**Futures Rise As Regional Banks Squeezed Higher**

Futures Rise As Regional Banks Squeezed Higher

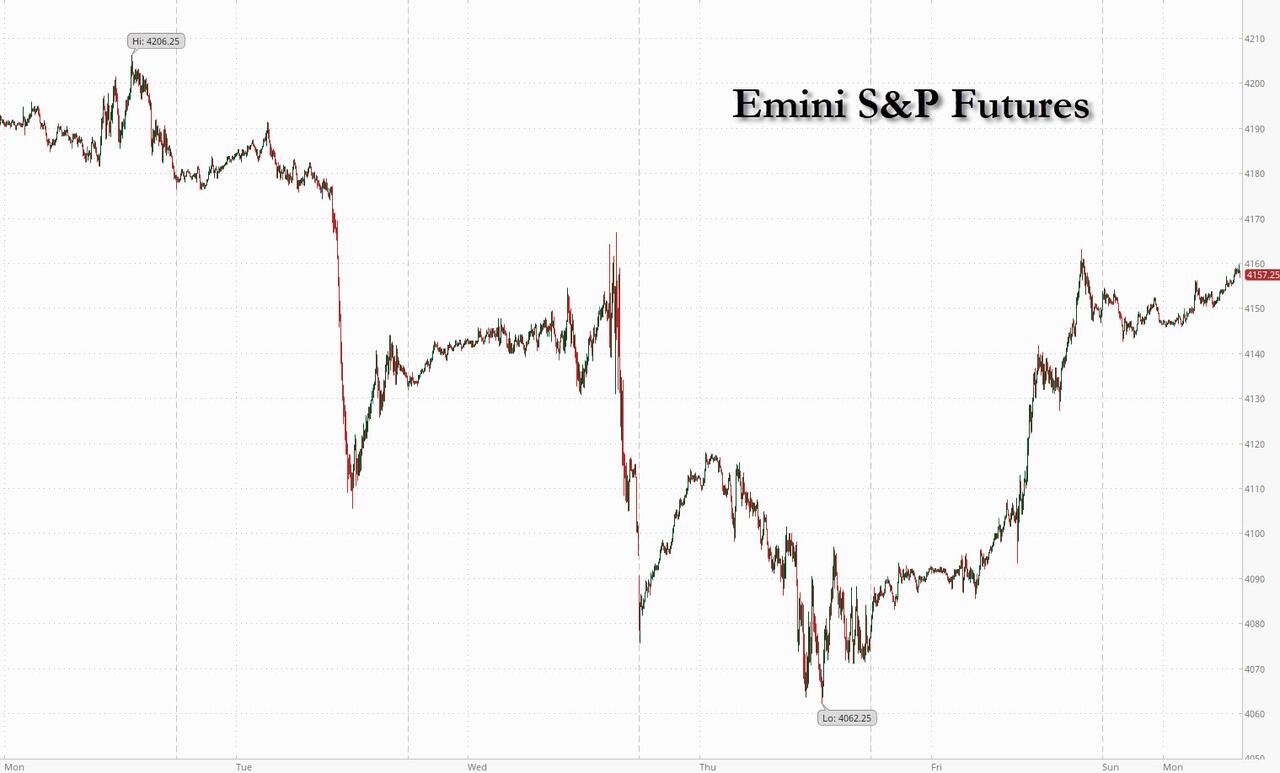

US stock futures reversed losses and traded near session highs as the squeeze in regional banks pushed stock prices higher despite another huge (unadjusted) deposit drop last week (https://www.zerohedge.com/markets/deposit-outflows-continue-foreign-banks-bleeding-most)as investors assessed the outlook for the banking crisis while awaiting inflation figures due later this week for clues about the path of Federal Reserve policy. Contracts on the S&P 500 and Nasdaq 100 rose 0.2% at 735am ET. The underlying benchmarks had rallied 1.8% and 2.1% on Friday, respectively. Oil edged higher to start the week, while European markets rose and Chinese bank stocks soared. Japanese stocks fell as traders came back online after a holiday. Elsewhere, Janet Yellen warned the debt-limit impasse may trigger a constitutional crisis (https://www.zerohedge.com/political/desperate-dems-float-14th-amendment-debt-ceiling-override). And Warren Buffett says good times are coming to an end (https://www.zerohedge.com/markets/buffett-turns-gloomy-incredible-period-us-economy-coming-end).

