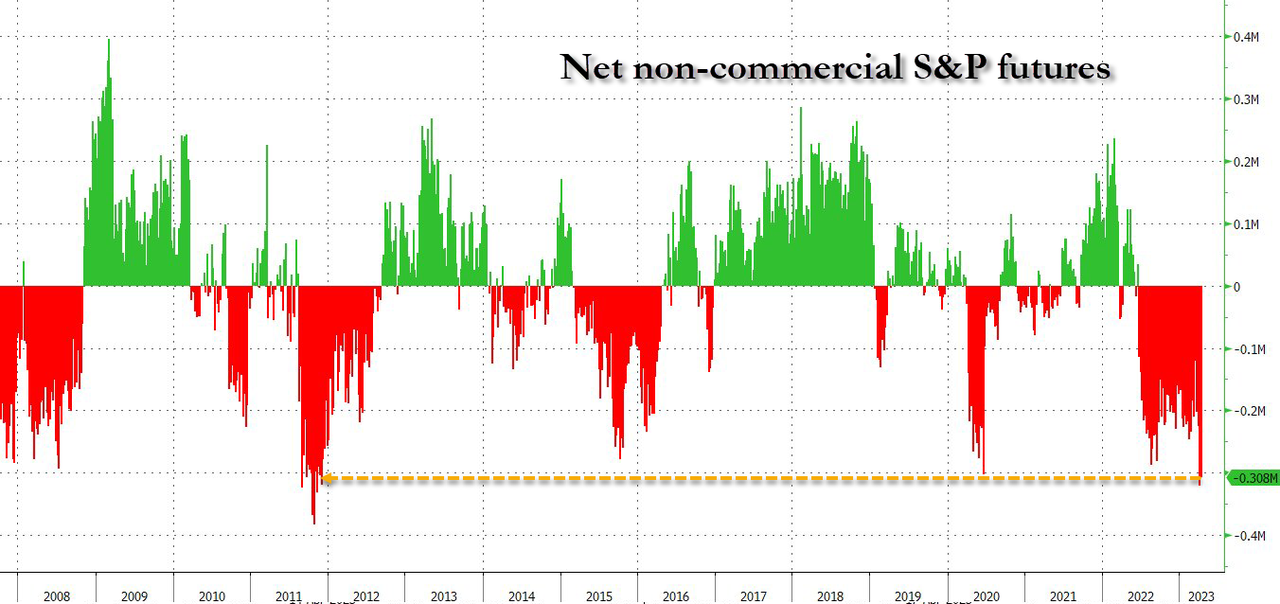

... and leads to a powerful rally every time a selling thrust is exhausted, and today was no difference. And speaking of massive short overhangs, after we noted last week that the number of non-commercial net specs (i.e. hedge funds) shorting the S&P is at an 11 year high, we have barely budged..

?itok=8v2toBCn (

?itok=8v2toBCn ( ?itok=8v2toBCn)

?itok=8v2toBCn)

... which is also why stocks took the escalator down, and the short squeeze elevator up closing at session highs and squeezing another round of shorts in the process...

?itok=lxptj9jf (

?itok=lxptj9jf ( ?itok=lxptj9jf)

?itok=lxptj9jf)

... a reversal which the 0DTE crew orchestrated starting at exactly 2pm ET with a market-leading spike in delta, driven by a surge in call buying and put selling, a market inflection which was captured vividly in this chart from our SpotGamma partners (https://www.zerohedge.com/spotgamma)...

?itok=tANahLsG (

?itok=tANahLsG ( ?itok=tANahLsG)_Source:_ (

?itok=tANahLsG)_Source:_ ( ?itok=tANahLsG) _Spotgamma (https://www.zerohedge.com/spotgamma)_

?itok=tANahLsG) _Spotgamma (https://www.zerohedge.com/spotgamma)_

... which also is why the VIX was crushed today, as puts were unwound in a frenzy, and tumbled below 17 to the level where it was back in Jan 2022 when stocks were at all time highs!

?itok=TUYbZ9Ff (

?itok=TUYbZ9Ff ( ?itok=TUYbZ9Ff)

?itok=TUYbZ9Ff)

And while banks promptly recovered and joined most other sectors in the green, the only sector that was lower was energy...

?itok=rrS5Rv5u (

?itok=rrS5Rv5u ( ?itok=rrS5Rv5u)

?itok=rrS5Rv5u)

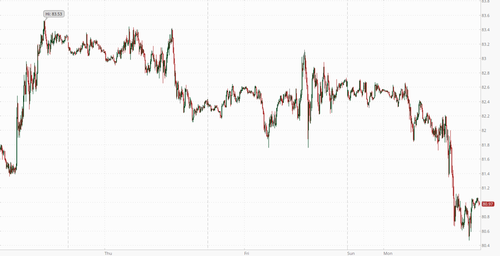

... tracking the renewed weakness in oil...

?itok=FUrmhQ1J (

?itok=FUrmhQ1J ( ?itok=FUrmhQ1J)

?itok=FUrmhQ1J)

... where unlike stocks, shorts once again have _**zero**_ fear of a squeeze, at least no a financial one - indeed, while all financial actors in energy are pressing their shorts having picked this asset class as the best expression of rising recession bets - bets which are encouraged by the senile occupant of the White House, because we learned today that another 1.6 million ba…