**JPMorgan, PNC To Buy First Republic After FDIC Seizure First Leaves Taxpayers Holding The Toxic Stuff**

JPMorgan, PNC To Buy First Republic After FDIC Seizure First Leaves Taxpayers Holding The Toxic Stuff

_**Update (2210ET)**_: As the weekend begins, the WSJ reports late on Friday that big banks including JPMorgan and PNC are set to buy First Republic Bank but not in a private, market-arranged deal but rather in a transaction that would follow a government seizure of the troubled lender. A seizure and sale of First Republic, which would wipe out the equity of FRC and potentially impose losses on creditors, could come as soon as this weekend, the WSJ sources said.

And so JPM, which is already the largest US bank is about to get even bigger, by scooping up all the good FRC assets while leaving US taxpayer holdings on to the toxic ones.

That said, it wasn't immediately clear whether the $30 billion in deposits funneled by JPM and other banks into FRC will be treated as insured funds (why _**should**_ they should be insured?), nor was it clear how a wipeout of this capital, which would spark a systemic crisis simply because the Fed is now running policy of " **monetary tightening through bank collapse"**, having failed to contain inflation and tighten policy using conventional means.

\\* \\* \\*

_**Update (1640ET)**_: As many expected given the intraday collapse of FRC, Reuters reports after the bell that **The FDIC will imminently the bank into receivership.**

> First Republic most likely headed for FDIC receivership - CNBC https://t.co/9HT5s9Yoqj (https://t.co/9HT5s9Yoqj)pic.twitter.com/FRenLK8juh (https://t.co/FRenLK8juh)

>

> — Reuters (@Reuters) April 28, 2023 (https://twitter.com/Reuters/status/1652050174313656321?ref_src=twsrc%5Etfw)

