I know this feeds the conspiracy theory view on BlackRock influencing a hard fork. But that’s also a really smart risk factor to include in the disclosures, just good CYA.

Not your keys, not your chain.

https://www.blackrock.com/us/individual/resources/regulatory-documents/stream-document

Discussion

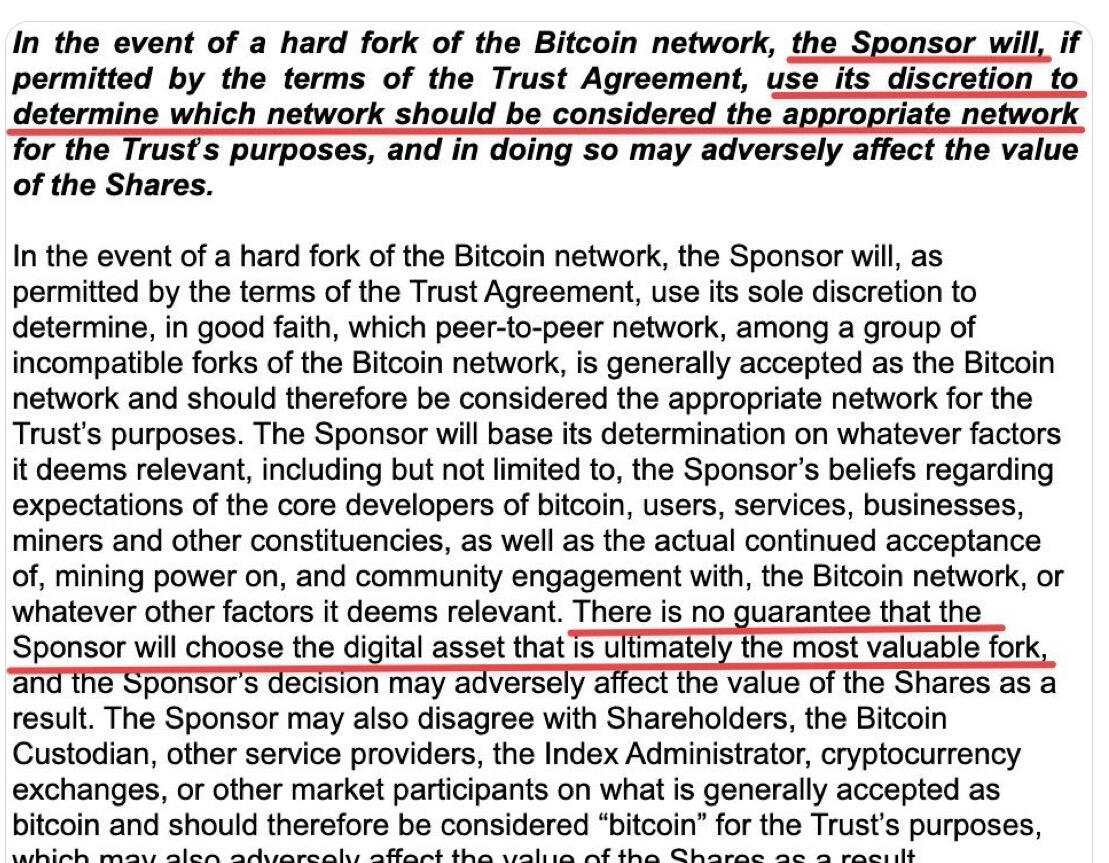

They could hardfork their users. One day you wake up and find your bitcoin now exists on the house blockchain, redeemable subject to house policy. Not that different than publicly traded share you might think you own. Often they are owned by the house (brokerage) with a credit to your account.

Don’t think that’s the way it would work. They hold Bitcoin, they don’t run nodes or miners. If there’s a hard fork, they would hold Bitcoin and the equivalent units of the forked coin. What they could do (which would still be very damaging) is dump real Bitcoin, reduce the price significantly and hold the forked coin to represent the ETF capital. Eventually investors could redeem for cash, buy real Bitcoin and eventually it would recover. But it would be painful.