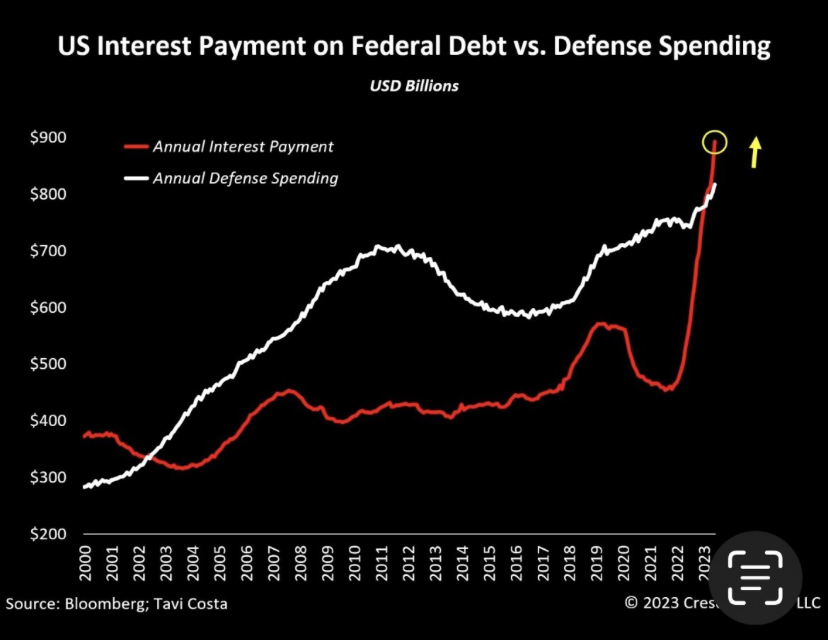

This is just the start, as the $33 trillion of debt rolls over (as the Treasury bonds reach maturity), the debt has to be refinanced at the current interest rate.

USA is on course for spending $2 trillion a year on interest payments, and would obviously have to raise taxes to do so.

Taxes in America are going to have to rise a lot this decade as de-dollarisation also hurts America’s ability to export inflation.