**Why Gold May Be On The Cusp Of Another Major Bull Market**

Why Gold May Be On The Cusp Of Another Major Bull Market

_Authored by Jesse Felder via TheFelderReport.com,_ (https://thefelderreport.com/2023/04/19/got-gold-7/)

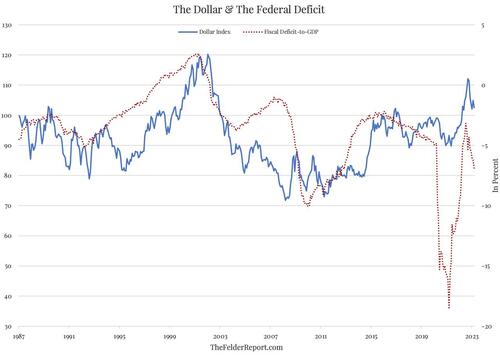

Last week, the Treasury Department revealed that the federal deficit hit $1.1 trillion (https://twitter.com/jessefelder/status/1646875098975203329) in the first half of the fiscal year ending in March, $432 billion larger than the same period a year earlier.

**Moreover, most of this expansion came in the month of March, as spending rose 36% year-over-year (https://twitter.com/McClellanOsc/status/1646219215710601217)** (not in small part due to rapidly rising interest costs). Longer-term, there is a clear widening trend that began back in 2015 that appears to now have resumed after some pandemic-inspired gyrations. And, if history is any guide, this deteriorating fiscal trend should represent a structurally bearish influence for the dollar in the months and years to come.

?itok=eI-bTuNJ (

?itok=eI-bTuNJ ( ?itok=eI-bTuNJ)

?itok=eI-bTuNJ)

**Moreover, if history is any guide, the best protection against a deteriorating fiscal situation (mathematically guaranteed by rapidly growing social security and medicare spending (https://twitter.com/Brian_Riedl/status/1626032982426353664)) is gold.**

?itok=D7cl2x5r (

?itok=D7cl2x5r ( ?itok=D7cl2x5r)

?itok=D7cl2x5r)

