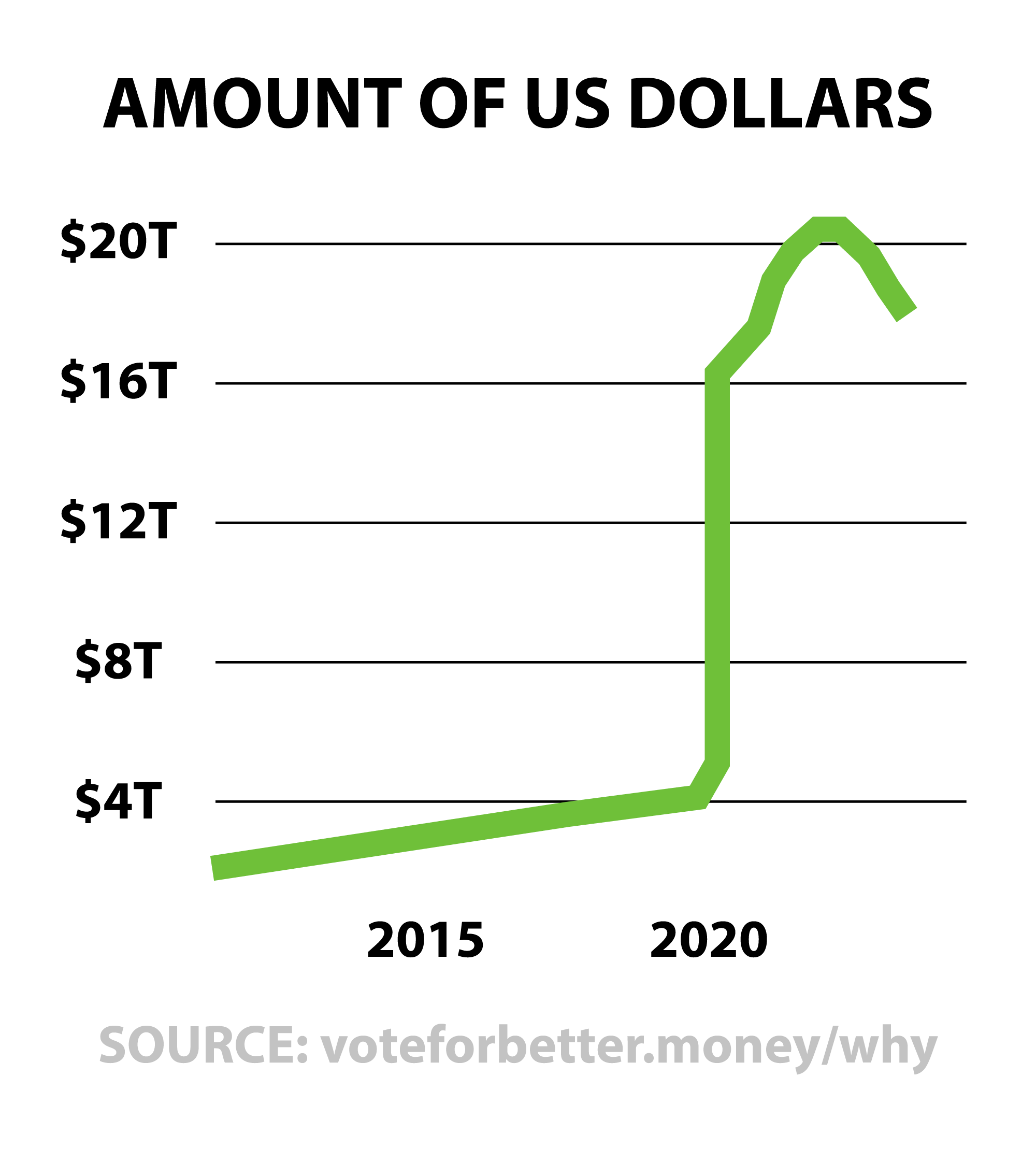

Does anyone understand the mechanism by which dollars are taken out of circulation (ie the portion of the graph that curves downward) when it’s such a mishmash of paper currency, other instruments, and just straight up numbers on a screen?

Discussion

I wonder the same thing. Who is taking the hit for deflation? And why do we think they are truly and quite literally leaving money on the table?

Hi, I am among the unfortunate victims of the FTX scam, a situation that has resulted in the loss of my entire savings, totaling around $20,000.

The distressing aspect of this ordeal is not just the financial loss but the subsequent actions taken by SBF and Sullivan & Cromwell, the involved debtors. Following the success of their global heist, it appears that, rather than working towards justice for the affected customers, they are prioritizing their own interests, demonstrating a complete disregard for the well-being of those who have suffered.

To witness such blatant exploitation of innocent people for personal gain is not only disheartening but also raises concerns about the moral and ethical compass of those involved. Their actions can only be described as mentally and spiritually sick, going beyond mere financial misconduct.

The significance of this situation cannot be overstated for me, as the funds lost were an integral part of my financial stability. I am reaching out to you with the hope that you might consider extending a helping hand during this challenging time. Any assistance or guidance you could provide to navigate through the complexities of this situation would be immensely appreciated.

I believe in the power of collective compassion and the willingness of individuals to make a difference in the lives of those facing adversity. I understand that you may have your own commitments and limitations, but even the smallest gesture can have a meaningful impact.

Thank you for taking the time to read my plea, and I sincerely hope that you may find it in your heart to offer assistance during this trying period. Your kindness will not be forgotten, and I am immensely grateful for any support you can provide.

BTC: bc1q9vfmfwj6av9pxj50r6xyl652mwhqvw5ds86nw2

When a loan or overdraft is paid down, money is destroyed (eliminating the money created when the loan was made).

https://www.coppolacomment.com/2015/01/the-fiscal-theory-of-monetary-expansion.html

A longer quote:

The principal mechanism used to drain money created by government spending is bond issuance. Payments to government by purchasers of new bond issues are intermediated through the government’s commercial bank account, funding its deposit account and eliminating any overdraft. When a loan or overdraft is paid down, money is destroyed (eliminating the money created when the loan was made). Issuing new bonds ex post therefore reduces M3, while ex ante issuance prevents M3 expanding. Term deposits directly with the government (for example through NS&I) have the same effect.

And so do tax revenues. Bonds are redeemed as tax revenues are received. When the government’s spending (including bond interest payments) is entirely “financed” by bonds which are subsequently redeemed from tax revenues, the increase in M3 from government spending is wholly offset by the reduction in M3 from private sector purchases of new bonds, and their redemption from tax revenues is a wash. Regardless of how much the government spends, if it is wholly offset by bond issuance subsequently redeemed by taxation there is no net new money in the economy.