?itok=l153mjkp (

?itok=l153mjkp ( ?itok=l153mjkp)

?itok=l153mjkp)

In premarket trading, Occidental Petroleum dropped after Warren Buffett said Berkshire Hathaway won’t make an offer for full control of the energy group. Meanwhile, PacWest Bancorp soared as much as 32%, extending Friday’s brisk rebound and leading gains in US regional banks as short were squeezed, after it slashed its quarterly dividend and said business remains “sound” even though clearly deposit outflow will continue as long as the Fed's QT continues. Tyson shares plunged as much as 10% in premarket trading Monday after cutting its sales guidance for the full year. The updated guidance also missed the average analyst estimate for the period. Cryptocurrency-exposed stocks slump as Binance restarted withdrawals of Bitcoin after citing congestion on the token’s blockchain for two halts in less than 12 hours. Marathon Digital (MARA US) -6.9%, Riot Platforms (RIOT US) -6.7%.

US stocks have tracked sideways since the beginning of April as as better-than-feared corporate earnings offset concerns around an economic slowdown and the health of regional banks. Unexpectedly strong jobs data Friday supported bets the Federal Reserve will hold rates high for longer, straining consumer spending, corporate profits and bank balance sheets. Despite Friday’s stock rebound, investors still have much to worry about. The rout in US bank shares has the S&P 500 financials index on the verge of falling back below its 2007 peak.

Meanwhile, Treasury Secretary Janet Yellen sees “simply no good options” for solving the debt limit stalemate in Washington without Congress raising the cap. She even cautioned that resorting to the 14th Amendment would provoke a constitutional crisis.

“We see a chance that Treasury’s cash amount is enough to sustain till mid-June and probably slightly beyond that,” Oversea-Chinese Banking Corp. strategists Frances Cheung and Christopher Wong wrote in a note. However, “the irregular nature of fiscal receipts and outlays shall render investors staying cautious,” they said.

Investors are monitoring turmoil in regional banks and the impact on the wider sector, with **the S&P 500 financials index on the verge of falling back below its 2007 peak (https://www.bloomberg.com/news/articles/2023-05-07/bank-stocks-nearing-a-crisis-era-threshold-raises-warning-sign).** Meanwhile, investors are looking forward to consumer-price data due on Wednesday to assess whether the Fed’s fight against inflation has been paying off.

“None of the underlying fundamentals in US banks give us any reason to be deeply frightened, it’s really more investors confidence and managements ability to rein in investor confidence fast enough that’s been the primary issue,” said Alexander Morris, chief investment officer and president of F/M Acceleration said on Bloomberg Television. There could be another small Fed hike and rate cuts will likely be reserved until 2024, he added.

Rates on swap contracts linked to Fed meetings — which on Thursday briefly priced in a cut in July — moved higher, to levels consistent with a stable policy rate until September, followed by at least two quarter-point cuts by year-end. Consumer-inflation data Wednesday may provide further clues on the rates path.

“Unless we see a sharp turnaround in the inflation numbers, the Fed ought to be quite comfortable with where policy rates are right now,” Tai Hui, chief Asia market strategist at JPMorgan Asset Management, said on Bloomberg Television.

In Europe, the Stoxx Europe 600 index edged 0.2% higher, with energy stocks outperform…

https://www.zerohedge.com/markets/futures-rise-regional-banks-squeezed-higher