This is strong evidence that nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a‘s thesis that the difference in the speed of settlement between commodity money and credit money was gold’s downfall as money is correct.

It’s been a long time since I’ve read McCulloch v. Maryland. Certainly it was before Bitcoin was even invented. I’m going to have to reread it.

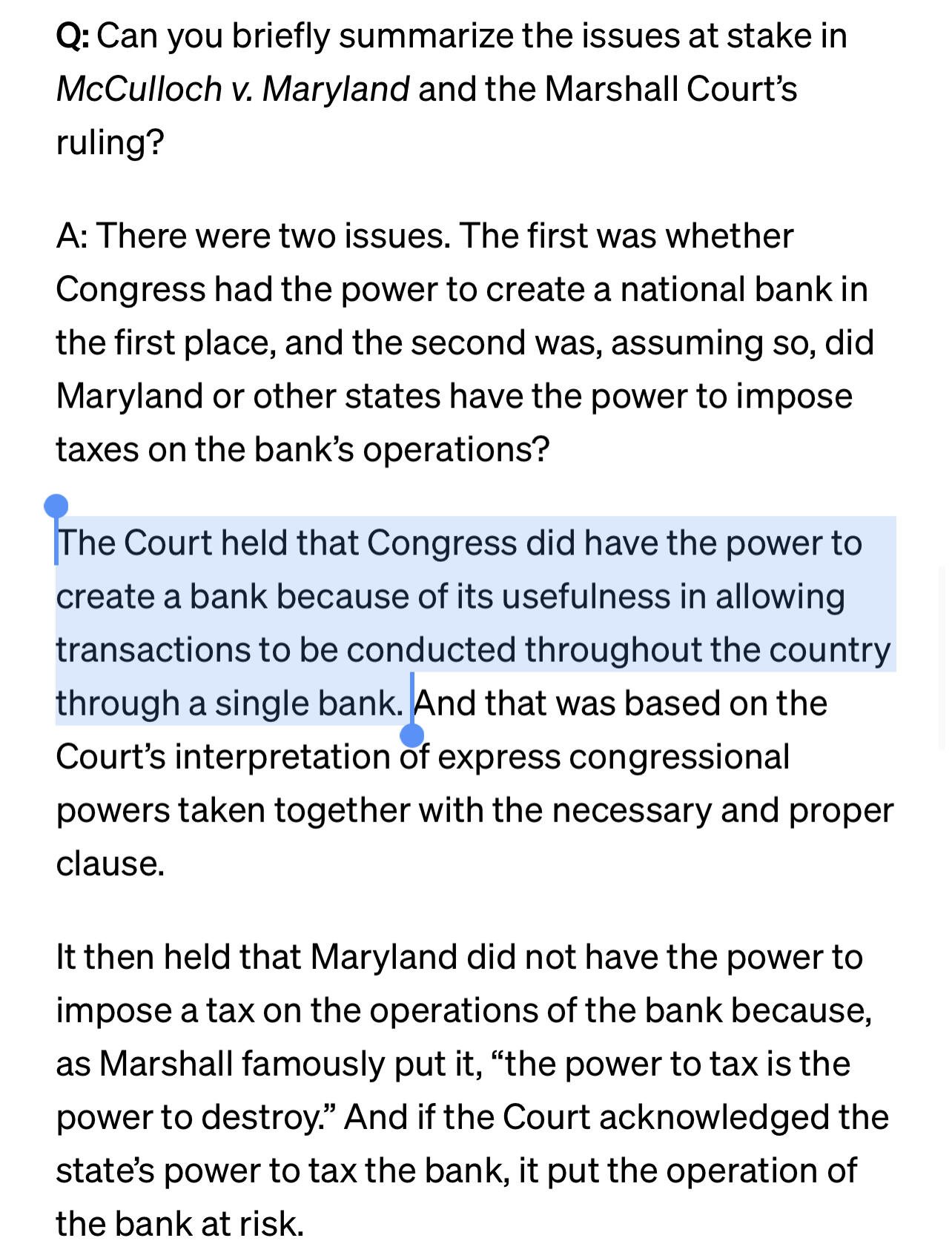

https://hls.harvard.edu/today/mcculloch-v-maryland-two-centuries-later/