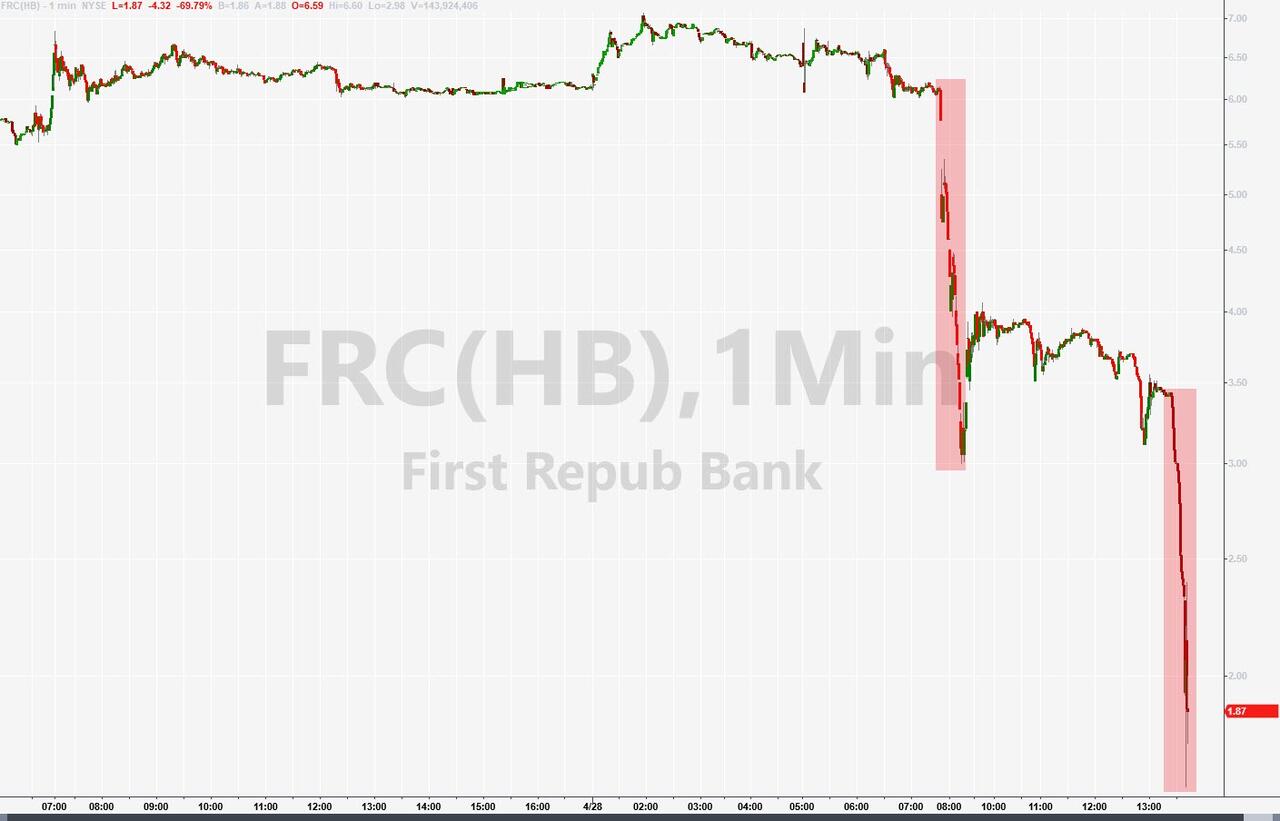

Shares collapsed to a $1 handle in the after hours trading, down 70% on the day...

?itok=UEUvz8Ty (

?itok=UEUvz8Ty ( ?itok=UEUvz8Ty)

?itok=UEUvz8Ty)

**FRC was trading at $120 at the start of March... and now it's trading close to $1.20...**

?itok=Tunx3o3S (

?itok=Tunx3o3S ( ?itok=Tunx3o3S)

?itok=Tunx3o3S)

...Aaaaand it's gone...

?itok=Aq9n0Uei (

?itok=Aq9n0Uei ( ?itok=Aq9n0Uei)

?itok=Aq9n0Uei)

\* \* \*

**Update (1045ET)**: First Republic Bank shares are halted for volatility having collapsed 50% back to record lows as hopes of a 'private' deal fade...

?itok=9itPGxYw (

?itok=9itPGxYw ( ?itok=9itPGxYw)

?itok=9itPGxYw)

Former Treasury Secretary Lawrence Summers criticized Washington regulators and US banking giants for not having already figured out a solution for the beleaguered lender First Republic Bank.

> _“I’m surprised and disappointed that this situation has continued to linger as long as it has, with the bank’s stock down 95%” and credit gauges deteriorating, Summers said on Bloomberg Television’s “Wall Street Week” with David Westin._

>

> _“I hope that between the banks, the FDIC, the other public authorities, that the best way forward will be found within the next week or 10 days.”_

_**“These are things like forest fires, it is much easier to prevent them than it is to contain them after they start to spread,”**_ Summers said.

He didn’t offer a preference for either an FDIC takeover or “some private sector oriented” workout.

> _“But we need to figure out the answer to that question as quickly as possible and move on.”_

Imagine the deposit outflows occurring today!

'The question now is simple - _**will they make it to the close without the FDIC stepping in?**_

\* \* \*

The First Republic farce rolls on...

After reporting dramatically worse deposit outflows (and aggregate banking system flows suggesting things are getting worse, not better in April), The FT (https://www.ft.com/content/818c44cb-0612-47c7-8b6f-3f5e1c38f009) reports that there had been **a shift in tone among the First Republic Bank’s advisers compared with Tuesday and Wednesday** when First Republic's shares fell 65 per cent and fears grew that it was close to being taken over by the FDIC.

**The conversations about the bank reportedly remain fraught,** and the people cautioned that it was not clear that a solution would be found.

The **banks are reluctant to put their shareholders at risk of losses without some sort of government participation.**

**https://assets.zerohedge.com/s3fs-public/styles/inline_image_mobile/public/inline-images…

https://www.zerohedge.com/markets/first-republic-shares-rise-reports-rescue-talks