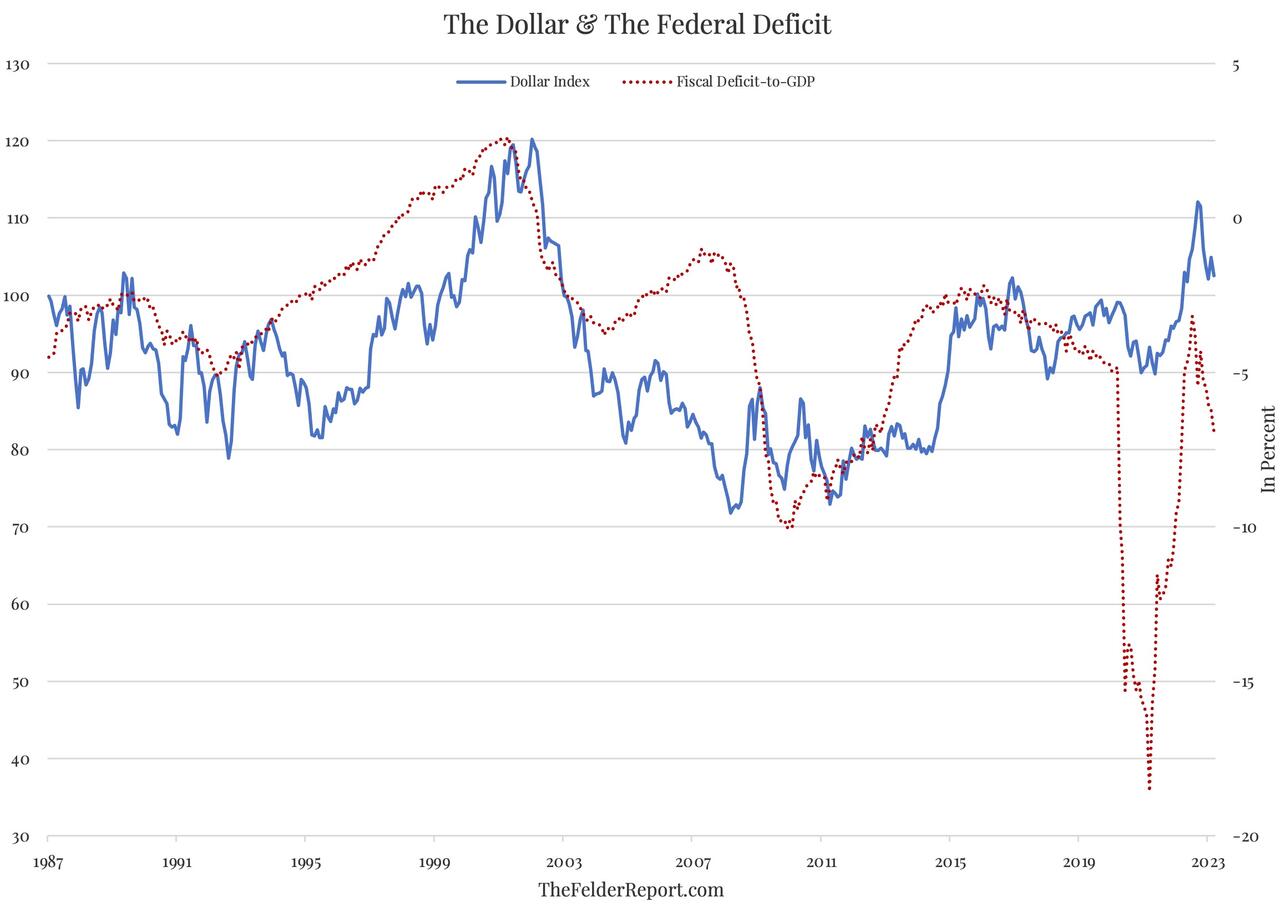

The last time the deficit reversed from a narrowing trend and began a major widening trend, back in the early-2000’s, it coincided with a major top in the dollar index which evolved into a major bear market for the greenback (inverted in the chart below) that lasted roughly a decade.

**This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.**

?itok=xM04sYvo (

?itok=xM04sYvo ( ?itok=xM04sYvo)

?itok=xM04sYvo)

