**Recession Risk Grows After Money Supply Shrinks At Fastest Pace Since Great Depression**

Recession Risk Grows After Money Supply Shrinks At Fastest Pace Since Great Depression

_Authored by Andrew Moran via The Epoch Times,_ (https://www.theepochtimes.com/recession-risk-grows-after-money-supply-shrinks-at-fastest-pace-since-great-depression_5187430.html)

**The U.S. money supply contracted for the third consecutive month, and is declining at the fastest pace since the Great Depression, new Federal Reserve data show.**

In February, the M2 money supply (https://fred.stlouisfed.org/series/WM2NS#0) \- a benchmark for how much cash, bills, bank deposits, coins, and money market funds are circulating throughout the national economy - tumbled 2.24 percent from the same time a year ago, down from negative 1.7 percent in January. This represented the third straight month of a contracting money supply.

**Early indicators point to another contraction in March, as the M2 money supply tumbled 3.13 percent year over year for the week ending March 6.**

** ?itok=6jUDyOlZ (

?itok=6jUDyOlZ ( ?itok=6jUDyOlZ)**

?itok=6jUDyOlZ)**

In total, the U.S. money supply stood at $21.099 trillion at the end of February.

**Between 1929 and 1933, the money supply plummeted (https://www.econlib.org/the-factors-in-the-drastic-money-supply-drop-from-1929-to-1933/) by 28 percent.**

Despite the year-over-year percentage decline, the money supply remains nearly 38 percent above the pre-pandemic level.

The downward trend, which started in February 2021, resulted from the central bank reversing its pandemic-era liquidity injections, the Fed reducing the enormous balance sheet, and sliding bank deposits.

**Across the globe, many economies are reporting slowing or contracting M1 money supply growth.**

In the European Union, the M1 annual growth rate contracted by 2.7 percent (https://sdw.ecb.europa.eu/reports.do?node=1000005717) in February, down from negative 0.8 percent in January. The United Kingdom’s M1 slowed (https://fred.stlouisfed.org/series/MANMM101GBM189S) to 1.55 percent in January. The M1 for Canada fell (https://fred.stlouisfed.org/series/MANMM101CAM189S#0) for three straight months to close out 2022, tumbling 3.57 percent in December.

?itok=egZ5YZ_S (

?itok=egZ5YZ_S ( ?itok=egZ5YZ_S)

?itok=egZ5YZ_S)

Recession Confirmed?

So, does this point to a recession? Some economists warn that the collapse in money supply growth in the United States and other countries is a warning of an economic downturn.

> _“We have not seen money supply declines like this since the Great Depression,” said (https://twitter.com/MishGEA/status/1642954188199174144) Mike Shedlock, an economist and registered investment advisor for SitkaPacific Capital Management._

>

> _“The contrarian position isn’t that a recession will come later, but rather that it’s already started.”_

According to Steve Hanke, the professor of applied economics at Johns Hopkins University and a senior fellow at the Independent Institute, thinks “a U.S. recession is baked in the cake.”

> _“Due to the Fed’s monetary mismanagement, the M2 money supply is falling at its fastest rate since the 1930s,” he stated (https://twitter.com/steve_hanke/status/1642210215327326208)._

>

> _“The QUANTITY THEORY OF MONEY tells us that, w/ a 6-18 month lag after M2 drops, economic activity will slump.”_

But others, like Fed Chair Jerome Powell, do not believe the money supply impacts the economy.

“When you and I studied economics a million years ago, M2 and monetary aggregates seemed to have a relationship to economic growth,” Powell told (https://research.stlouisfed.org/publications/page1-econ/2021/09/17/teaching-the-linkage-between-banks-and-the-fed-r-i-p-money-multiplier) Sen. John Kennedy (R-La.) during his semiannual monetary policy report to Congress in 2021. “Right now … M2 … does not really have important implications. It is something we have to unlearn I guess.”

?itok=p5cscYvq (

?itok=p5cscYvq ( ?itok=p5cscYvq)

?itok=p5cscYvq)

_Federal Reserve Board chairman Jerome Powell speaks during an interview at the Renaissance Hotel in Washington, on Feb. 7, 2023. (Julia Nikhinson/Getty Images)_

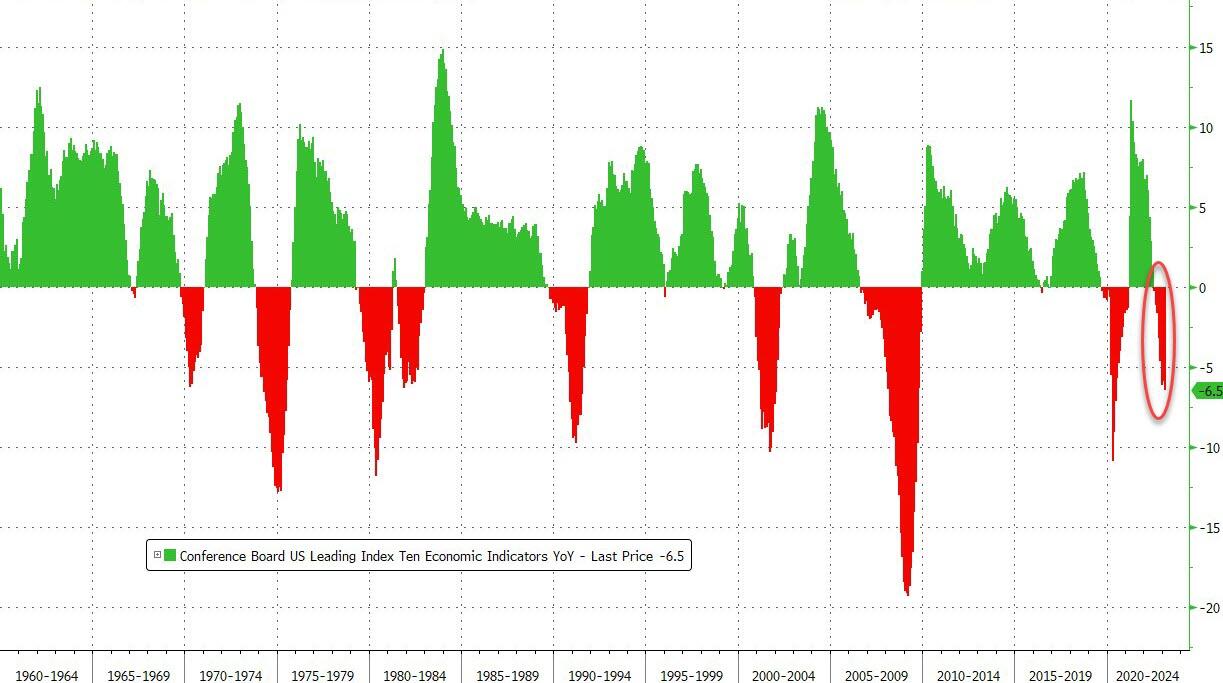

**Meanwhile, many leading recession indicators have been flashing red again.**

?itok=f2XSa8mv (

?itok=f2XSa8mv ( ?itok=f2XSa8mv)

?itok=f2XSa8mv)

The six-month average of the Conference Board Leading Economic …