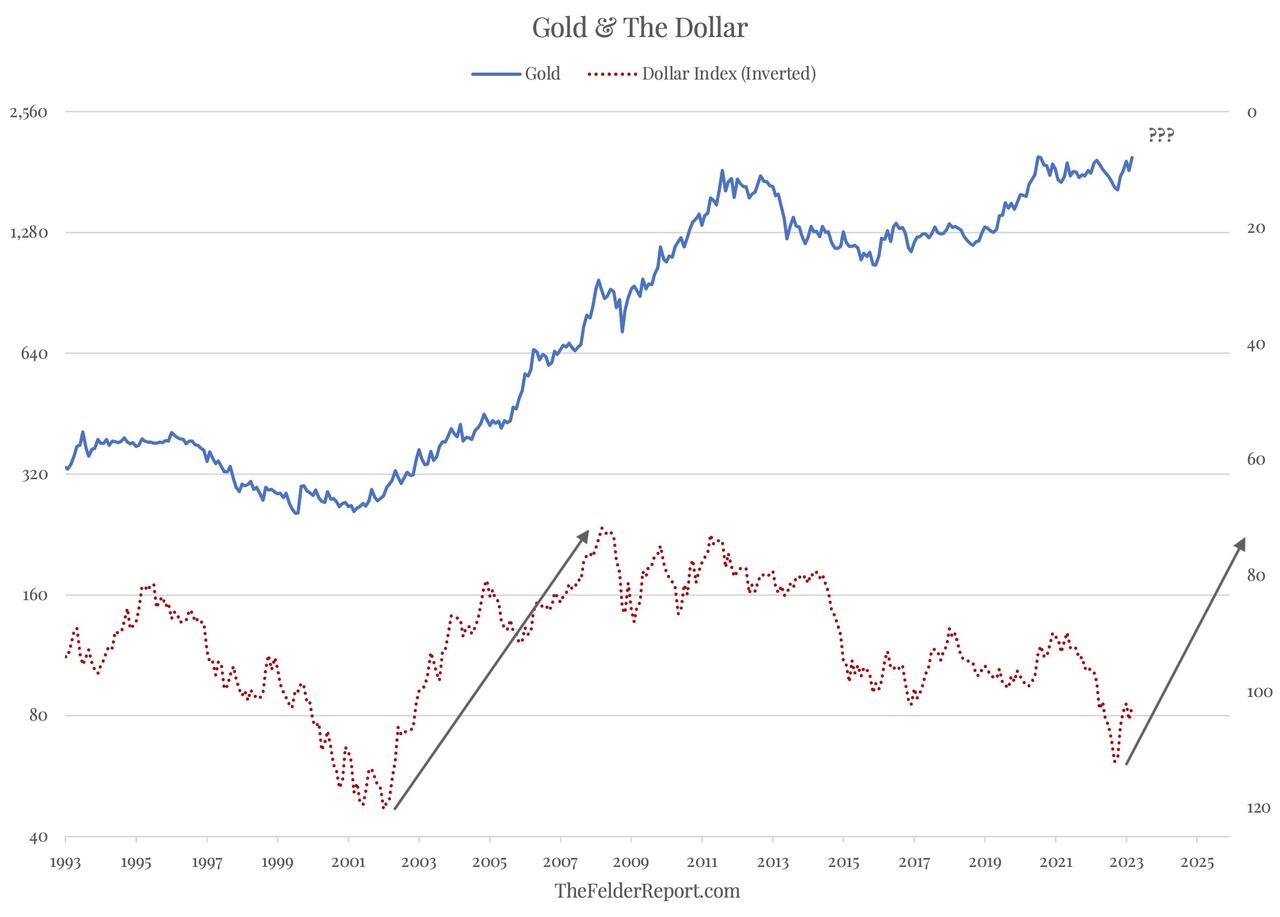

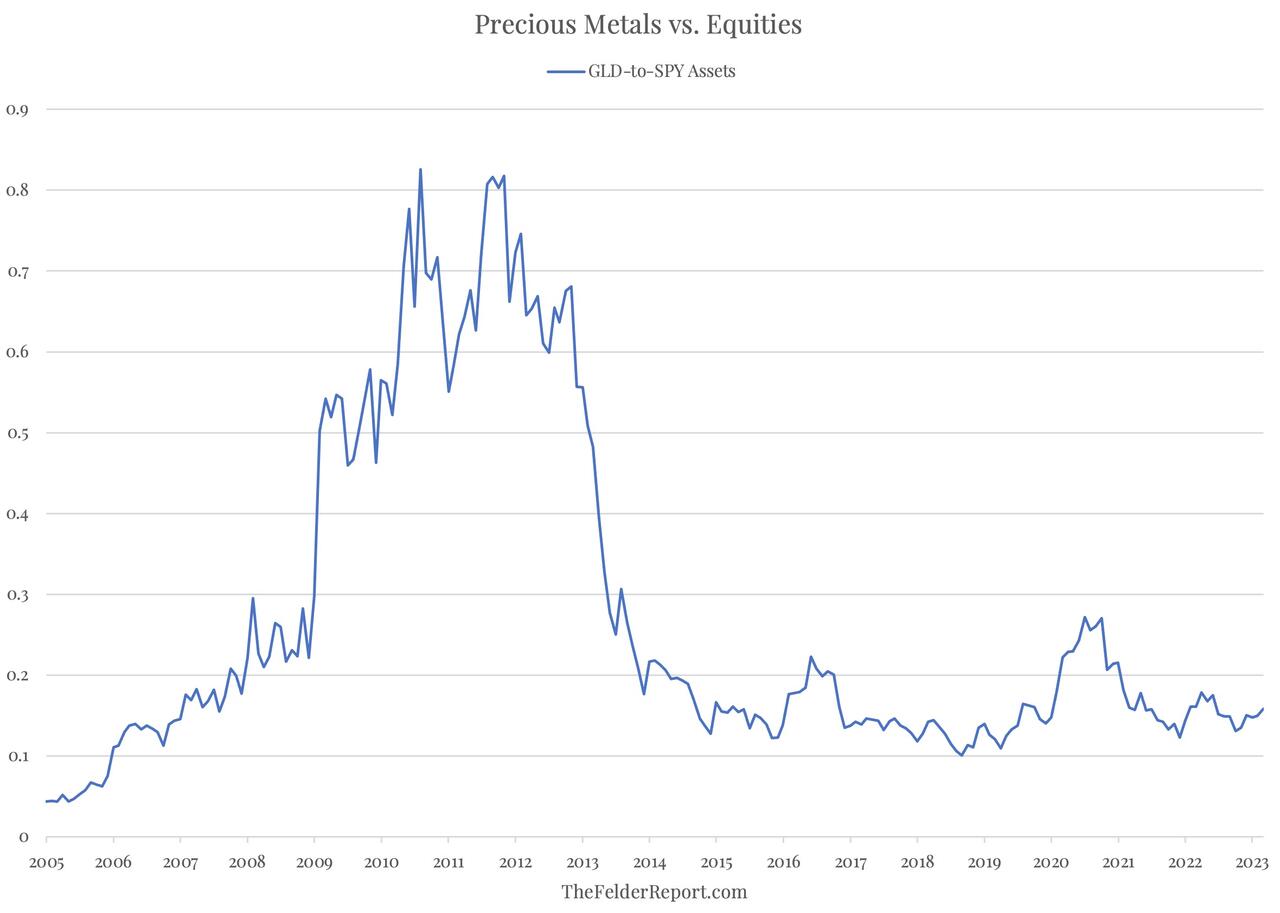

**Currently, investors have little to no interest in owning gold (which is a bullish contrarian sign in my book).**

As my friend Callum Thomas (https://twitter.com/Callum_Thomas/status/1647321147724427265) recently pointed out, assets in gold ETFs like GLD are a tiny fraction of those invested in equity ETFs like SPY.

**However, there’s a good chance that the deteriorating fiscal situation will over time light a fire under investor appetites for precious metals relative to financial assets, just as it did two decades ago.**

And that’s exactly the sort of thing that could power another major bull market (https://thefelderreport.com/2023/02/22/gold-is-knocking-on-the-door-of-new-record-highs/) for the precious metal.

?itok=SC5HdgO4 (

?itok=SC5HdgO4 ( ?itok=SC5HdgO4)

?itok=SC5HdgO4)

_**Got gold?**_

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 04/24/2023 - 06:30

https://www.zerohedge.com/markets/why-gold-may-be-cusp-another-major-bull-market